United States Steel Corporation (NYSE:X) is scheduled to come up with its second-quarter 2022 results after the bell on Jul 28.

The company surpassed the Zacks Consensus Estimate in three of the trailing four quarters, while missed once. U.S. Steel has a trailing-four quarter negative earnings surprise of 0.3%, on average. It delivered an earnings surprise of roughly 1.7% in the last reported quarter. Healthy end-market demand and higher year-over-year selling prices are likely to have supported its second-quarter results.

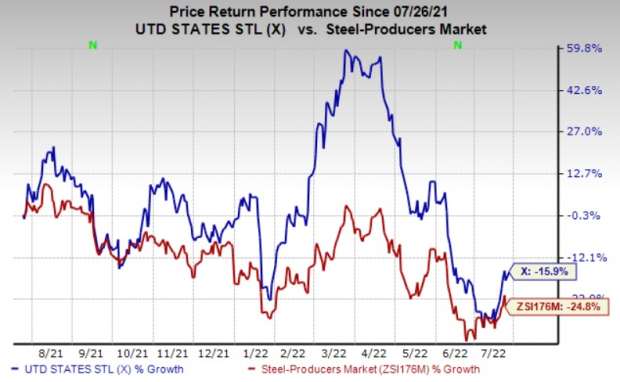

Shares of U.S. Steel are down 15.9% over a year compared with the industry's decline of 24.8%.

Let's see how things are shaping up for this announcement.

What do the Estimates Say?

U.S. Steel, last month, issued its guidance for the second quarter. It envisions adjusted EBITDA of roughly $1.6 billion for the quarter. Second-quarter adjusted earnings per share are projected between $3.83 and $3.88.

The Zacks Consensus Estimate for revenues for U.S. Steel for the second quarter is currently pinned at $5,808.6 million, indicating a 15.6% year-over-year rise.

Moreover, the Zacks Consensus Estimate for shipments for the company's Flat-Rolled unit for the quarter currently stands at 2,260,000 tons, reflecting a 2.8% year-over-year decline. The consensus estimate for average realized price per ton in the unit stands at $1,376, suggesting a 27.6% year-over-year increase.

The consensus estimate for shipments for the Mini Mill unit is pegged at 558,000 tons, suggesting a 9.4% year-over-year decline. The same for average realized price per ton for the unit stands at $1,457, reflecting a 20.7% year-over-year rise.

The Zacks Consensus Estimate for shipments for the U.S. Steel Europe segment is pegged at 1,053,000 tons, indicating a 9.8% year-over-year decline. The same for average realized price per ton for the unit stands at $1,238, calling for a 36.8% year-over-year rise.

For the Tubular segment, the consensus estimate for shipments is pegged at 128,000 tons, reflecting a 21.9% year-over-year rise. The same for average realized price per ton for the unit stands at $2,450, calling for a 50% year-over-year increase.

Some Factors at Play

The company's second-quarter results are likely to have benefited from healthy demand across end markets, higher selling prices and its actions to improve cost and operating performance. It is expected to have gained from an uptick in fixed-price contracts in the quarter to be reported.

U.S. steel prices witnessed a significant downward correction during the second quarter. After surging to nearly $1,500 per short ton in April 2022 due to supply concerns stemming from the Russia-Ukraine war, the benchmark hot-rolled coil ("HRC") prices are on a downward trend and have retreated to levels before the conflict. HRC prices have fallen below the $1,000 per short ton level. The downward drift partly reflects shorter lead times. Fears of a recession have also impacted prices.

Nevertheless, higher year-over-year average realized prices are likely to have supported the company's revenues and margins in the to-be-reported quarter.

U.S. Steel, in June, stated that it expects to deliver record performance in the second quarter, with each business segment significantly contributing to profitability. The Flat-Rolled segment is expected to have gained from higher demand across the company's diverse customer base in the June quarter. The results in the Europe unit are expected to have been supported by higher selling prices amid headwinds from higher input costs. The Tubular segment is also expected to have benefited from a resurgent energy market and higher selling prices. The Mini Mill unit is expected to have gained from higher order activities in the June quarter.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows these have the right combination of elements to post an earnings beat this quarter:

Albemarle Corporation (NYSE:ALB) , scheduled to release earnings on Aug 3, has an Earnings ESP of +11.87% and carries a Zacks Rank #2.

The Zacks Consensus Estimate for Albemarle's second-quarter earnings has been revised 11.8% upward over the past 60 days. The consensus estimate for ALB's earnings for the quarter is currently pegged at $2.94.

Celanese Corporation (NYSE:CE), scheduled to release earnings on Jul 28, has an Earnings ESP of +0.89% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for Celanese's second-quarter earnings has been revised 2.2% upward over the past 60 days. The Zacks Consensus Estimate for CE's earnings for the quarter is currently pegged at $4.58.

Tronox Holdings Inc. (NYSE:TROX), slated to release earnings on Jul 27, has an Earnings ESP of +3.57% and carries a Zacks Rank #3.

The consensus estimate for Tronox's second-quarter earnings has been revised 0.6% upward in the past 60 days. The Zacks Consensus Estimate for TROX's earnings for the quarter is pegged at 84 cents.

To read this article on Zacks.com click here.

Zacks Investment Research

Image sourced from Shutterstock