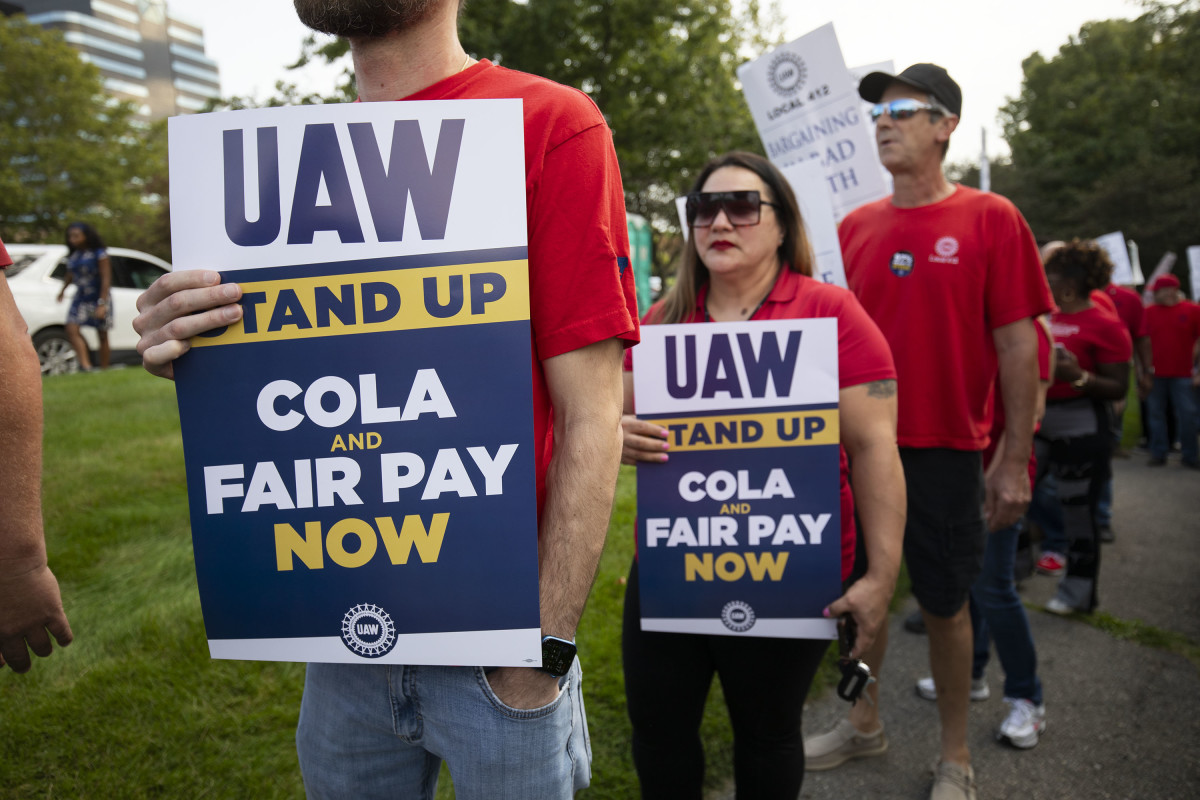

The United Auto Workers is broiled in a contentious battle with General Motors (GM) -), Ford Motors (F) -), and Stellantis (STLA) -) over pay and benefits.

Workers are already striking at three plants to force Deroit's Big Three to agree to a broad wish list of demands, including a 40% pay increase and a shorter 32-hour work week. So far, there appears to be little progress in finding common ground.

General Motors' President Mark Reuss penned an op-ed on Sept. 20 for the Detroit Free Press to dispel what the auto executive called myths regarding the automakers' ability to increase wages significantly.

On Sept. 21, UAW Vice President Mike Booth fired back at Reuss' claims, doubling down on assertions that General Motors has the financial firepower necessary to ink a record deal with workers.

Workers and automakers dig in heels

U.S. auto manufacturers were on the ropes during the Great Financial Crisis, so workers agreed to concessions to help them stay in business. Now that GM, Ford, and Stellantis revenue and profit have rebounded, workers are negotiating to boost pay to offset rising inflation-related expenses and better prepare for retirement.

Alongside a significant pay increase, reinstating pensions for new workers that were ended during the Great Recession, a shorter 32-hour workweek, and cost-of-living increases are among striking auto workers' demands.

Related: General Motors delivers hard-nosed message to UAW workers

Based on Reuss' op-ed, automakers are reluctant to accept those requests.

Reuss says increasing worker pay and benefits would hamstring its ability to reinvest to compete in an increasingly tough market. Electric vehicle demand is growing quickly, and if the company doesn't make the investments necessary, it could lose out to others, including Tesla (TSLA) -), which hires non-union workers and currently controls 62% of the EV market. GM's EV market share is less than 5%.

"If we don’t continue to invest, we will lose ground — quickly," wrote Reuss. "Over the past ten years, our net income totaled $65 billion, and the amount we invested in that same period? $77 billion."

More Business of EVs:

- A full list of EVs and hybrids that qualify for federal tax credits

- Here’s why EV experts are flaming Joe Biden’s car policy

- The EV industry is facing an unusual new problem

Booth is unconvinced. In his op-ed, he questioned Reuss's claim that profits are heading back into the business to fend off competition from the likes of Toyota (TM) -) and Honda (HMC) -).

"A GM statement from June says the company has invested $30.5 billion in U.S. manufacturing and parts distribution facilities in the past 10 years. We welcome that investment in the U.S., but where's the other $47 billion going?" asked Booth.

General Motors has offered striking workers a 20% pay increase that it believes is generous. Reuss points out that 85% of General Motors' union workers would make about $82,000 annually.

"Reuss touts the wages of 85% of GM’s workforce. What about the other 15%? We’re fighting for 100% fairness for 100% of our members," says Booth. "6% to 10% of GM’s workforce are temps. Temps start at $16.67 an hour. Once a temp actually gets a permanent job, the starting wage is $18 an hour. I don’t know what qualifies as “poverty wages,” but show me a Big Three executive who would work for that pay."

Instead of profits returning to factories, Booth says they're lining shareholders' pockets. He points out that the company has aggressively repurchased shares,

"Here’s another fact: GM is spending more on stock buybacks than they are on U.S. labor," says Booth. "In a review of U.S. Securities and Exchange Commission filings, our research team found that GM has spent more than $21 billion on stock buybacks over the last decade, lavishing Wall Street with the results of our labor. That's not right."

Forget General Motors – Sign up to see what stocks we’re buying now