UiPath Inc. (PATH), a leading enterprise in automation software, is set to announce its fiscal third-quarter results on November 30, post trading hours. The firm boasts an exceptional history of exceeding consensus estimates, consistently surpassing both revenue and earnings predictions over the trailing four quarters.

As a rapidly expanding player in the sector, PATH continues to make substantial investments in AI technology. The company leverages this to offer customers the means to realize AI's full potential today through an integrated suite of capabilities, sparking significant investor interest throughout the year.

For its fiscal third quarter, PATH forecasts revenue between $313 million and $318 million. Furthermore, it projects its ARR to fall in the band of $1.359 billion to $1.364 billion as of October 31, 2023. Meanwhile, Wall Street estimates current quarter revenue to hit $315.62 million, with an EPS of $0.07.

However, amidst a nearly 50% surge in stock price over the past year, the company’s shares currently command a steep valuation, potentially dissuading some investors. Presently, PATH's Price/Sales ratio stands at 8.43x, indicating a premium of 219.3% over the industry average of 2.64x.

During a lightning round this month, Jim Cramer, host of "Mad Money," advised against investing in PATH at this time, as he stated, “No, no...Do not touch PATH.”

While the long-term outlook for PATH appears promising, there could be volatility in the short term. Therefore, prospective investors might want to bide their time for a more favorable entry point. A closer look at some vital financial metrics should shed more light on the situation.

