Financial giants have made a conspicuous bearish move on JD.com. Our analysis of options history for JD.com (NASDAQ:JD) revealed 73 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 49% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $182,166, and 68 were calls, valued at $8,291,554.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $17.5 to $70.0 for JD.com over the recent three months.

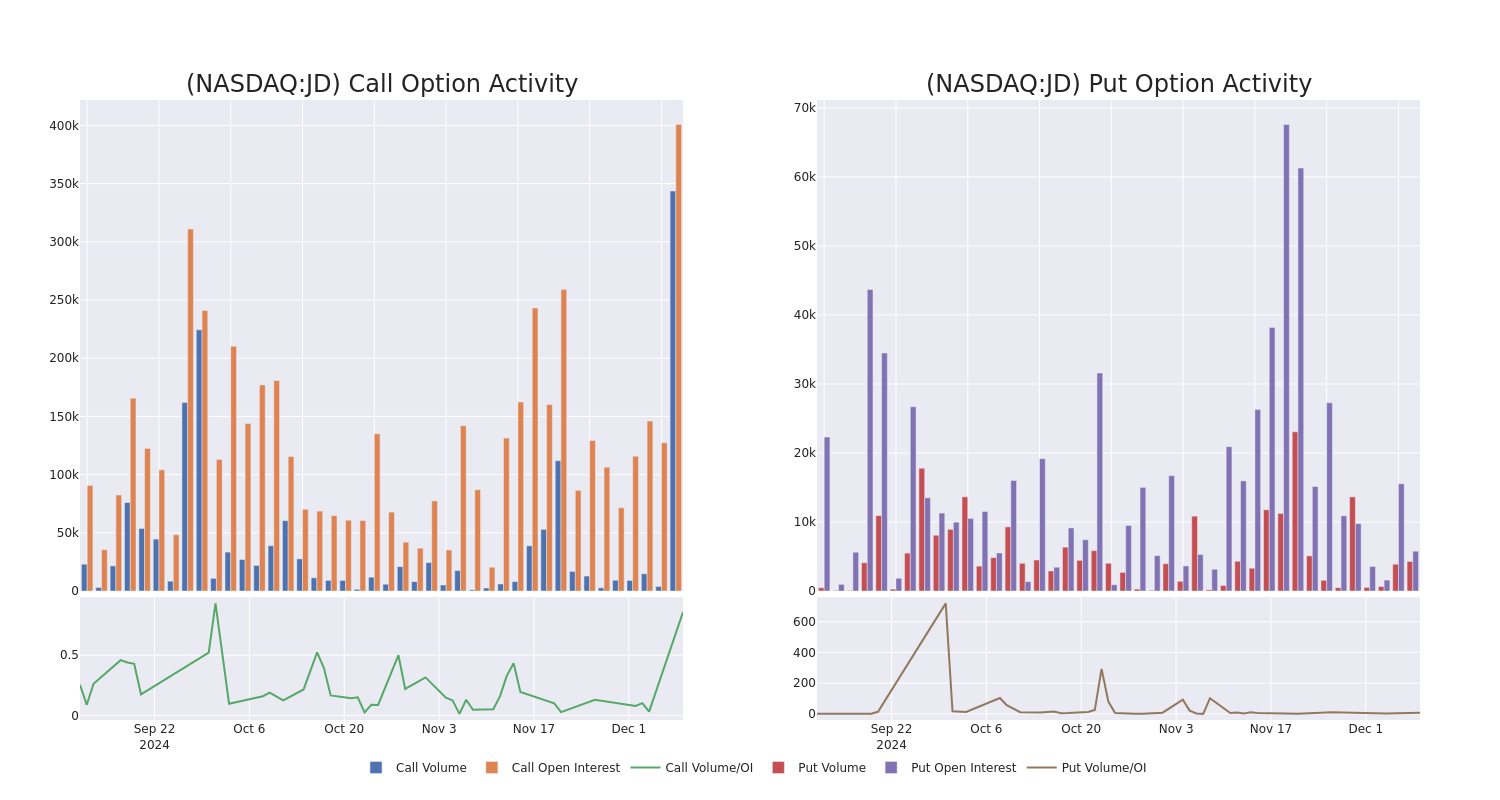

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com's whale activity within a strike price range from $17.5 to $70.0 in the last 30 days.

JD.com Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | SWEEP | BULLISH | 01/24/25 | $3.0 | $2.78 | $3.0 | $43.00 | $483.3K | 1 | 1.6K |

| JD | CALL | SWEEP | BULLISH | 01/17/25 | $2.47 | $2.44 | $2.45 | $44.00 | $407.3K | 12.4K | 9.2K |

| JD | CALL | SWEEP | BULLISH | 01/17/25 | $2.46 | $2.45 | $2.45 | $44.00 | $386.0K | 12.4K | 11.0K |

| JD | CALL | SWEEP | BULLISH | 01/17/25 | $2.5 | $2.44 | $2.45 | $44.00 | $378.1K | 12.4K | 4.3K |

| JD | CALL | TRADE | BEARISH | 01/17/25 | $12.55 | $12.4 | $12.4 | $30.00 | $372.0K | 21.5K | 402 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

After a thorough review of the options trading surrounding JD.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of JD.com

- With a volume of 18,524,126, the price of JD is up 13.13% at $42.06.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 86 days.

Professional Analyst Ratings for JD.com

3 market experts have recently issued ratings for this stock, with a consensus target price of $48.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Citigroup has decided to maintain their Buy rating on JD.com, which currently sits at a price target of $51. * An analyst from Benchmark downgraded its action to Buy with a price target of $47. * An analyst from Bernstein has elevated its stance to Outperform, setting a new price target at $46.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JD.com options trades with real-time alerts from Benzinga Pro.