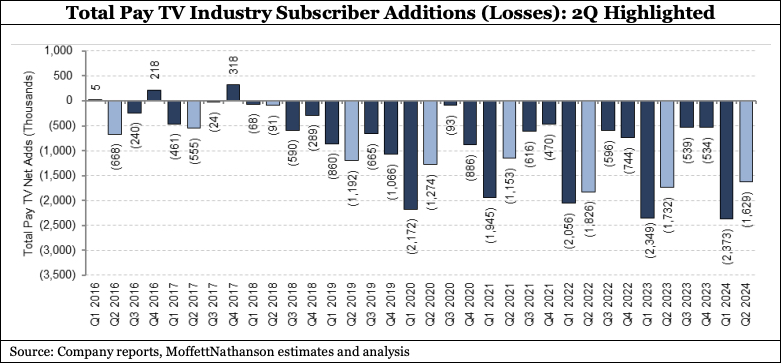

After suffering its worst ever cord-cutting quarter ever at the beginning of the year, the pay-TV sector lost another 1.629 million subscribers from April through June, a slight dip from the 1.732 million lost in the comparable period of 2023, according to figures compiled by equity research company MoffettNathanson.

U.S. cable took the greatest hit, losing 1.03 million subscribers in the quarter.

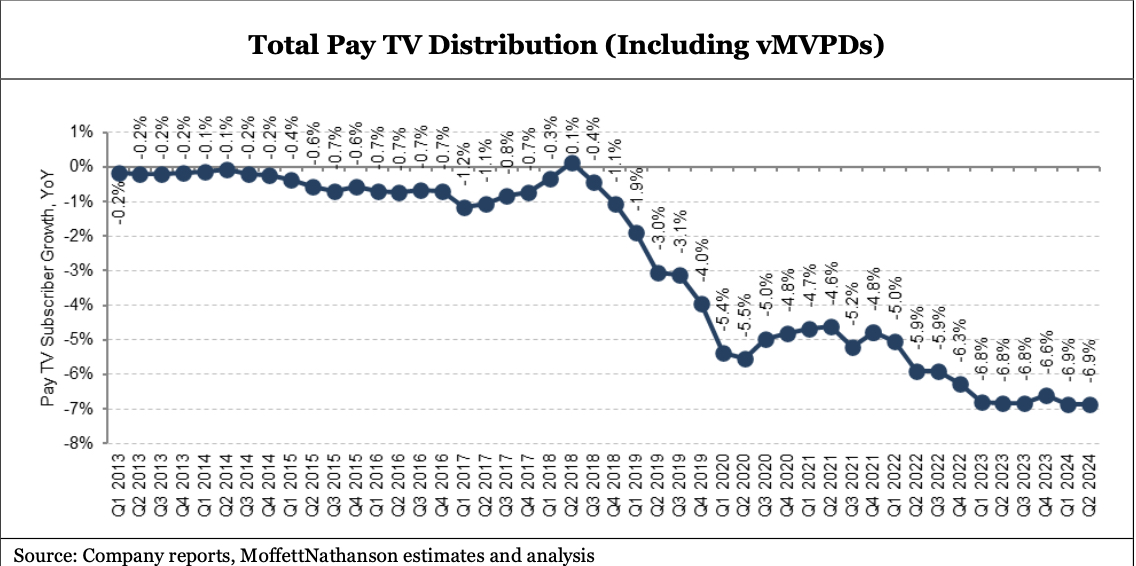

The full pay-TV industry ended Q2 with 68.76 million subscribers, down 6.9% from 73.83 million last year.

And when virtual multichannel video programming distributors (vMVPDs) aren’t factored into the equation, that rate of decline rises even higher, to 12.6% year-over-year.

“This marks the tenth consecutive quarter of double-digit declines,” wrote analysts Craig Moffett. “It is becoming increasingly clear that there is no longer any floor.”

Though the industry shed fewer customers during Q2 2024 than it did in the year-ago quarter, losses for the first six months of 2024 have already reached a “mind boggling” 4 million.

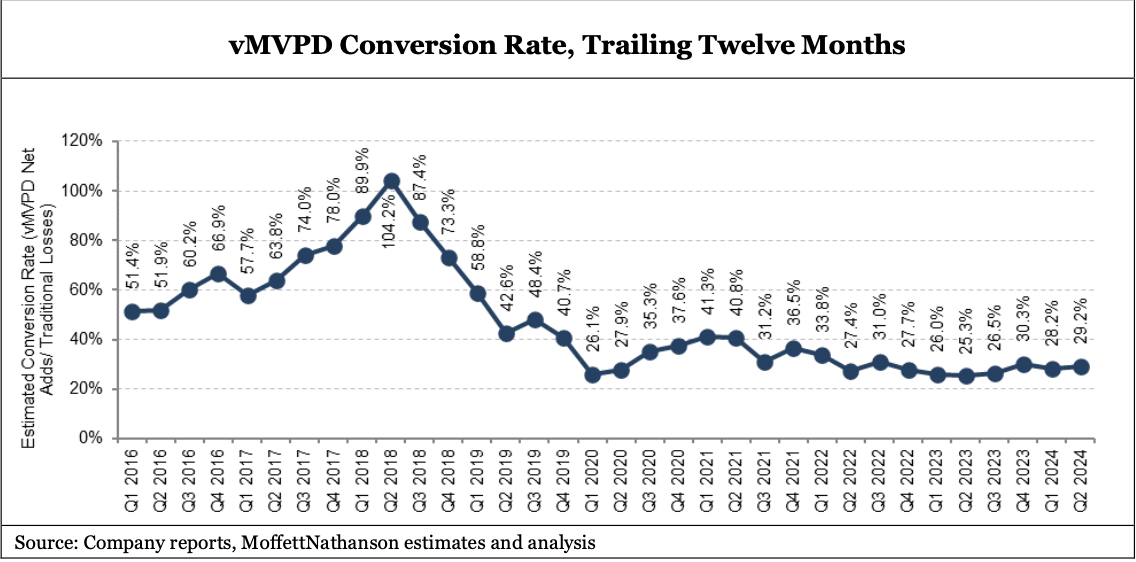

There is good news — vMVPDs added 490,000 subscribers in Q2, a notable increase from the year-ago loss of 6,000 customers.

While some had hopes that live TV streaming services like YouTube TV, Hulu + Live TV and Fubo would offset the losses from traditional cable TV subscriptions, Moffett also raises concerns about the seasonality of many vMVPDs.

“The first quarter sees the largest number of disconnects -- reflecting the end of the NFL season,” he wrote. “And those customers generally don’t return until Q3, when the season resumes. That leaves the second quarter stranded in the middle, with little or no bounce back from the Q1 losses.”