Analyzing PATH's Financial Performance: A Comprehensive Review from 2021 to 2023

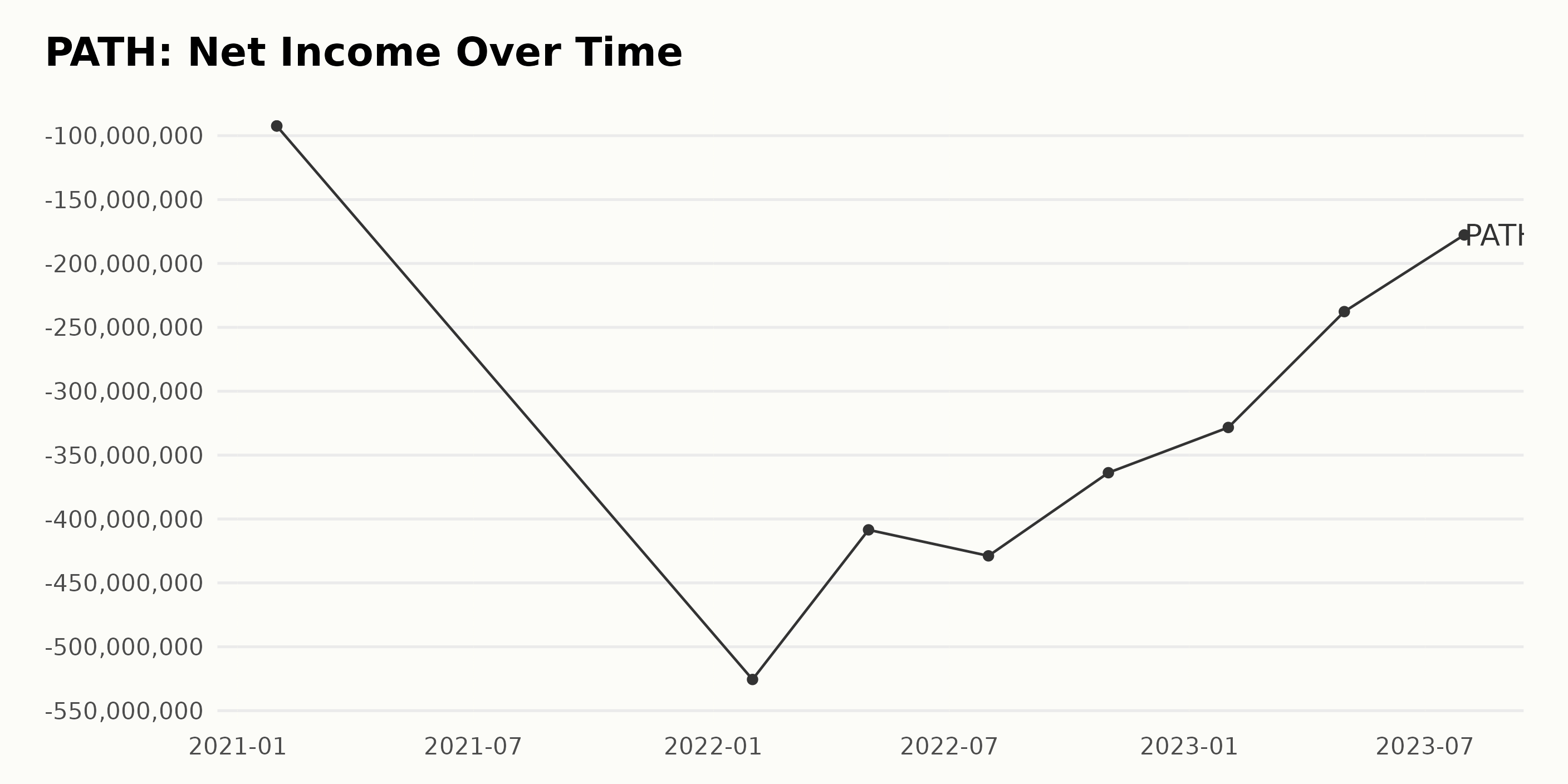

The trailing-12-month Net Income of PATH, has consistently been in the negative from January 2021 through July 2023. Despite this, an overall trend of slowly improving (less negative) Net Income can be observed.

- In January 2021, PATH registered a net loss of $92.39 million.

- However, the company's financial condition deteriorated significantly by January 2022, with Net Income dropping to -$525.59 million. This marked a significant decline over the year.

- In the subsequent months, PATH recorded a slow recovery: Net Income stood at -$428.84 million in July 2022 and -$363.77 million in October 2022.

- By January 2023, the company reported a reduced net loss of -$328.35 million.

- The rebound appeared to gain momentum as the net loss further shrank to -$237.69million by April 2023.

- As of the most recent data point in July 2023, PATH's net loss was -$177.68 million.

In terms of growth, comparing the latest available value from July 2023 with the initial value from January 2021, PATH's Net Income growth rate is negative. However, it's worth noting that there is a clear sign of reduction in losses over time. While the company is still posting net losses, the amount has been decreasing since its peak in early 2022.

