Retail stocks are trading surprisingly well and that trend can be seen with Ulta Beauty (ULTA) and TJX (TJX).

Both have made a recent appearance on the 52-week-high list.

Another retailer doing well is Walmart (WMT), as we recently outlined.

At a time where so many investors are focused on FAANG, cryptocurrencies and other focus groups, too many traders are missing great stocks right in front of them.

Let’s look at these two names now.

Trading Ulta Beauty Stock

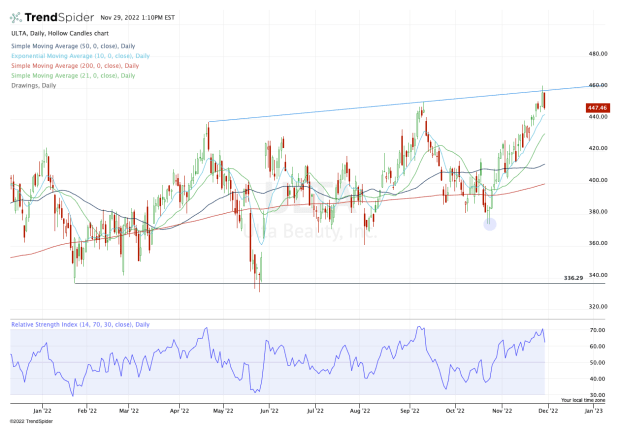

Chart courtesy of TrendSpider.com

When looking at Ulta Beauty stock, we note how it hit new highs in Monday’s session before retreating from $460. The stock is now pulling back.

Also note buyers’ willingness to gobble up the stock a month ago on each trip to $375 (noted on the chart with a purple circle). Since then, it has been riding the 10-day moving average higher.

On a pullback, aggressive bulls who want to stick with the trend will be looking to buy in the low $440s and on a test of the 10-day moving average.

A break lower opens the door down to the 21-day, but the real test here is active support via the 10-day. If that holds, uptrend resistance (blue line) and $460 is back in play.

The one caveat here is a pending earnings report. Ulta Beauty is scheduled to report third-quarter results on Dec. 1.

Trading TJX Stock

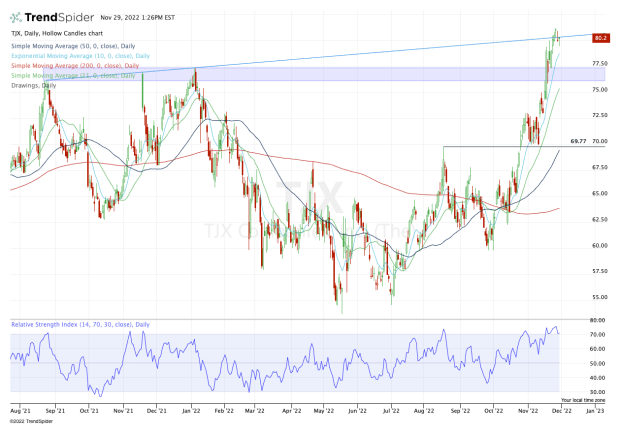

Chart courtesy of TrendSpider.com

TJX, parent of T.J. Maxx, Marshall's and other chains, is another stock with a stellar look.

Initially, aggressive bulls will likely look to buy the dip to the 10-day moving average and the $79 level, the latter of which was prior short-term resistance turned into current support.

As much as I love when short-term support holds and remains active, there’s a more attractive buying zone for TJX shares.

That’s the $76 to $77 zone. There we find three significant prior highs before this year’s breakout, as well as the rising 21-day moving average.

That to me would be a more attractive risk/reward balance for buyers. If TJX stock really breaks down, then the $70 area could be an area of immense interest for buyers, especially if it aligns with the 50-day moving average.

Regardless of where support comes into play, the bulls will be looking for a bounce back up to the $80 to $81 area.