As expected...

the S&P 500 (SPY) made it to my year end target of 6,000. Gladly that goal was achieved on the early side with the close on November 11th.

And as expected...since then stocks have been consolidating under 6,000. Meaning that level is proving to be a spot of notable resistance.

A lot of what happens next has to do with the state of inflation and what that means for future Fed actions. Let’s dig in on the latest data to see what those tea leaves tell us where stocks head next.

Market Outlook

This week we have received the 2 key inflation reports in CPI and PPI. I would not call either a positive for the further reigning in of inflation or what that means for the next move by the Fed.

Let’s start with the CPI report on Tuesday that came in at 2.6% year over year. Unfortunately, that is higher than the previous reading of 2.4%. Also note that the Core Inflation report was stuck at the same reading as last month 3.3%.

You can appreciate why bond rates moved higher once again on that news back above 4.4% for the 10 Year Treasury.

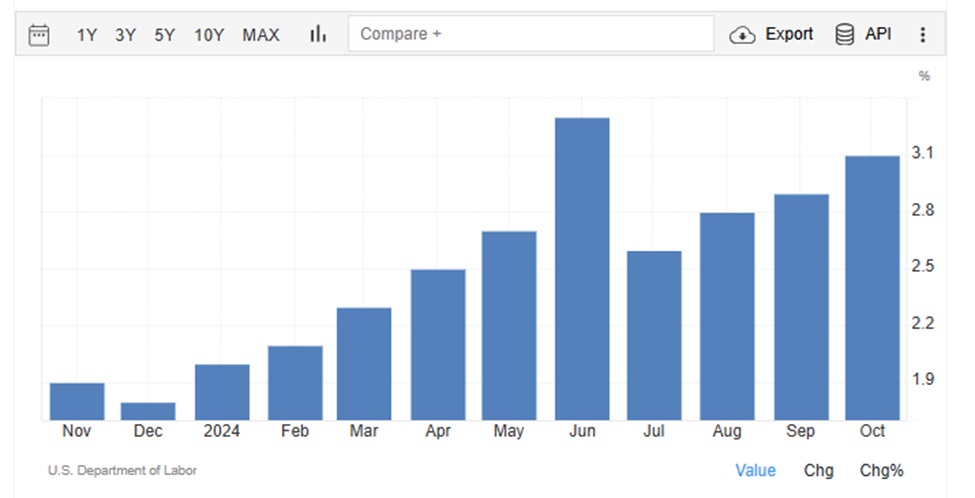

Thursday’s release of the forward looking PPI report did not improve the situation. Here is the chart for the core reading:

This chart is headed the wrong direction if your goal is lower inflation. Sure, we can say that the June spike is a fluke...but even with removing that outlier, there is a clear upward trend for Core PPI. Certainly this will be noticed by Fed officials which may have some being more cautious on the idea of cuts as we move ahead.

These same alarming trends were in place prior to the November cut. I honestly didn’t expect them to take action until the anemic jobs report came at the beginning of the month. Given that maximum employment also part of their mandate is why rates were cut once again. I assure you that wasn’t being done because inflation data is improving...cuz it ain’t.

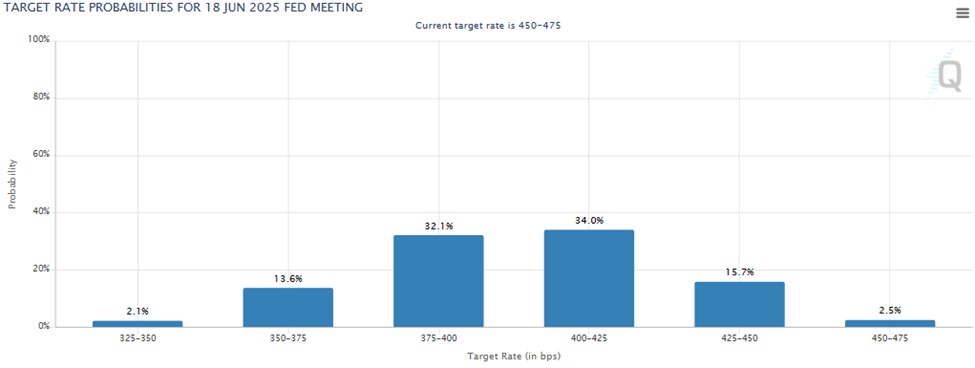

Looking ahead, the CME’s Fed Watch tool is showing a 79% probability for another quarter point cut at the next Fed meeting on December 18. Plus, here is the picture for the June 2025 meeting to give you a longer term picture of what investors expect. Note that the current rate is the one on the far right 450-475 basis points.

I may not be a Fed official, but I do have an economics background which most stock/bond traders do not. And thus have a better understanding of the patience usually displayed by Fed officials while most traders act like petulant children who just want things to happen NOW!!!

The point is that I think there are fewer rate cuts on the horizon then viewed by the average investor. There are only 2 things that could change that view.

- Inflation data does start coming down reversing recent troubling trends.

- Unemployment starts rising making the Fed lower rates to make sure that does not get out of hand.

What does that mean for stock prices?

6,000 could prove to be a stiffer point of resistance than many appreciate. It could put a lid on more upside this year. However, I sense that we will probably crack above with the benefit of a Santa Claus rally in late November and early December.

So maybe 6,100 is a reasonable year end target...maybe a touch higher. But even more important than that, it may lead to a stiff pullback or even correction in January as investors delay profit taking to the new year to delay the tax consequences.

That actually would be very rational. As in healthy.

The key is what happens after that. The rational choice would be a rotation to groups that are still attractive values. Namely small and mid cap stocks which on average have a PE 30% lower than their large cap peers.

The combination of small caps and value is music to the ears of anyone using our POWR Ratings system that has a bias to both of these groups. That is why I like the odds for even more impressive outperformance for our stocks in the new year.

Read on to discover my current favorite stock picks...

What To Do Next?

Discover my current portfolio of 10 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999).

All of these hand selected picks are all based on my 44 years of investing experience seeing bull markets...bear markets...and everything between.

And right now this portfolio is beating the stuffing out of the market.

If you are curious to learn more, and want to see my 10 timely stock recommendations, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top 10 Stocks >

Wishing you a world of investment success!

SPY shares fell $0.53 (-0.09%) in after-hours trading Thursday. Year-to-date, SPY has gained 26.01%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Updated Stock Market Expectations StockNews.com