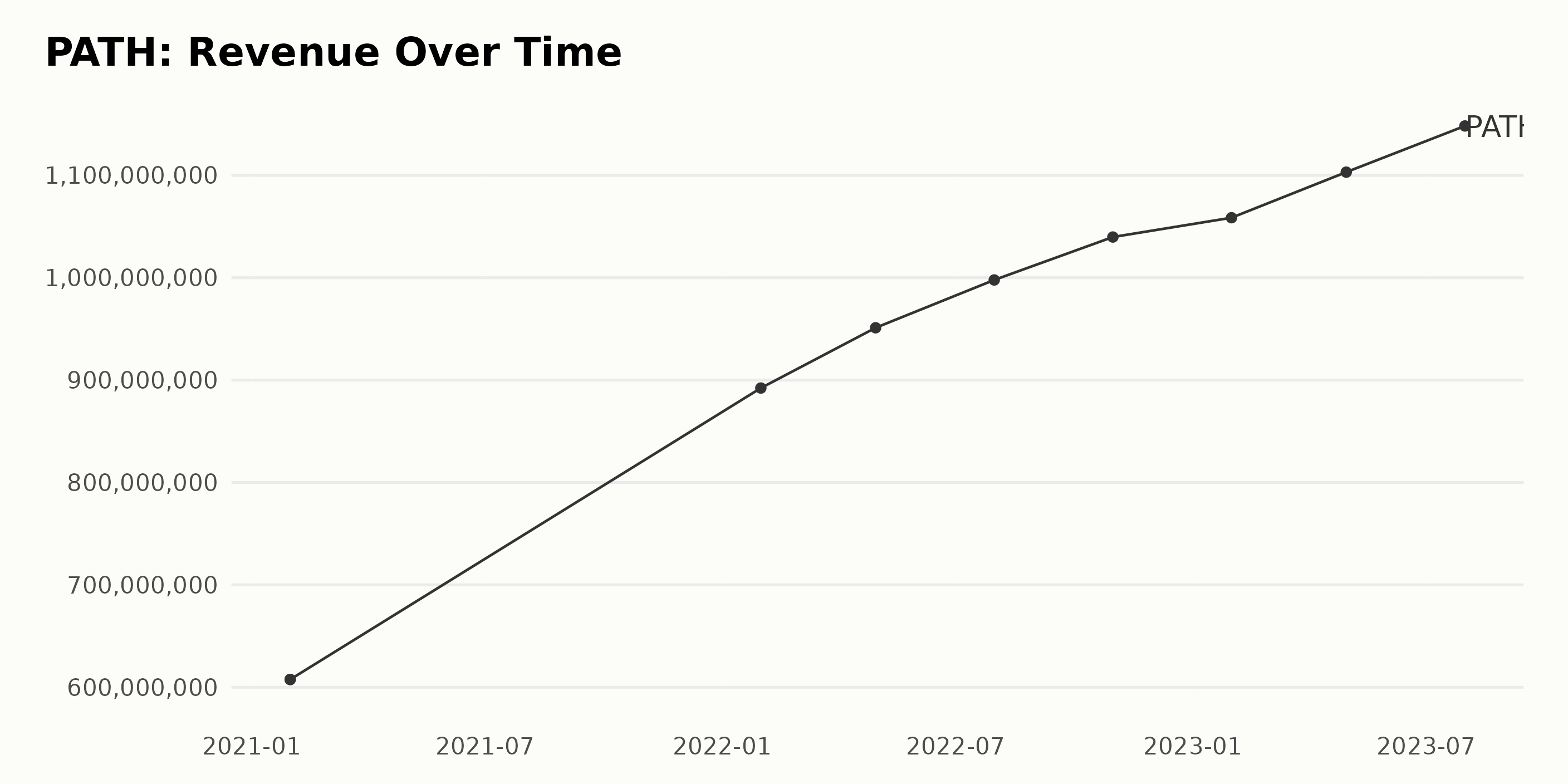

The trend and fluctuation of the trailing-12-month revenue of PATH, can be summarized as follows:

- As of January 2021, PATH posted a revenue of $607.64 million.

- The revenue saw a steady increase throughout 2021 and 2022. As of January 2022, PATH's revenue had grown to $892.25 million, displaying a significant growth compared to the same month in the previous year.

- By April 2022, PATH's revenue had slightly increased to reach $951.10 million, and continued its upward trend to hit approximately $997.80 million by July of the same year.

- PATH closed out the fiscal year 2022 on October 31 with its highest revenue to date $1.03 billion.

- Moving into 2023, the upwards trend in PATH’s revenue seems to continue. By the end of January, it stood at a solid $1.05 billion, and by April of the same year, it rose to $1.10 billion.

- The data concludes with PATH's revenue reaching its peak at $1.14 billion in July 2023.

Analyzing the data from January 2021 to July 2023, there is an approximately 89% growth in PATH’s reported revenue. This growth rate is calculated by comparing the first and last value in the series. The data indicates a consistent and robust development in its Revenue over the evaluated period, with a focus on the substantial increases observed more recently. A continuation of this trend could possibly result in further revenue advancements in subsequent quarters.

