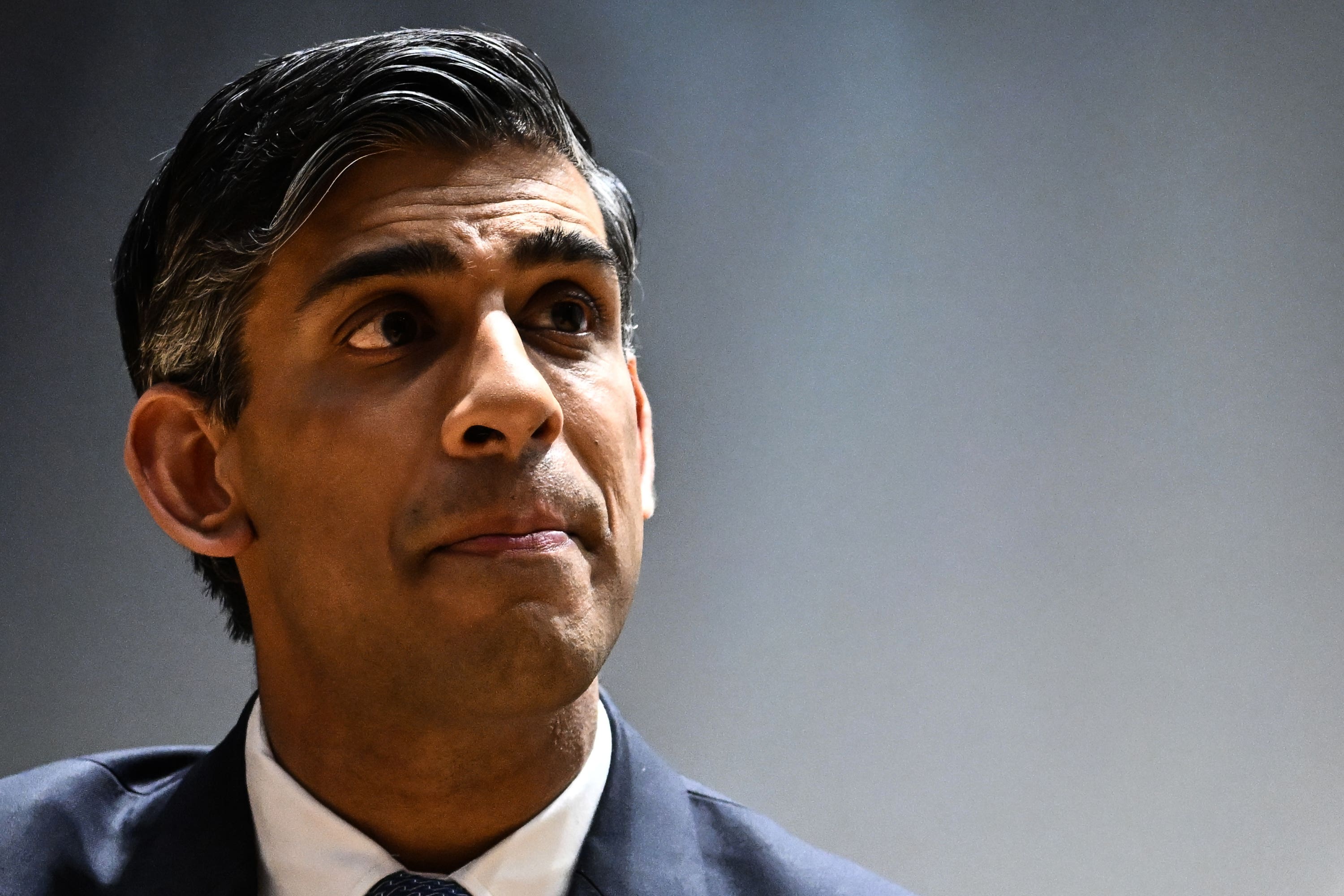

Rishi Sunak has urged the banks to offer “bespoke support” for those struggling with their mortgages – but ruled out any extra government extra help for homeowners facing soaring interest rates.

The Sunak government was urged to “end this mortgage horror show” as the average two-year fixed-rate deal topped 6 per cent for the first time this year – levels last seen in the aftermath of Liz Truss’s disastrous mini-Budget.

