The US central bank should keep interest rates at their current "restrictive" levels until it sees real progress in the fight to lower inflation, a senior Fed official said Monday.

The US Federal Reserve has hiked interest rates -- and held them -- at a 23-year high as it looks to bring inflation down to its long-term target of two percent.

After making significant progress last year, Fed policymakers have hit a speed bump since the start of the year, with inflation coming in too hot in the first three months of 2024.

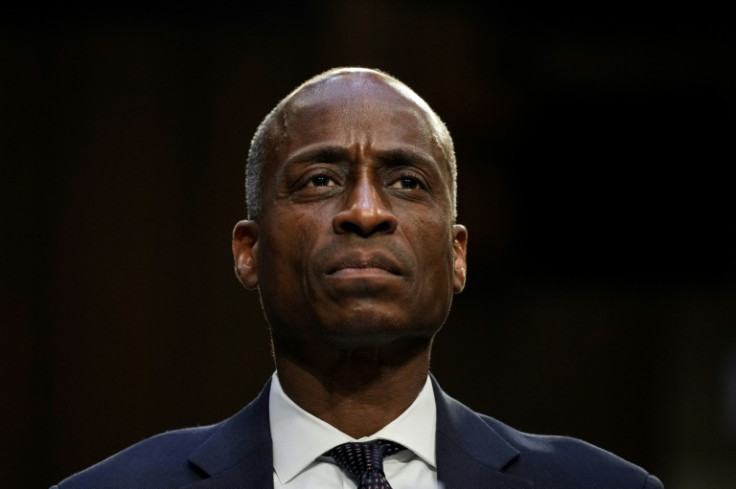

"In light of the attenuation in progress in terms of getting inflation down to our target, it is appropriate that we maintain the policy rates in restrictive territory, which it is right now," Fed vice chair Philip Jefferson said at an event in Cleveland, Ohio.

"We continue to look for additional evidence that inflation is going to return to our two percent target," he said, adding that "until we have that, I think it is appropriate to keep the policy rate in restrictive territory."

The Fed said earlier this month that it does not expect to start lowering rates until it has "greater confidence" that inflation is moving sustainably towards its two percent target.

Jefferson's comments on Monday echo those of Fed chair Jerome Powell, who told reporters in early May that "it is likely that gaining such greater confidence will take longer than previously expected."

Futures traders currently assign a probability of close to 65 percent that the Fed will start lowering interest rates by mid-September, according to data from CME Group.