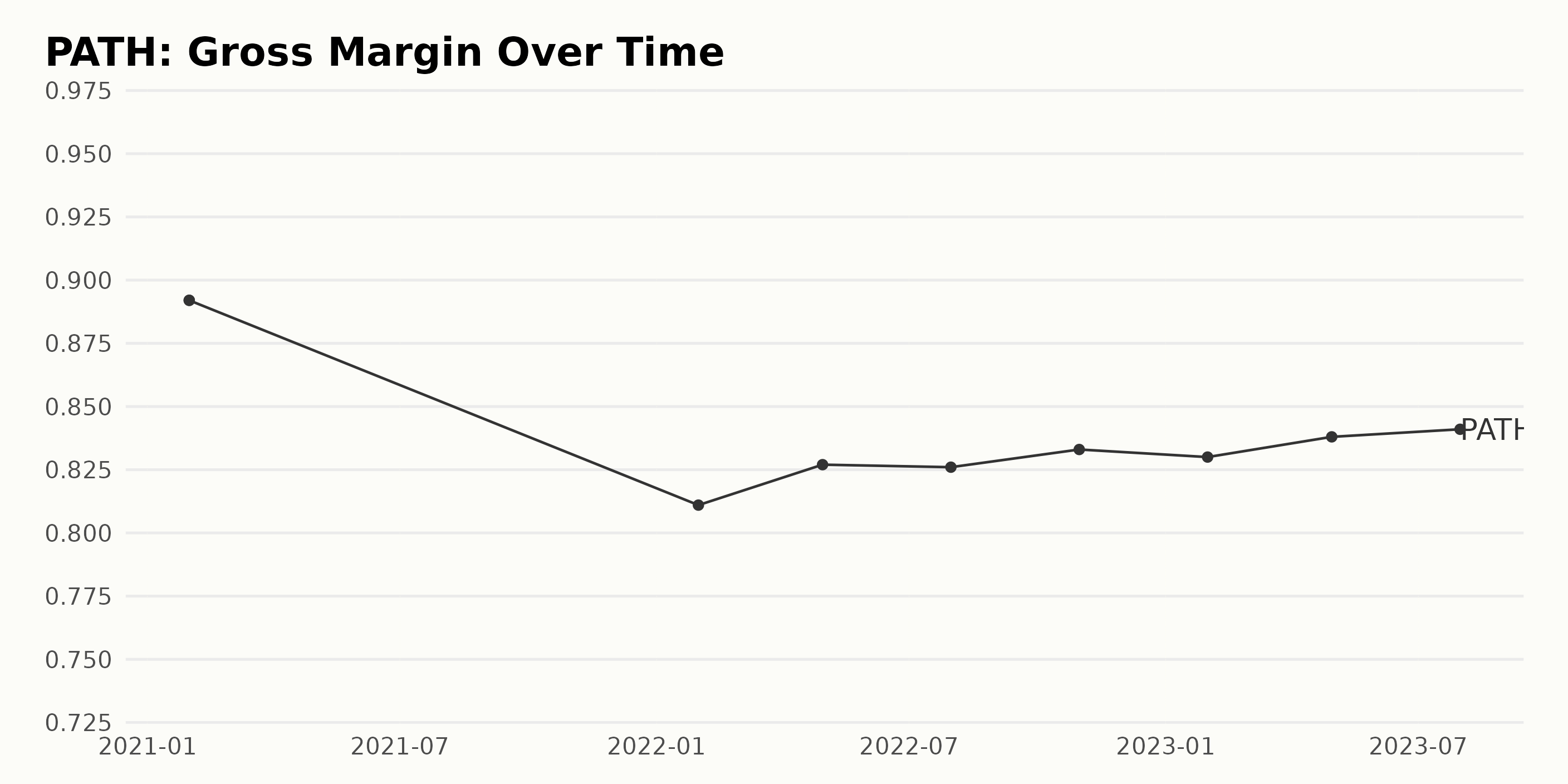

The Gross Margin of PATH , has shown some variability over time:

- Beginning with a rate of 89.2% in January 2021

- Ending with a latest reported figure of 84.1% in July 2023

In more recent times we have witnessed minor fluctuations:

- The value dipped to 81.1% by January 2022

- It then slightly recovered, climbing up to 83.8% by April 2023

- From there, it made a marginal further increase to reach its latest value of 84.1% in July 2023

Overall, the Gross Margin for PATH has experienced a net decrease of ~5.1% points over this time period. The emphasis on recent data shows a mild recovery after an initial drop at the start of 2022. This trend indicates a level of volatility and a slight downward trend in the Gross Margin since the start of the series.

