The US Federal Reserve may signal this week that interest rate cuts are on the way -- although it is widely expected to remain on pause until its next rate decision in September.

Fed officials, who have admitted to moving too slowly to stem an inflationary surge in 2021 and 2022, have been wary of cutting rates too soon and accidentally reigniting inflation.

"The Fed as a group does not want to be seen as having allowed inflation to reaccelerate, or inflation to remain persistent at above their target," EY chief economist Gregory Daco told AFP. "There is definitely a bias from having been burned on the upside."

Most analysts and traders do not expect the Fed to start cutting rates in July, even with recent data indicating that inflation continues to slow toward the US central bank's long-term target of two percent, while economic growth remains strong and the labor market is coming into better balance.

"Clearly the ongoing disinflation process is occurring," Citi global chief economist Nathan Sheets told AFP. "And that is very encouraging for the Fed."

But the US central bank "still has time to start its cutting cycle," he added.

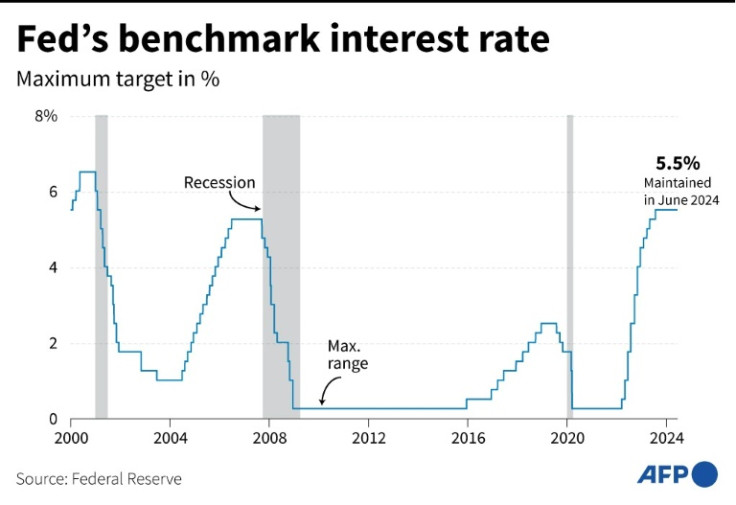

The Fed has held its key lending rate at the current range between 5.25 and 5.50 percent for the past year as it has sought to dampen demand in the world's biggest economy and bring inflation back down to target.

Higher interest rates make borrowing more expensive for consumers and businesses, indirectly pushing up the cost of everything from car loans to home mortgages.

With the data now moving firmly in the right direction, Fed chair Jerome Powell can use the July meeting to lay the groundwork for a September rate cut, and reinforce his message during a keynote speech to a gathering of the world's central bankers in Jackson Hole, Wyoming, next month, according to Sheets from Citi.

While most analysts now broadly expect the first rate cut to come in September, there are still some who are taking a more cautious view of the US economy.

"The Fed is optimistic that cuts are likely in the near-term, but we do not think it is willing to signal September is a done deal," Bank of America economists wrote in a recent note to clients, adding they still expect the first cut to come only in December.

Futures traders are now completely convinced that the first rate cut will come by mid-September, assigning a probability of 100 percent that the Fed will have cut rates by at least a quarter percentage-point by then, according to data from CME Group.

A September rate cut would thrust the independent US central bank into the middle of what is swiftly shaping up to be a heated and divisive presidential election campaign between vice president Kamala Harris and former president Donald Trump.

Trump has repeatedly criticized Powell, who he nominated, and suggested he would not look to reappoint him as Fed chair if he is reelected president in November.

For his part, Powell has insisted that the Fed adopts a data-dependent approach to interest rate cuts that does not take political considerations into account.

Nevertheless, "the realities of the political situation mean that if they're cutting, if the cycle is starting in September, it is likely to draw some political attention," Sheets from Citi said.

Assuming that the Fed does make its first rate cut in September, most analysts expect policymakers to make at least once more rate cut before the end of the year -- possibly in December.

While most analysts expects a minimum of two cuts this year, Fed policymakers recently penciled in just one rate cut for 2024, down from three in March, following a few months of higher inflation reports at the start of the year.