The recent ravaging of stocks may be coming closer to an end. Yet a return to fresh new all-time highs, especially in the NASDAQ names, may be difficult to achieve given the damage done.

Below are two bullish and bearish arguments that point to a period of consolidation over the next few weeks. In other words, up one day, down the next but nothing much happening week to week.

Also, of course, an option trade that has the potential to make money for nothing. We are option traders after all.

THE BULL CASE

Technicals

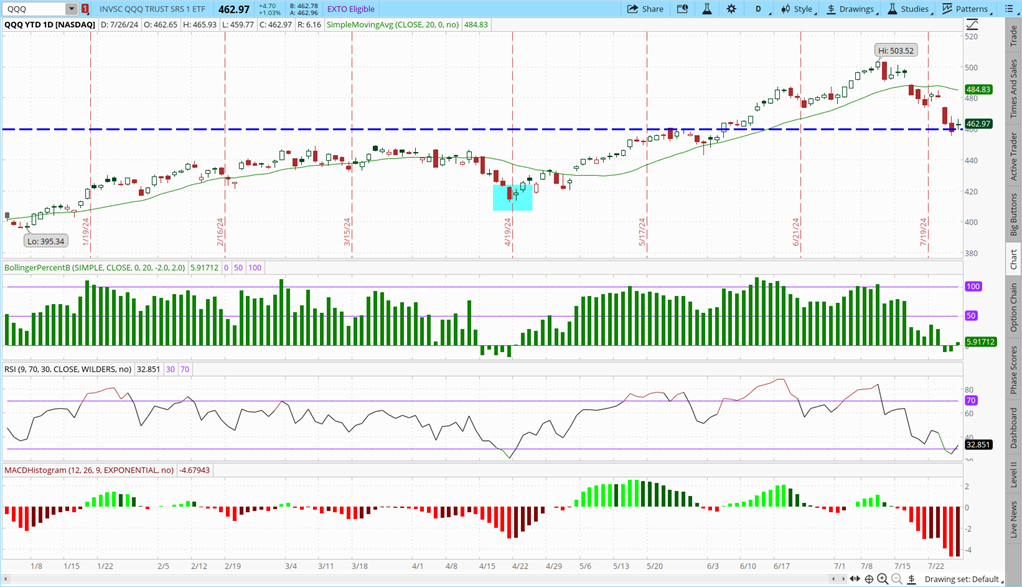

The NASDAQ 100 (QQQ) is deeply oversold but is beginning to strengthen. Bollinger Percent B went negative but is now back in positive territory. 9-day RSI dipped below 30 before turning higher to close above it. MACD got to the most extreme reading of the year and is now consolidating.

QQQ held the critical $460 support level after reaching a deep discount to the 20-day moving average. The last time all these indicators aligned in a similar manner marked a significant short-term low in QQQ.

Implied Volatility

Most of you are likely familiar with the VIX. It is a measure of 30-day implied volatility on the S&P 500 options. It is called the “Fear Gauge” since VIX tends to spike higher when the stock market sells off sharply.

The NASDAQ 100 has a similar measure of implied volatility called the VXN- or “Vixen”. It measures the market expectation of the expected 30-day move in the NASDAQ 100 stocks.

The VXN just recently hit a new high for the year on Thursday at just over 24. Friday saw the Vixen drop to close just under 22.50.

The prior time VXN witnessed similar price action was in mid-April. This coincided with a meaningful bottom in QQQ.

Indeed, spikes in implied volatility are many times a reliable indication that fear has reached an extreme. Usually, a good time to consider a counter-trend bullish position. As Warren Buffett has said “Be Greedy When Others Are Fearful”.

High levels of VXN also mean QQQ option prices are rich. This favors option selling strategies when constructing trades-whether bullish, bearish or neutral.

THE BEAR CASE

Seasonality

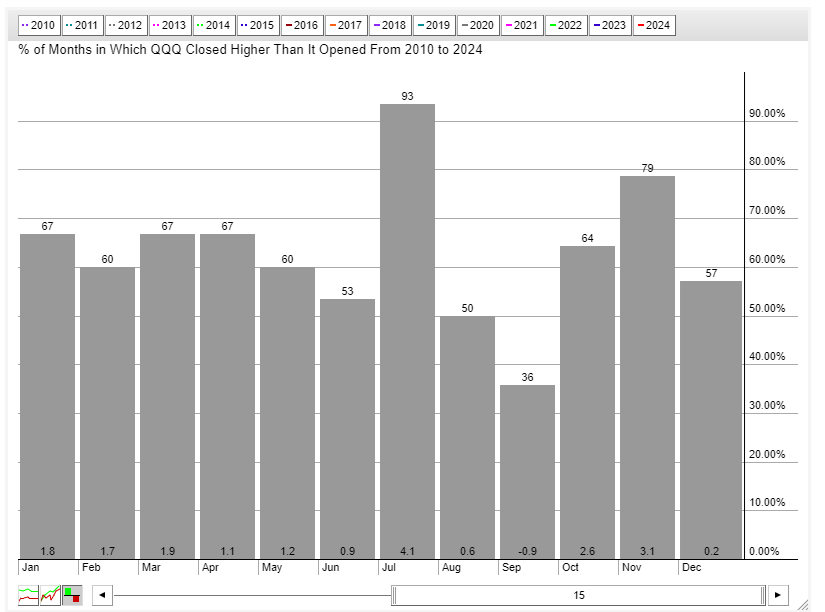

QQQ is entering into a difficult period from a seasonal perspective. Over the last 15 years (post Financial Crisis), August and September have been the worst two months performance-wise for the NASDAQ 100.