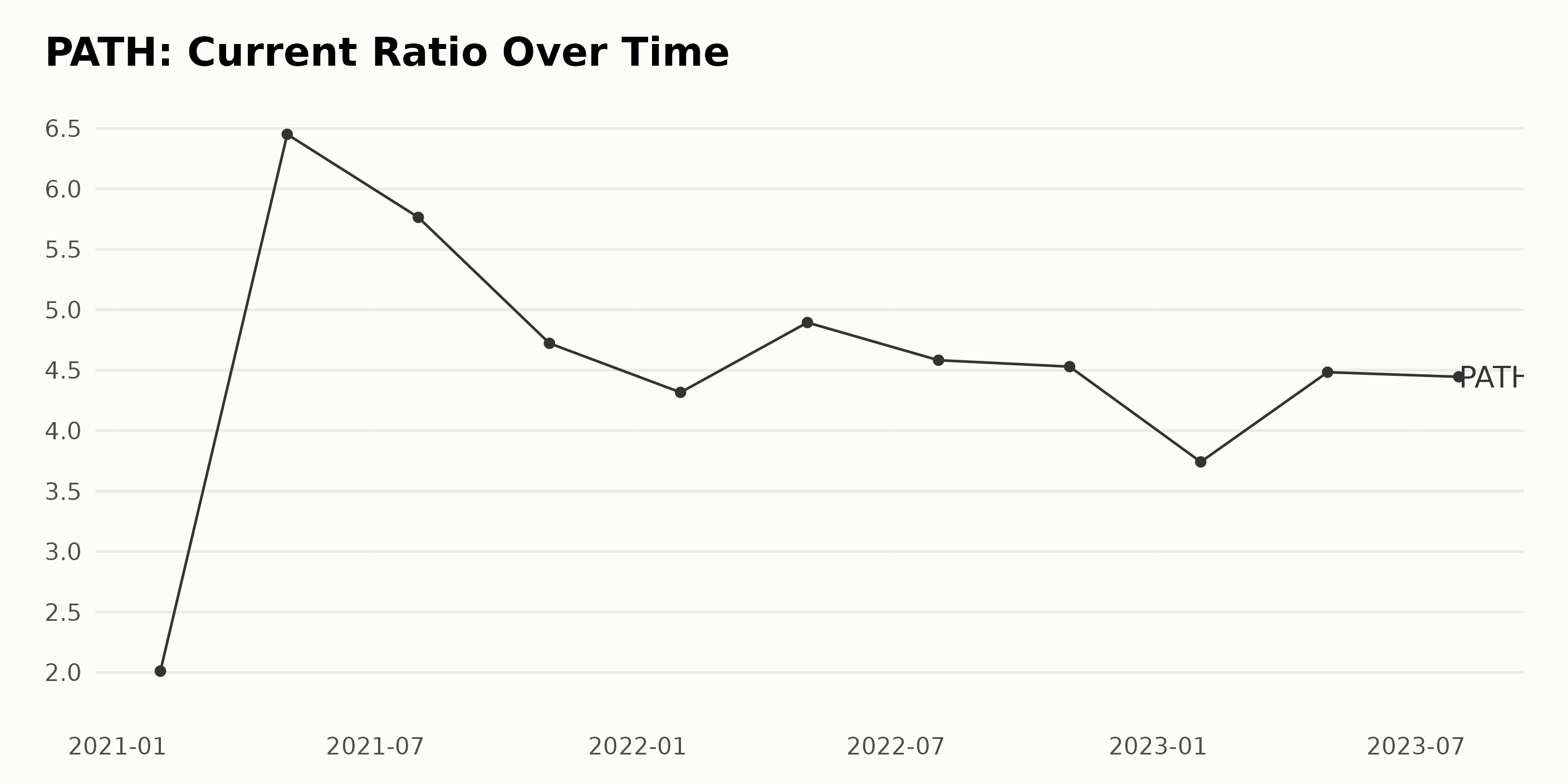

The Current Ratio of PATH has shown some fluctuation over the given period. Key points include:

- Starting from 2.01 in January 2021, the Current Ratio significantly increased to peak at 6.45 by April 2021.

