/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

UnitedHealth (UNH) is in focus on Jan. 15 following reports that a Senate committee investigation has discovered that the insurance firm deployed “aggressive tactics” to maximize federal Medicare Advantage payments.

UNH reportedly used advanced AI, specialized staff, and high-tech scanning equipment to identify discretionary diagnoses – often minor conditions – that justify higher government reimbursements regardless of whether these diagnoses require treatment.

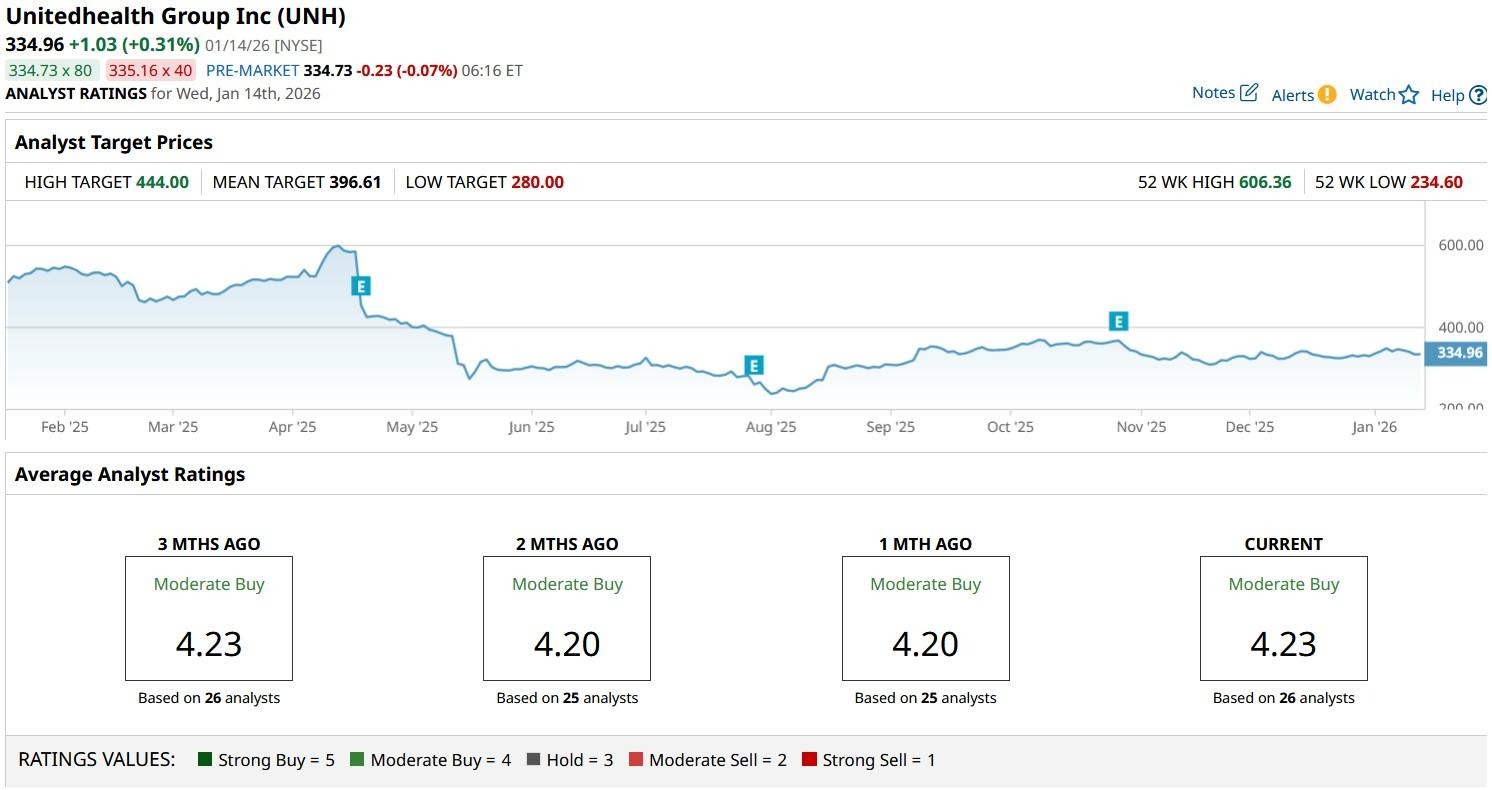

At the time of writing, UnitedHealth stock is up more than 40% versus its 52-week low.

Does This Warrant Selling UnitedHealth Stock?

According to the Senate’s finding, UnitedHealth’s average risk scores exceed industry benchmarks by about 0.28 points, resulting in as much as $643 in additional government spending per member annually compared to industry averages.

These new accusations arrive shortly after the $556 million Kaiser Permanente settlement, creating additional execution risks for UNH stock that’s already down roughly 45% versus record levels in late 2024.

Additionally, the NYSE-listed firm has recently slipped below a major support, coinciding with its long-term moving average (200-day), reinforcing that the downward pressure could sustain in the weeks ahead.

Aren’t UNH Shares Trading at a Discount?

While UnitedHealth shares are currently trading at a discount, their compressed multiple likely reflects appropriate market skepticism.

The company already faced significant headwinds through 2025. Its medical care ratio deteriorated, its CEO stepped down, and guidance withdrawals shook investors.

And now the Senate investigation findings, combined with ongoing DOJ billing practice inquiries, have created a regulatory and reputation risk environment that constrains multiple expansion, at least in the near-term.

That’s why the lower price on options contracts expiring mid-April – according to Barchart – sits at about $293 currently, indicating potential downside of another 12% from current levels.

What’s the Consensus Rating on UnitedHealth?

Despite significant risks related to duration and resolution of regulatory uncertainties, Wall Street analysts haven’t thrown in the towel on UNH shares yet.

The consensus rating on UnitedHealth stock remains at “Moderate Buy” with the mean target of about $397 indicating potential upside of nearly 20% from here.

Note that the health insurance giant currently pays a healthy dividend yield of 2.67% as well.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.