August has been up just half the time in this period with a small overall average gain of 0.6%. September is by far the worst month in the past 15 years with losing months exceeding winning months and an average loss of nearly 1%.

Might be a period of consolidation in the offing for QQQ.

Valuations

The three biggest stocks in the NASDAQ 100 are Apple (AAPL), Microsoft (MSFT) and Nvidia (NVDA). These three comprise about 25% of the weighting in the overall QQQ.

The current Price to Sales (P/S) ratio for these names currently stands at 9x,13.5x and 35x. All of these multiples are just off the all-time highs for these names.

This even though interest rates are also at decade highs. Normally higher rates lower valuation multiples.

A look at Apple will help shed some light at just how rich multiples have become.

Hard to imagine a further multiple expansion from here, even with the Fed likely to cut rates somewhat over the next few quarters. No one, though, is expecting Fed Funds rate to go back anywhere near the 0.00-0.25% level it was from 2020 to 2022. (

So, some pluses (technicals and VXN) and some minuses (seasonality and valuations).

Luckily, the options market provides a way to make money in a somewhat stagnant price environment. It is called an iron condor trade. Combines an out-of-the money bearish call spread along with an out-of-the money bullish put spread.

The Chicago Board Options Exchange has an index based on this strategy in the S&P 500 called CNDR.

In essence, get paid to be a seller of the NASDAQ 100 on a sharp rally higher and get paid to be a buyer of the NASDAQ 100 on a further decent drop lower.

Let’s run through a quick example of an iron condor on the QQQ.

Iron Condor

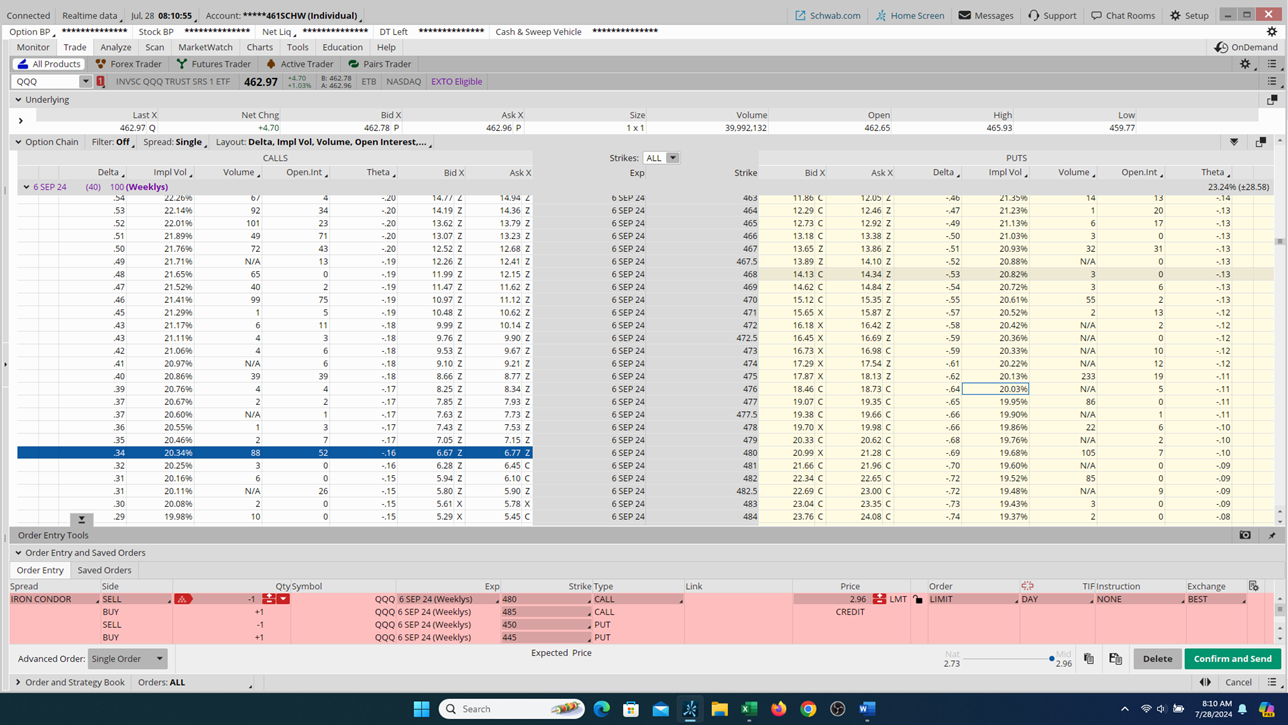

For this example, I chose to go with a 40 days until expiration (DTE) iron condor position with the call spread and put spread roughly 15 points away to both the upside and downside from the current price of the QQQ.