- Following this peak, numbers fell, hitting a low of 4.32 in January 2022 before bouncing back slightly to 4.9 in April 2022.

- The Period from July 2022 onwards saw a minor dip, largely around the 4.5 mark, with the ratio reaching its lowest at 3.74 in January 2023.

- The most recent data point, July 2023, shows a slight recovery with a Current Ratio of 4.45.

Overall, despite the fluctuations, the Current Ratio appears have grown by approximately 121% from the initial figure of 2.01 in January 2021 to the latest available data point in July 2023 at 4.45. The greater emphasis on more recent data suggests that while there may have been declines in specific quarters, the overall trajectory of the Current Ratio for PATH demonstrates a substantial increase over the reported period. All data points provided have been rounded off to two significant digits.

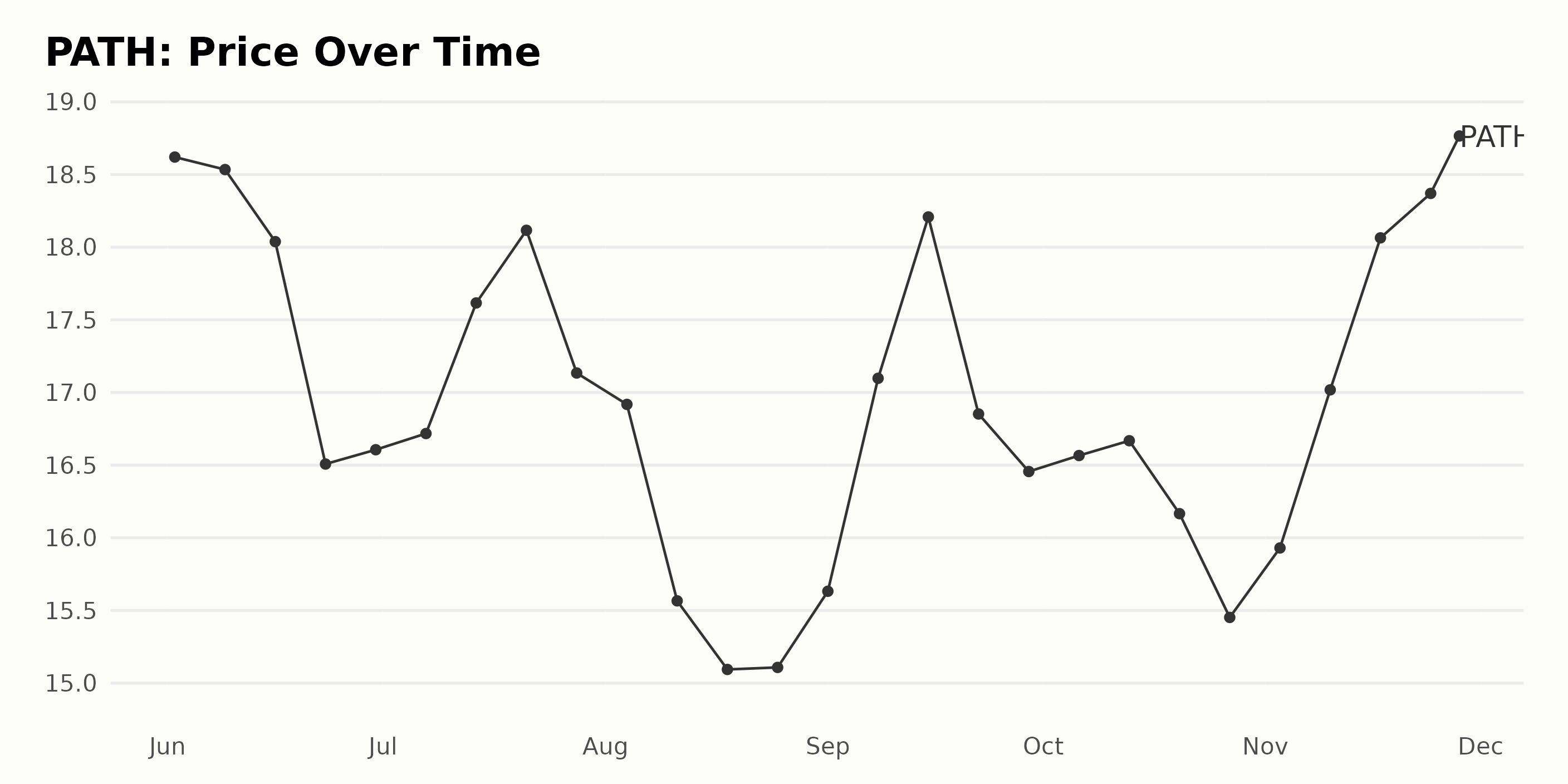

PATH Stock's Rollercoaster Ride: A Six-Month Journey from Stability to Fluctuation

The price of PATH starts at $18.62 on June 2, 2023. Over this period, PATH experiences volatility in its share prices with an overall downward trend until mid-July 2023 reaching its lowest price of the period at $16.5075 on June 23, 2023.

- From late July onwards, PATH begins to experience fluctuations again with a slight increasing trend peaking at $18.116 on July 21, 2023. This rise is shortly followed by another decline reaching down to $15.094 by August 18, 2023.

- The lowest price comes into view at $15.094 on August 18, 2023, after which there's a change in the trend and the price starts rising again.

- Although it's not a smooth upward trend, the price hits $18.208 on September 15, exhibits a short drop, then continues to climb up again, hitting $18.37 by November 24, 2023. By the end of the monitored period on November 28, 2023, the price has carried on climbing slightly to reach $18.765.

Looking at the entire span from June to November 2023, it's clear that PATH's share price exhibited plenty of fluctuation but ended up close to where it began - a change of merely 0.78% over about six months. This trend suggests a certain level of stability for PATH during this period, notwithstanding some ups and downs. Given the variance in each period, it's important to watch out for sudden changes as they may influence future trends. Here is a chart of PATH's price over the past 180 days.

