KEY POINTS

- All US Bitcoin miners are now "in the red," said Uphold's Martin Hiesboeck

- He reiterated that the German government's massive dump last week had "nothing to do" with BTC's price plunge

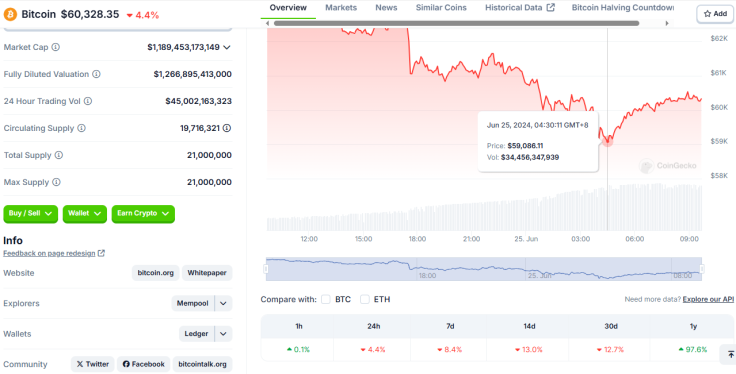

- Bitcoin plummeted below $60,000 Monday and the hashprice declined by nearly 52%

American miners of Bitcoin, the world's largest cryptocurrency by market cap, have been struggling in recent days, especially after the digital asset crashed below $60,000 at one point on Monday, an industry expert said.

Luxor Technology's Hashrate Index showed that BTC's hashprice – the metric that quantifies a miner's expected earnings from a specific quantity of hashrate – plunged nearly 52% to $0.04595 per terahash second on Monday afternoon, nearing its record-low of $0.0447 on May 1.

Martin Hiesboeck, the head of research at cryptocurrency buy and sell platform Uphold, said Monday that all miners in the United States "are now in the red." The hashprice drop also came on the same day Bitcoin plunged below the $60,000-mark, sending jitters to the BTC community.

"They [miners] have to continue selling all $BTC to make ends meet. This is the worst case scenario we described in March. Because of miner centralization, their actions and economic planning have an outsized effect on the price of Bitcoin," Hiesboeck said.

As with some industry observers who explained the decline of the world's most popular digital asset, Hiesboeck pointed out that the German government's selling of some $325 million worth of its seized BTC last week and Mt Gox's announcement it will start repayments in July has "nothing to do" with Bitcoin's price slump.

Bitcoin dips below 60k. All US miners are now in the red. They have to continue selling all $BTC to make ends meet. This is the worst case scenario we described in March. because of miner centralization, their actions and economic planning have an outsized effect on the price…

— Dr Martin Hiesboeck (@MHiesboeck) June 24, 2024

He went on to project that buyers of spot BTC exchange-traded funds (ETFs) who capitulate following their losses over the past few weeks will make the community "revisit $48k easily."

Data from London-based investment management company Farside Investor showed that spot Bitcoin ETFs bled a collective $174.5 million on Monday, with Grayscale's GBTC still leading the way in daily net outflows.

Adam Ortolf, a developer at BTC mining firm Upstream Data, said Sunday that miners are in for "survival games," adding that "many miners are currently enduring serious pain" from the sliding hashprice.

So far this difficulty epoch it looks like #bitcoin hashpower has fallen off a cliff.

— 🏔Adam O🏔 (@denverbitcoin) June 23, 2024

Avg blocktime over the last 460 blocks has been 647sec or almost 8% slower than 600-sec target.

Considering hashprice is $0.05 many miners are currently enduring serious pain.

Survival games pic.twitter.com/i18EnuM2fj

Decentralized finance (DeFi) intelligence firm IntoTheBlock also revealed Sunday that Bitcoin miners have sold more than 30,000 BTC worth some $2 billion this month, marking the "fastest pace in over a year."

🚨 Bitcoin miners have sold over 30k BTC (~$2B) since June, the fastest pace in over a year. The recent halving has tightened margins, prompting this sell-off. pic.twitter.com/dy289bu7p4

— IntoTheBlock (@intotheblock) June 22, 2024

Crypto market intelligence firm CryptoQuant reported earlier this month that in a single day, Bitcoin miners dumped 1,200 BTC. It also revealed at the time that "some big mining companies have been selling a portion of their serves." Among the sellers was mining titan Marathon Digital, "likely to cover expenses," as per CryptoQuant CEO Ki Young Ju.