KEY POINTS

- The ETFs snapped up over 5,000 Bitcoins Monday when prices fell below $55,000

- BlackRock's IBIT led the pack, but even the retail-unpopular GBTC contributed to Monday's haul

- Some investors suggested ETFs may be trying to "offset" the German government's massive sell-off

U.S. spot Bitcoin exchange-traded funds (ETFs) have started regaining momentum after several weeks of mostly negative inflows as the funds snapped up nearly $295 million on Monday.

Buying the dip for an all-positive day

Data from London-based investment management company Farside Investors showed that a total of $294.8 million (over 5,000 $BTC) was accumulated by American spot BTC ETFs on Monday, marking the largest inflow in nearly two weeks.

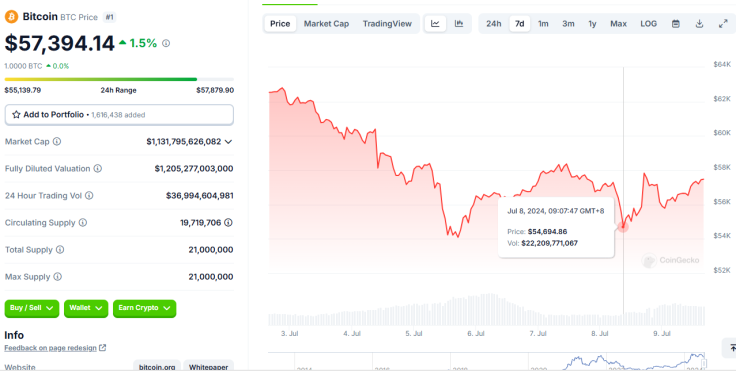

Interestingly, the world's top cryptocurrency by market cap was trading below $55,000 for several hours on Monday, as per data from CoinGecko. The coin has since reclaimed $57,000.

Even Grayscale helped crunch the numbers

It comes as no surprise that BlackRock's IBIT led Monday's buying spree, hauling in $187.2 million, followed by Fidelity's FBTC, with $61.5 million in. Three other spot $BTC ETFs saw positive inflows as well, but it was a surprise for some that Grayscale's GBTC clocked $25.1 million.

GBTC has one of the highest management fees among U.S. Bitcoin ETFs, gaining notoriety as an unpopular choice among retail investors. Farside data also shows that GBTC has led the way in most of the outflows in the past two weeks, but it's Monday performance may be signaling a more positive trend for the funds.

Bull prepping to run ahead of bears?

Vivek Sen, the founder of Bitcoin public relations firm Bitgrow Lab, said Grayscale's Monday inflow could be a sign that the "tides are turning." He posted a video chart that showed a bull preparing to make a dash.

Grayscale #Bitcoin ETF just bought $25 million in BTC.

— Vivek⚡️ (@Vivek4real_) July 8, 2024

Tides are turning 🚀 pic.twitter.com/nL1Kid280d

Prominent $BTC investor @invest_answers has a different take on the latest activity among spot Bitcoin ETFs. He said the massive buys could be an attempt "to offset this selling," referring to the spectacular dump by the German government in recent days that has significantly affected sentiment in the community.

ETFs must be stacking hard to offset this selling

— InvestAnswers (@invest_answers) July 8, 2024

Soaking in Germany's dump

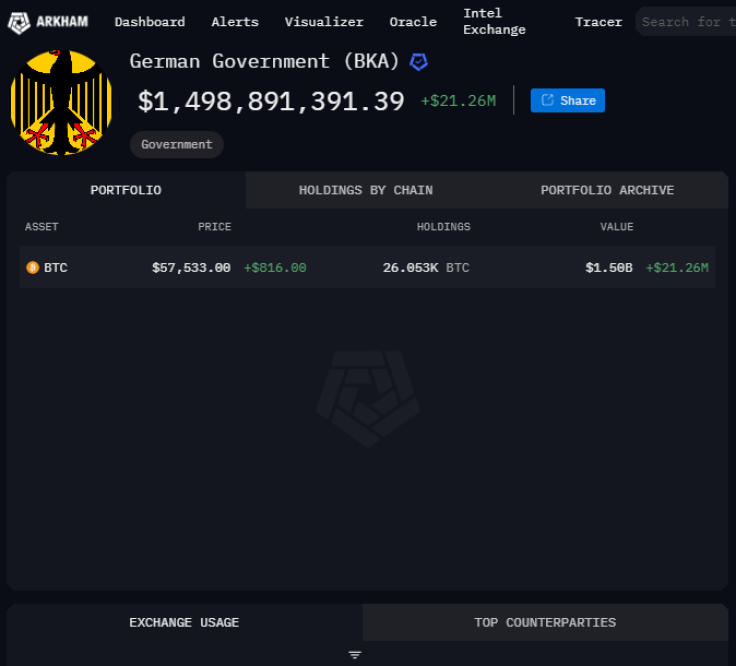

The German government started unloading its Bitcoin stash late last month. Its huge treasury was seized from a movie piracy website that accepted payments in crypto. Before it started the dump, it had approximately $3 billion in $BTC. As of early morning Tuesday, the government wallets tracked by blockchain analytics firm Arkham Intelligence still holds over $1.4 billion in Bitcoins.

Many Bitcoiners are pleased to know that it seems Bitcoin ETFs are snapping up the crypto Germany is selling across several exchanges.

The Bitcoin ETFs are all buying what Germany is selling

— Alistair Milne (@alistairmilne) July 9, 2024

Net inflows of nearly $300million yesterday

Even GBTC saw inflows! pic.twitter.com/rkOnHbKm0S

🚨 Holy Crap! 🚨#Grayscale just had their fifth biggest day ever, taking in over $25 million! While the Germans were selling, the ETFs were stacking. 📈💰 #Bitcoin 🚀 pic.twitter.com/lt90c67YEq

— InvestAnswers (@invest_answers) July 8, 2024

What the latest ETF activity means for crypto

Richard Teng, the CEO of crypto exchange giant Binance, said early Tuesday that U.S. spot Bitcoin ETFs saw $14.7 billion in net inflows in a period of six months, which suggests that interest in digital assets, specifically Bitcoin, remains high.

In 6 months, US-listed Bitcoin ETFs brought in over $14.7B in net inflows. Key takeaway? Interest in #Bitcoin and digital assets remains high.

— Richard Teng (@_RichardTeng) July 9, 2024

Token prices and market caps fluctuate, but the long-term fundamentals of our industry is strong.

Stay focused and keep building! 🚀

For the crypto executive, the attitude coin holders should maintain is "focus" so they can "keep building." He said even as token prices are volatile, the "long-term fundamentals" of the crypto industry is still strong.