KLA (NASDAQ:KLAC) underwent analysis by 12 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 4 | 0 | 0 |

| 3M Ago | 1 | 1 | 3 | 0 | 0 |

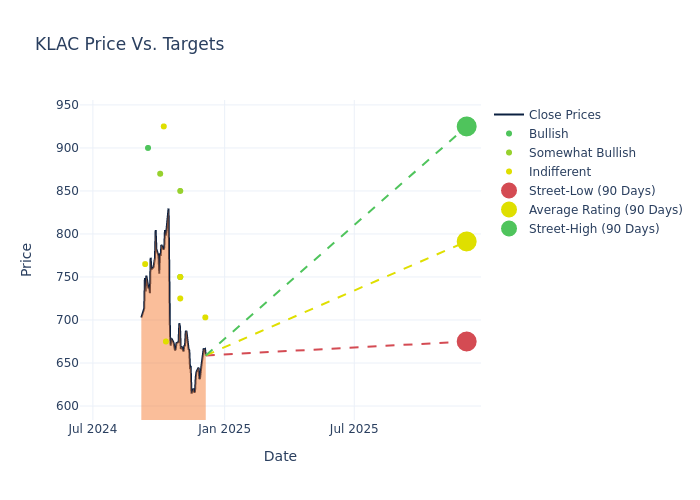

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $799.0, a high estimate of $925.00, and a low estimate of $675.00. Observing a downward trend, the current average is 5.61% lower than the prior average price target of $846.45.

Investigating Analyst Ratings: An Elaborate Study

The standing of KLA among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Moore | Morgan Stanley | Lowers | Equal-Weight | $703.00 | $746.00 |

| Krish Sankar | TD Cowen | Lowers | Hold | $725.00 | $760.00 |

| Tom O'Malley | Barclays | Lowers | Equal-Weight | $750.00 | $800.00 |

| Edward Yang | Oppenheimer | Raises | Outperform | $850.00 | $750.00 |

| Sidney Ho | Deutsche Bank | Lowers | Buy | $750.00 | $890.00 |

| Mehdi Hosseini | Susquehanna | Lowers | Neutral | $675.00 | $680.00 |

| C J Muse | Cantor Fitzgerald | Maintains | Neutral | $925.00 | $925.00 |

| Joseph Quatrochi | Wells Fargo | Lowers | Overweight | $870.00 | $950.00 |

| C J Muse | Cantor Fitzgerald | Lowers | Neutral | $925.00 | $950.00 |

| Edward Yang | Oppenheimer | Announces | Perform | $750.00 | - |

| Atif Malik | Citigroup | Lowers | Buy | $900.00 | $960.00 |

| Timothy Arcuri | UBS | Lowers | Neutral | $765.00 | $900.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to KLA. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of KLA compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for KLA's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of KLA's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on KLA analyst ratings.

About KLA

KLA is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segment of semiconductor process control, wherein machines inspect semiconductor wafers during research and development and manufacturing for defects and verify precise measurements. In this section of the market, KLA holds a majority share. It also has a small exposure to the etch and deposition segments of the WFE market. It counts as top customers the largest chipmakers in the world, including TSMC and Samsung.

Breaking Down KLA's Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining KLA's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 18.55% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: KLA's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 33.29%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): KLA's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 27.3%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): KLA's ROA excels beyond industry benchmarks, reaching 6.08%. This signifies efficient management of assets and strong financial health.

Debt Management: KLA's debt-to-equity ratio surpasses industry norms, standing at 1.92. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.