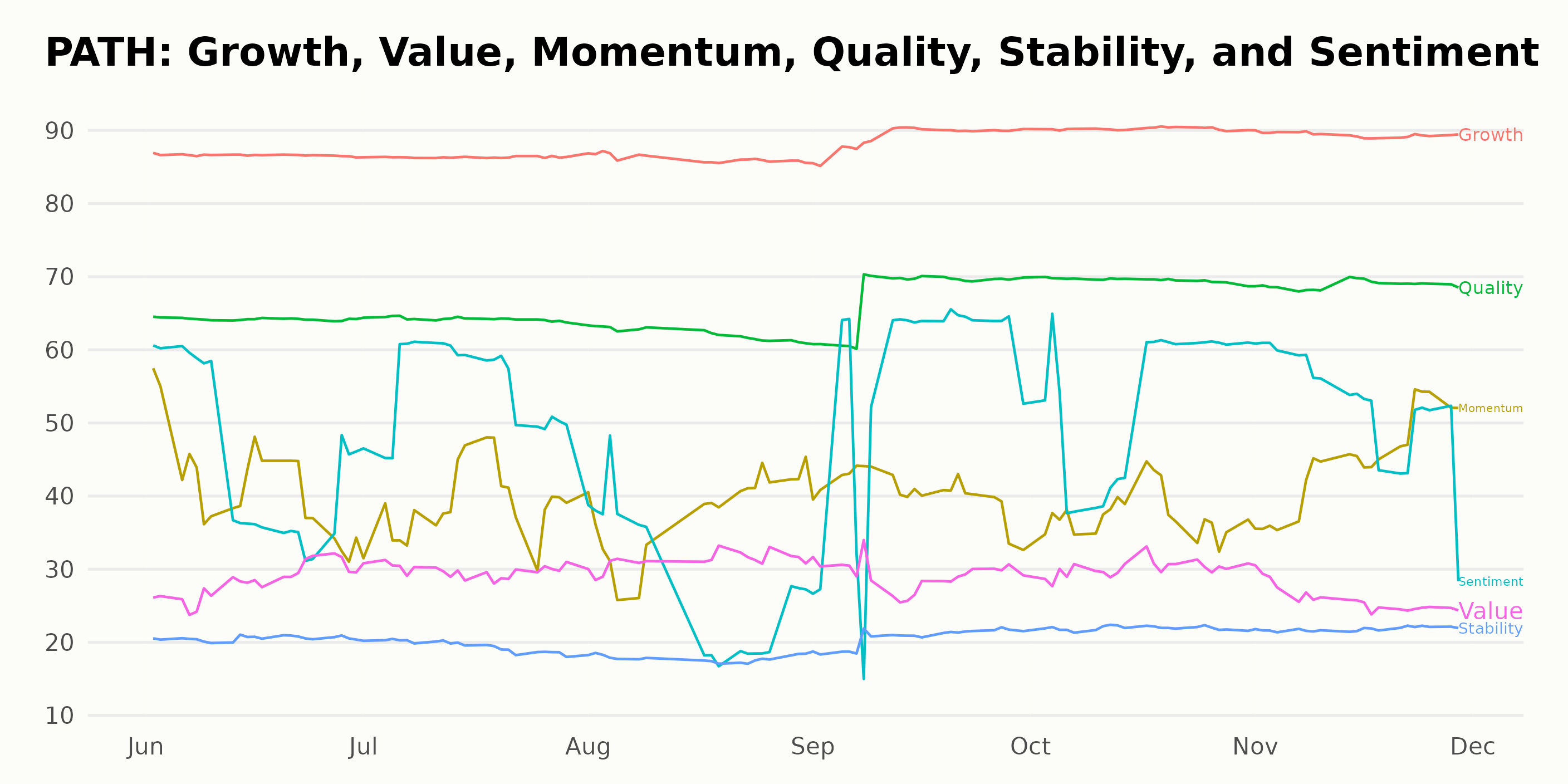

Analyzing PATH's Top POWR Ratings: Growth, Quality, and Momentum (June-Nov 2023)

PATH has an overall C rating translating to Neutral in our POWR Ratings system. It is ranked #19 out of the 23 stocks in the Software - SAAS category.

Analyzing PATH's POWR Ratings across various dimensions shows certain trends and performances of note. The data stretches over the period of June 2023 to November 2023 and the three highest rated dimensions during this time have been Growth, Quality, and Momentum. These three are the focal point for the ensuing discussion.

- Growth: The Growth dimension was consistently high valued across this period, starting at 87 in June 2023 and peaking at 90 in October 2023. Despite a small drop to 89 in November, it maintains its position as the highly rated category in PATH's POWR Ratings.

- Quality: PATH has demonstrated a consistent increase in terms of its "Quality" rating. Commencing with a score of 64 in June 2023, this rating then saw a steady increment, reaching the 70 mark in October 2023, which is an ample indication of the positive appeal of PATH in this parameter.

- Momentum: The "Momentum" rating has shown slight fluctuation, starting at 42 in June 2023, dwindling down to 38 by August, and then gradually increasing back up to 45 in November.

The observed trends highlight PATH's robustness in terms of "Growth", its improving quality standing, and a potentially rebounding momentum as we head further into the last quarter of the year.

How does UiPath Inc. (PATH) Stack Up Against its Peers?

Other stocks in the Software - SAAS sector that may be worth considering are Vimeo Inc. (VMEO), F5 Networks Inc. (FFIV), and Informatica Corp (INFA) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

PATH shares were trading at $19.92 per share on Wednesday afternoon, up $0.94 (+4.95%). Year-to-date, PATH has gained 56.73%, versus a 20.61% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

UiPath (PATH) Earnings Unveiled: Software Stock Opportunity? StockNews.com