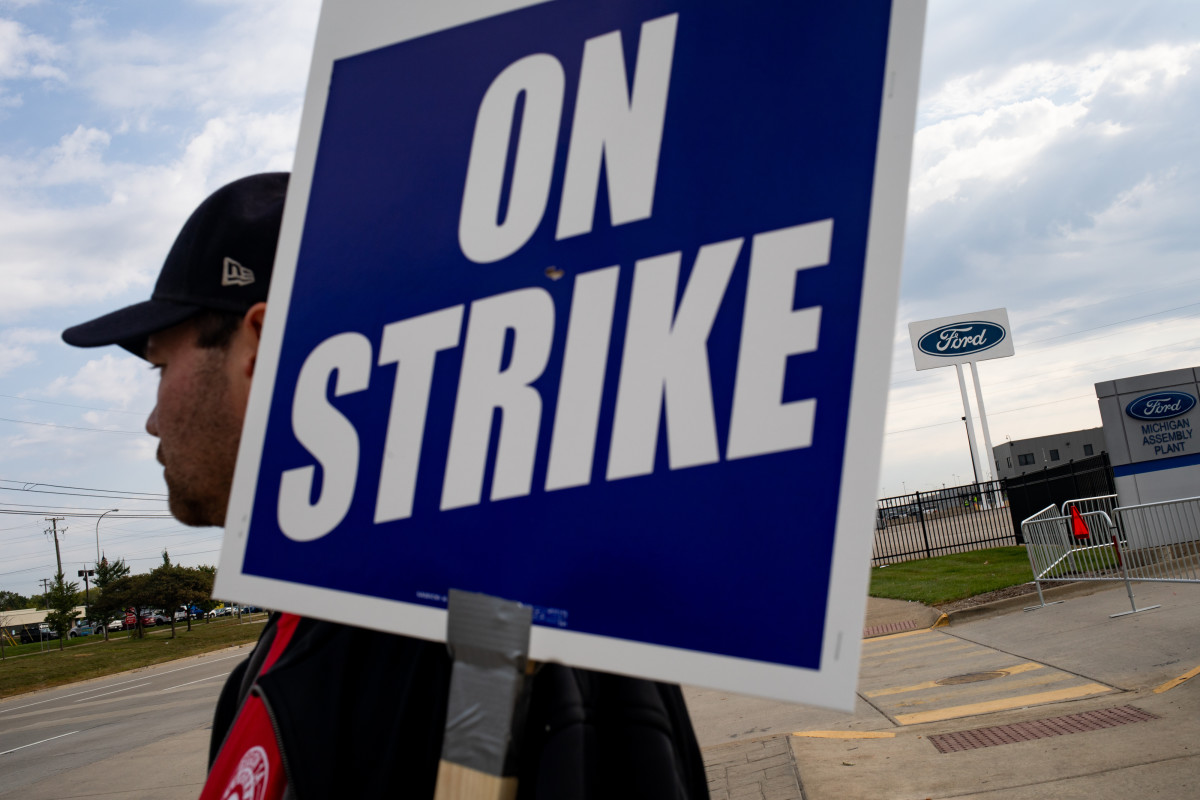

After reporting $3.5 billion in third-quarter profits, General Motors (GM) -) suffered yet another significant blow from striking United Auto Workers on Oct. 24. The union's latest decision is a bold move designed to force management to agree to a slate of terms, including higher wages, more retirement money, and additional time off.

General Motors profits put it on the hot seat

General Motors argues UAW workers' wage demands would crimp its ability to invest in necessary technology, putting it at risk of losing market share to non-union competitors vying for a share of the emerging electric vehicle market.

Electric vehicle sales growth is far outpacing internal combustion engine (ICE) growth, a trend that's unlikely to change. In Q3, Cox Automotive's Kelley Blue Book reports electric vehicle sales in the U.S. skyrocketed 50%, increasing EV's share of total vehicle sales to 8%.

Related: Former Ford CEO has a blunt warning for UAW union strikers

The stakes are undeniably high.

General Motors' EV market share slipped against key rivals last quarter, a warning sign that it's already struggling to outmaneuver other carmakers. Wall Street analysts estimate EV sales will comprise 40% of all vehicles sold in America in 2030.

General Motors must spend big money if it hopes to remain the nation's biggest automaker. However, claims General Motors can't afford to meet striking workers' demands have fallen flat with workers in the wake of record profitability.

More Business of EVs:

- A full list of EVs and hybrids that qualify for federal tax credits

- Here’s why EV experts are flaming Joe Biden’s car policy

- The EV industry is facing an unusual new problem

The company's third-quarter sales exceeded $44 billion, up 5% from one year ago, and earnings per share totaled $2.28 per share, up slightly from last year. The company has pocketed about $10 billion in profits through the first nine months of this year.

UAW workers target a crucial source of General Motors' profit

Given General Motors' record earnings and stalled contract negotiations, the union has turned its attention to General Motors' biggest cash cow.

Workers walked off the assembly line at Arlington Assembly on Oct. 24, halting production of the highly profitable Chevy Tahoe, Chevy Suburban, GMC Yukon, and Cadillac Escalade, at General Motors' largest plant.

“Another record quarter, another record year. As we’ve said for months: record profits equal record contracts,” said UAW President Shawn Fain. “It’s time GM workers, and the whole working class, get their fair share.”

So far, General Motors has offered striking workers less than Ford Motors (F) -),

According to a UAW statement, Ford's deal includes a better path to top wages, more retirement money, and a more compelling cost-of-living plan to account for annual inflation than General Motors' offer.

Initially, union workers demanded a 40% pay increase, a return to pensions, a 32-hour workweek, cost-of-living increases, a faster pathway to top wages, and other perks.

They rejected a General Motors offer earlier this month that included a 20% pay increase, a reinstatement of COLA inflation adjustments for top-wage tier workers in year two, reducing how long it takes to reach its top wage tier to four years, an increase in temporary worker pay to $20 per hour, and a boost to 401(k) retirement contributions to 8% from 6.4%.

The decision to expand the strike to Arlington Assembly increased the number of workers participating in its stand-up strike against General Motors, Ford Motors, and Stellantis to 45,000 across eight plants and 38 parts distribution centers.

Overall, the UAW boasts nearly 150,000 members.

Forget General Motors – Sign up to see what stocks we’re buying now