United Airlines is the IBD Stock Of The Day for Monday. UAL stock cruised briefly into a buy zone as airlines stocks in general make their way back from the coronavirus pandemic travel dearth. The Chicago-based airline was added to the IBD Leaderboard list of top growth stocks on Monday at a one-half position size.

United Airlines stock is on the mend as the company returned to profitability during its second quarter, buoyed by recovering travel demand. United posted earnings of $1.43 per share in Q2 and $2.81 in the third quarter this year. That's compared to losses of $3.91 per share and $1.02 per share, respectively, for the same periods in 2021.

For the fourth quarter, United expects adjusted earnings to range from $2 to $2.25 per share after it posted a loss of $1.60 in Q4 last year. Meanwhile, FactSet analysts forecast earnings of $2.07 for the period.

In September, United said it continued to see "strong demand" vs. pre-pandemic levels. And the recovery could really take off next year. Analysts expect full-year earnings to fly to $6.11 per share for 2023, up from a forecast of $2.14 for this year, and much improved from the loss of $13.94 per share reported for 2021.

On Monday, Morgan Stanley upgraded United Airlines stock to overweight, from equal weight. It tagged the stock with a price target of 67, almost 50% above where shares traded on Monday.

Last week, Helaine Becker at Cowen cited United as her top pick among airlines, partly due to its exposure to higher-margin international travel.

On Friday, rumblings surfaced that United Airlines is close to a deal with Boeing as United prepares to order around 100 planes to replace its aging widebody jets and fleet of Boeing 767s.

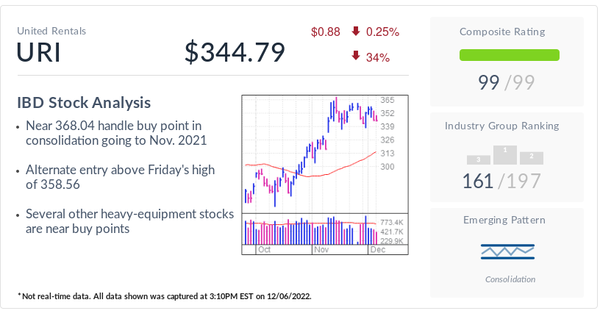

United Airlines Stock Analysis

IBD ranks United Airlines second in the Transportation-Airline Group, trailing only Copa Holdings according to the IBD Stock Checkup. UAL stock briefly eclipsed the 45.67 buy point for its six-month cup-with-handle base but retreated just below the entry.

The handle is showing firm support at the stock's 21-day exponential moving average. And shares are holding above the other key technical lines.

The latest base formed in a deep consolidation, which began in March 2021. That pullback started within an even longer-term consolidation triggered by the onset of the coronavirus pandemic in January 2020.

UAL stock's relative strength line is trending higher again. And shares have an 89 RS Rating out of a possible 99, indicating strong performance against its peers in the stock market. United Airlines has a 79 Composite Rating, which combines a number of technical indicators into one score. And its recovering earnings earned United a 78 EPS Rating.

United Airlines stock rose 2.6% to 45.03 by Monday's closing bell. UAL stock is up nearly 26% over the past three months but has gained only about 1.4% so far this year, and remains far below its record high set in 2018.

You can follow Harrison Miller for more stock news and updates on Twitter @IBD_Harrison