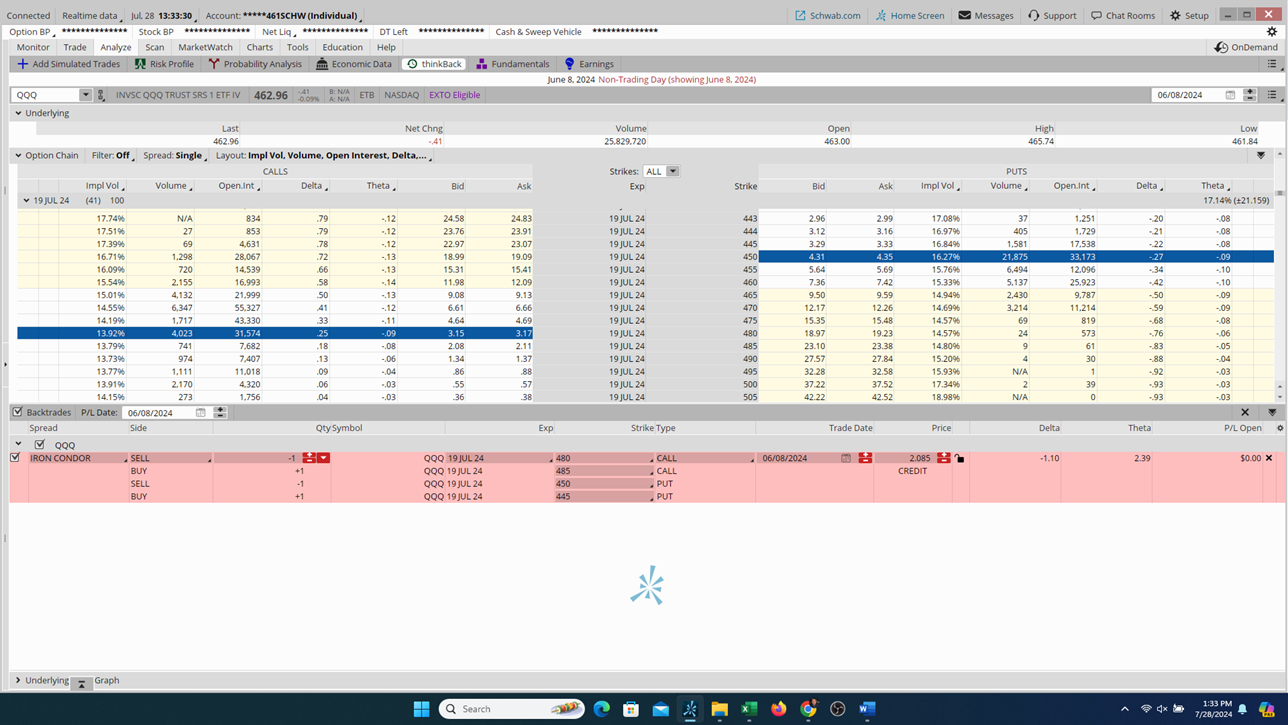

The trade is constructed (shown below) by selling the 9/6/2024 $480 call and buying the 9/6/2024 $485 call and simultaneously selling the 9/6/2024 $450 put and buying the 9/6/$445 put.

Total credit received by selling both the upside call spread and downside put spread is just under $3.00 ($2.96). Maximum loss on the trade is about $2.00.

It is gotten by taking the strike differential of $5.00 on either the short call spread or put spread less the initial credit received of about $3.00. Potential return on risk is just under 150% ($3.00 gain versus $200 loss) if QQQ closes between $450 and $480 on September 6 expiration.

The short upside call strike price at $480 has about a 17-point upside cushion (3.67%) to the $462.97 closing price of QQQ. The short downside put strike price at $450 provides nearly 13 points (2.8%) of breathing room.

Compare the pricing on the iron condor to the last time QQQ was trading at a similar price on June 7. Indeed, only a penny difference in the closing prices of $462.96 in June versus $426.97 now. Days to expiration virtually identical with 41 DTE for the June comparative versus 40 DTE for the most recent.

Yet the same iron condor (selling $480/$485 call spread and $450/$445 put spread) was trading much lower at just over $2.00 ($2.09).

So almost $1.00 less and a risk return of only 67% (make $2.00 and risk $3.00). Look at that return against the current return of 150%- make $3.00 and risk only $2.00.

Why? Because the big jump in implied volatility made it much more rewarding to sell the iron condor now compared to June 7.

Important to note that if the VXN continues to head lower the iron condor will lessen from current pricing as a function of lower IV.

Traders who have a somewhat neutral outlook now over the coming weeks and want to take advantage of the current high regime of implied volatility seen in the VXN should look at an iron condor strategy.

This is the type of analysis we do at POWR Options on a daily basis.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

QQQ shares closed at $462.97 on Friday, up $4.70 (+1.03%). Year-to-date, QQQ has gained 13.38%, versus a 15.27% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

Two Reasons To Be Both Bullish And Bearish StockNews.com