Black unemployment reached a historic low as the US economy added 253,000 jobs despite a torrent of news about bank failures and the Federal Reserve raising interest rates.

African-American unemployment reached 4.7 per cent, the Bureau of Labor Statistics reported, the lowest recorded level in history, according to former Obama administration economic adviser Jason Furman.

“The unemployment rate is very low, at 3.4%,” he tweeted. “Lowest ever for Black unemployment.”

The Bureau of Labor Statistics reported that the unemployment rate remained at 3.4 per cent, with 5.7 mn people unemployed. Conversely, the number of people who lost their jobs or completed temporary jobs dropped by 307,000.

The overall numbers exceeded expectations from economists and experts. The news comes after Federal Reserve Chairman Jerome Powell announced the tenth consecutive interest rate increase earlier this week amid inflation persisting.

“My colleagues and I are acutely aware that high inflation imposes significant hardship as it erodes purchasing power, especially for those least able to meet the higher costs of essentials like food, housing, and transportation,” he said.

But some Democratic Senators criticised Mr Powell’s continued interest rate hikes.

“Chairman Powell has raised interest rates at an extreme level, there's been nothing like it in modern history,” Senator Elizabeth Warren told The Independent earlier this week. “He risks putting millions of people out of work and tipping our economy into a recession.”

Democratic Senator Sherrod Brown of Ohio, the chairman of the Senate Banking Committee, echoed those sentiments, telling The Independent that corporate greed has driven inflation but Mr Powell has not addressed that.

“I think part a big part of inflation has been corporations taking advantage of the gaps in the supply chain and using it to raise prices way more than their costs have gone up,” he said.

The numbers come despite recent bank failures at Silicon Valley Bank, Signature Bank and First Republic.

But they also come the same week that Treasury Secretary Janet Yellen sent a letter to congressional leaders saying that the Treasury Department could exhaust its options to continue making payments on the nation’s debt obligations at the beginning of next month.

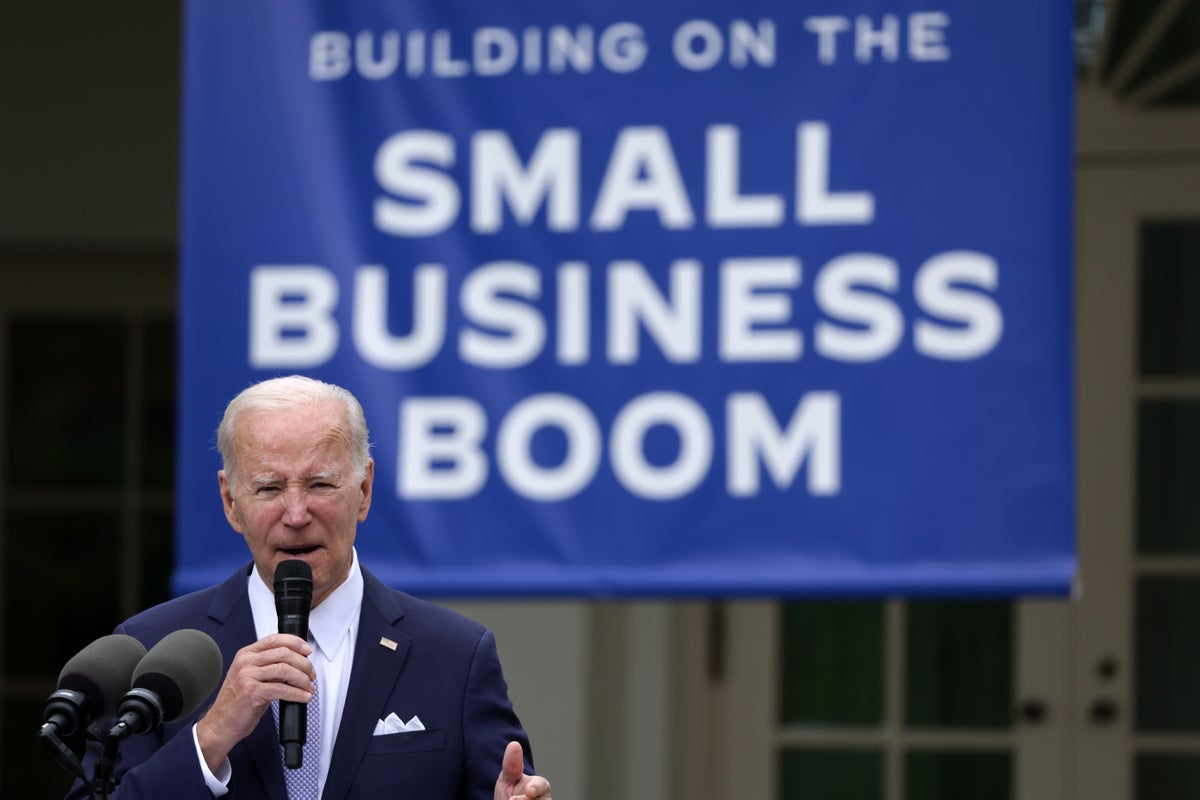

President Joe Biden and House Speaker Kevin McCarthy are set to meet next week along with other congressional leaders to begin negotiations on the nation’s debt limit to prevent a default.