If you’re looking for a complete picture of your financial health, you’ll want to check your net worth.

Net worth is defined as assets minus liabilities; essentially, what you have left over after you subtract all your debts.

DON’T MISS: How Much Income You Need to Buy a House in 20 of the Best Places to Live

Assets are what you own, including the value of investments, funds held in checking or savings accounts, retirement account balances, and real estate. Liabilities are what you owe. This includes any debts, such as personal loans, credit cards, student loans, unpaid taxes, and mortgages.

That’s a lot of moving parts. But their value contributes to how wealthy -- or not -- someone is.

So, what’s typical? How much of Americans’ wealth is tied up in their homes, for instance? Or in retirement accounts? A new report from the U.S. Census Bureau sheds some light.

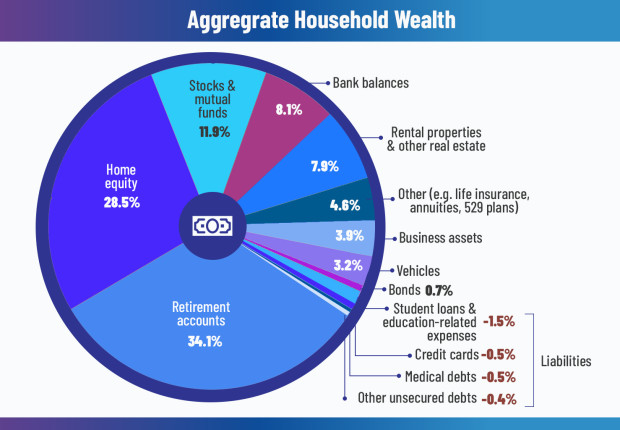

U.S. Net Worth Composition

If you own a car or have a checking or savings account, you're in good company. According to the Census report, these were the most commonly-held assets in the U.S. -- about 8 in 10 Americans have both -- as of 2021.

However, the typical value of these assets were relatively low: $10,000 for bank balances and $15,400 for vehicles.

Fewer Americans, but still a majority, had home equity and retirement accounts on their balance sheets. The median value of each asset, respectively, was $174,000 and $79,900 as of 2021. On the aggregate, it’s these higher-value assets that tend to prop up Americans’ wealth.

The following chart shows aggregate wealth of households at or below the 99th percentile, as calculated by the Census Bureau. The richest 1% of households are not represented, as their extreme wealth would skew the data.

While this breakdown isn’t indicative of individual household wealth, it illustrates how Americans, on the whole, carry their wealth and their debts.

Median wealth varies wildly when it's categorized by demographic and economic characteristics. For example, net worth tends to rise as you age, so older Americans are generally wealthier than younger groups. You’ll also see major variations when controlling for education and homeownership status.

College graduates tend to have a higher average net worth than those with a high school diploma or no high school diploma, the report shows. Households where the most educated member had a bachelor’s degree had a median net worth of $266,600 -- 32 times greater than households where no member had a high school diploma.

Homeowners also tend to be wealthier than renters. Folks that owned their home had a median wealth about 44 times larger than non-owners.

Compare The Best Savings Accounts

Frequently Asked Questions About Net Worth

Does 401(k) count in net worth?

The value of your 401(k) account is a part of your net worth and should be included in your net worth calculation.

What is the median net worth for the average American?

The median net worth of Americans is $166,900 as of 2021, according to data gathered by the U.S. Census Bureau. However, a range of factors such as age, education, income, homeownership, and marital status can lead to variations in wealth on an individual level.

What is the median net worth for millennials?

Born between 1981 and 1996, millennials were the largest generation in the U.S. in 2022, surpassing baby boomers. Fifty-one percent of millennials are homeowners, according to the Census Bureau, and the average net worth of millennials came to $58,430. Excluding home equity, median net worth for the generation was $28,760.

What is the median net worth of the upper middle class?

The median net worth for the richest 25% of households was $604,900 as of 2021, according to Census data.

The Takeaway: Retirement funds and home equity make up the biggest slice of Americans' net worths, even though they're not the most commonly-held assets.