Whales with a lot of money to spend have taken a noticeably bullish stance on Lam Research.

Looking at options history for Lam Research (NASDAQ:LRCX) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $568,208 and 6, calls, for a total amount of $293,895.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $52.0 and $90.0 for Lam Research, spanning the last three months.

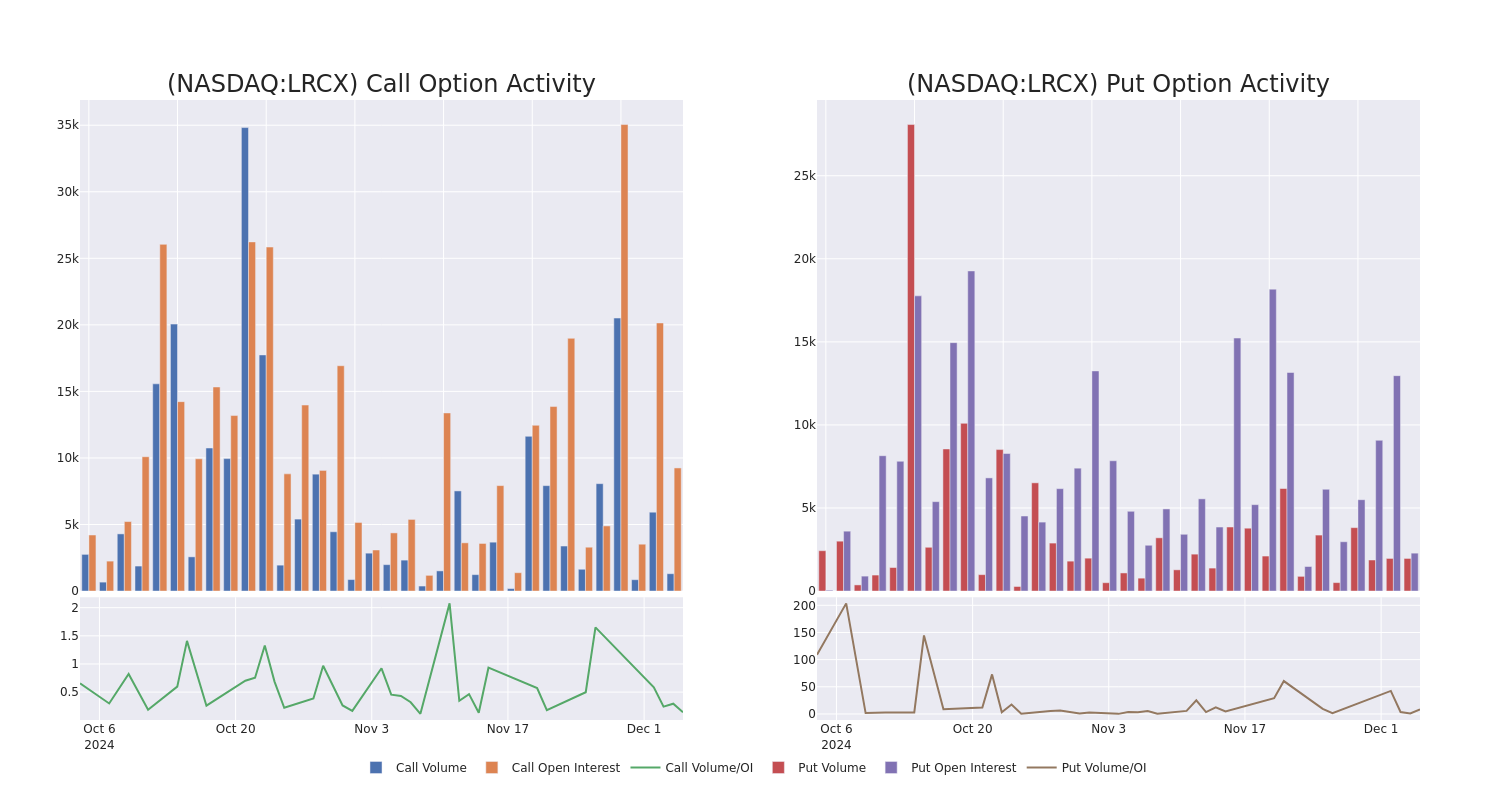

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Lam Research's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Lam Research's significant trades, within a strike price range of $52.0 to $90.0, over the past month.

Lam Research Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | PUT | SWEEP | BEARISH | 02/21/25 | $10.75 | $10.65 | $10.75 | $84.00 | $271.9K | 196 | 254 |

| LRCX | CALL | TRADE | BULLISH | 12/13/24 | $15.55 | $15.25 | $15.55 | $60.00 | $93.3K | 86 | 60 |

| LRCX | PUT | TRADE | BEARISH | 01/16/26 | $2.82 | $2.22 | $2.72 | $52.00 | $82.1K | 185 | 903 |

| LRCX | PUT | TRADE | BULLISH | 06/20/25 | $2.59 | $2.55 | $2.55 | $60.00 | $76.7K | 994 | 302 |

| LRCX | CALL | SWEEP | BULLISH | 02/21/25 | $2.66 | $2.64 | $2.66 | $85.00 | $73.4K | 634 | 323 |

About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment manufacturers in the world. It specializes in deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Lam Research's Current Market Status

- Trading volume stands at 3,150,949, with LRCX's price down by -3.55%, positioned at $75.48.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 48 days.

What Analysts Are Saying About Lam Research

In the last month, 2 experts released ratings on this stock with an average target price of $81.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Lam Research, targeting a price of $78. * Maintaining their stance, an analyst from Bernstein continues to hold a Market Perform rating for Lam Research, targeting a price of $85.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lam Research options trades with real-time alerts from Benzinga Pro.