Ahead of a further interest rate rise expected from the Bank of England this week, Mr Sunak told ITV that the government would “stick to the plan” to halve inflation – suggesting no further support would be available.

The PM’s official spokesman said he was “not aware of any plans” for further help despite rising rates, pointing instead to existing cost of living measures such as help with energy bills.

However, No 10 encouraged Britain’s banks to roll out more emergency support agreed with chancellor Jeremy Hunt after a December mortgage summit – including interest-only payments and the extending of mortgage terms.

Asked if Mr Sunak had a message for the banks, his official spokesman said: “It’s simply that we recognise the need for them to look at bespoke support for borrowers who are struggling.”

The No 10 official added: “They need to consider things such as term extensions, or moving to interest-only payments. Those are the sorts of things that we would expect to be offering anyone who is finding it hard.”

Labour’s shadow chancellor Rachel Reeves “dismissing [government support] out of hand will just be more bad news for people with mortgages who were looking to come off those deals this year”.

Ms Reeves “needs to work with banks to make sure that people are not at risk of losing their homes”, saying millions of families could see their bills go up by several thousands pounds a year.

The Liberal Democrats said anything else but intervention would be “a disaster for struggling families”, as the average two-year fixed-rate deal on the market hit 6.01 per cent – territory last seen during the market volatility that followed last autumn’s mini-budget.

The Bank of England is expected to raise the base rate further on Thursday as it grapples with stubbornly high inflation. If this happens, it would immediately push up costs further for some borrowers on variable rate mortgages.

Some analysts expect the base rate to rise by another 0.25 percentage points on Thursday, taking the rate to 4.75 per cent. This would immediately push up costs for people on variable rate tracker mortgages.

Around 2.4 million fixed-rate mortgages are due to end between now and the end of 2024, according to figures from UK Finance. Many of these homeowners could be in for a bill shock when they come to re-mortgage, having been used to paying significantly lower rates.

Senior Tory MP Lucy Allen warned the Bank not to put up intertest rates – saying the nation faced a “mortgage catastrophe”, warning of “hideous consequences” and that it is “only going to get worse”.

The chancellor has said there is “no alternative” to the painful interest rate hikes, aimed at bringing inflation under control.

In a blogpost, Ms Allen wrote: “‘Well, it’s a price worth paying to control inflation,’ is the mantra that is trotted out from their briefing packs, provided by mortgage-free senior civil servants. But is it? A price worth paying?”

The Tory MP added: “Have they really thought about what this means for the housing market and the wider economy and those scrambling to sell their homes while they still can.”

Sir Howard Davies, former Bank of England deputy governor, suggested the central bank could “wait a bit” for its most increases to have an impact on inflation, rather than hike the base rate again this week.

Martin Lewis, the leading consumer champion, criticised both the government and the financial sector for not taking stronger action to protect mortgage-payers – dismissing Mr Hunt’s December summit as “a missed opportunity talking shop”.

“The time bomb has exploded, and we’re scrambling about what to do,” he tweeted. Mr Lewis called for “political pressure” on banks to close the gap “between what lenders are charged and savers paid”.

The money-saving expert also said any that any help such as payment holidays “should be easily reversible on request”, and should have no or minimal impact on people’s credit scores.

Mr Sunak said on Monday that he understands the “anxiety people will have about mortgage rates”, but insisted that halving inflation was the priority.

He told Good Morning Britain: “That is the best and most important way that we can keep costs and interest rates down for people. We’ve got a clear plan to do that, it is delivering, we need to stick to the plan.”

No 10 acknowledged pointed to the “raft of support” already available, saying the banks had agreed to support borrowers through “potential options such as term extensions, moving to interest-only payments where appropriate” after a meeting in December.

A YouGov poll found that government support for mortgage payers would be popular. Some 54 per cent of voters support the idea, while only 29 per cent are opposed.

Some housing market experts raised concerns that giving some extra form of mortgage relief could create further issues and potentially make the situation worse.

Jamie Lennox, director at Dimora Mortgages, added: “If the government starts to help mortgage holders, tenants will also be asking for the same and it would be a case of where does it end? With many experiencing large increases in rent, there would be public outcry if support wasn’t offered further.”

The bank has hiked interest rates 12 times since December 2021, from 0.1 per cent to 4.5 per cent today. Higher than expected wage growth in the first three months of the year raised expectations they will be hiked again this week, and could peak as high as 6 per cent.