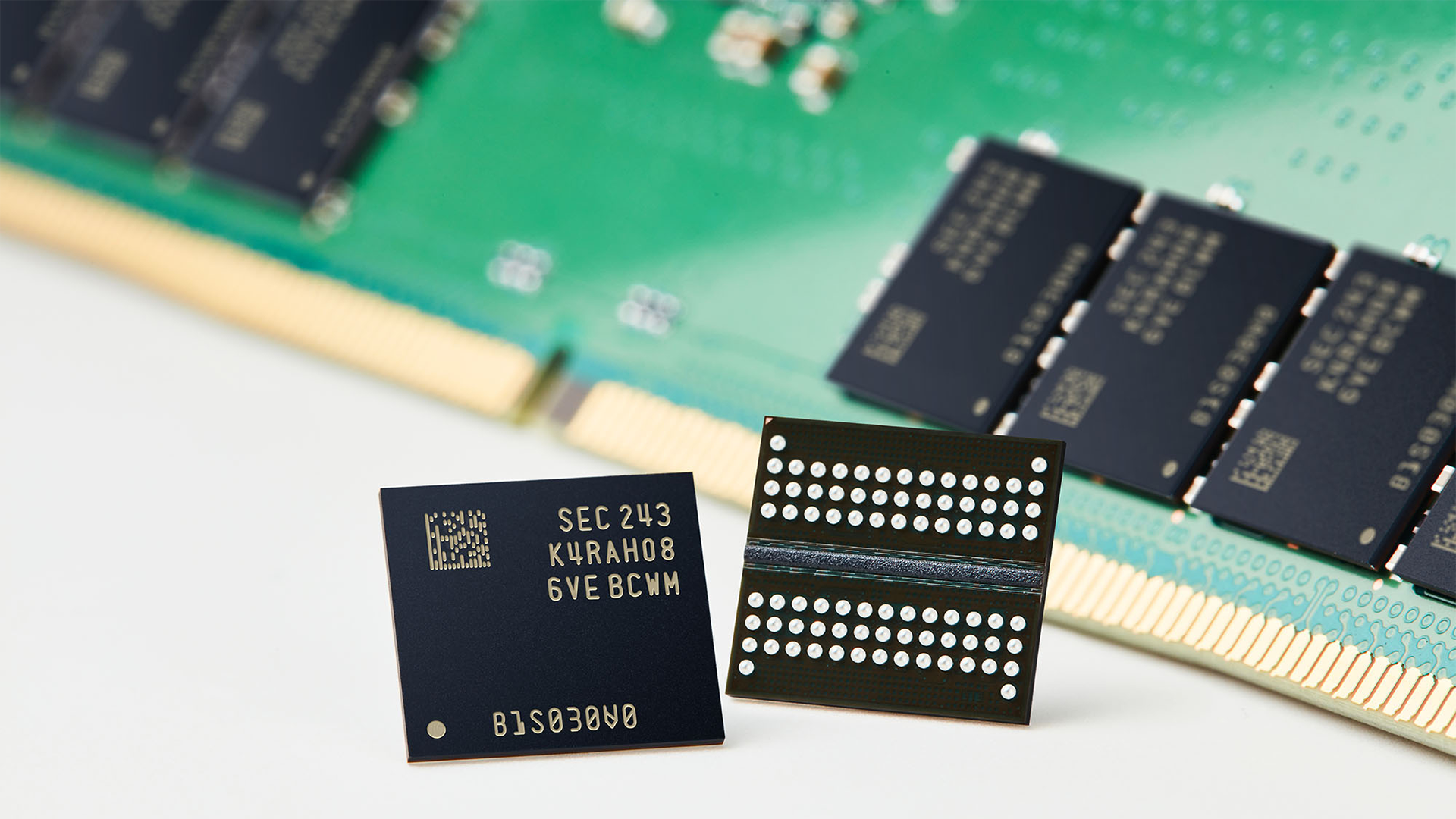

Consumers should be wary that they're getting DDR4 DRAM that's more smoke and mirrors than an actual straight-from-the-manufacturing-line product. As reported by TrendForce, the worldwide DRAM spot market is being hit by a wave of used DDR4-3200 MT/s memory chips that are being desoldered from old server RAM sticks, re-flashed, and then put to use in new, for-sale consumer RAM kits and devices.

Besides putting additional downward pricing pressure on a market that has almost imploded compared to its historic levels, there's also a justified concern that products packing these chips might fail earlier than expected.

Usually, there's not enough of a price difference between used and new memory chips that justify going to the trouble of actually separating (desoldering) all the individual DRAM chips from a used stick of memory. But for DDR4 memory, the usual economics don't apply; there's enough of a difference in performance between server CPU platforms offering either DDR4 or DDR5 support (remember that Zen 4 and Intel's Sapphire Rapids are DDR5-exclusive architectures) that enough professional environments are making the jump. And all those decommissioned high-capacity DDR4 memory chips have to go somewhere.

These chips primarily come from the two major South Korean suppliers’ legacy processes and are reused in PC DRAM and consumer DRAM products after software modifications. In terms of performance, the reused chips from the Korean suppliers can reach a data rate of 3200MT/s.…August 1, 2023

Most of the identified recycled chips are said to use "two major South Korean suppliers' legacy processes,' heavily implying that these chips originally came from Samsung and SK hynix.

TrendForce says there's an 'influx' of used chips flooding the market — enough to impact spot market pricing — so it's clear there is quite a volume of used chips finding their way onto the market. That means whoever is recycling the modules must have somehow automated the chip desoldering, extraction, reprogramming, and repackaging process, as many of these steps — particularly desoldering — would be arduous and time-consuming to do manually for large volumes of chips.

These companies are essentially exploring the delta between how low they can buy bulk DDR4 memory chips and DDR4's average spot market pricing. If their operational costs are lower than the difference, they can sell these used products at a price premium (compared to what they bought them for) that's still competitive with newly-manufactured DDR4 chips. And paying less so you can buy more is always an attractive business loop.

Some questions about product longevity are warranted, but we'd expect a limited warranty to still be put in place for chips acquired this way. It's likely that we're dealing with a temporary business arrangement - the companies' profits will start to decline the moment the used DRAM prices market increases. But while it's impressive that companies are finding ways to lower the recycling costs of chips low enough that they can engage in this niche business model, it isn't an attractive prospect to buy a new PC or DDR4 stick that actually uses old re-reprogrammed flash that might be a bit dodgy.