At Market Rebellion, we call monitoring unusual options activity “following the smart money”. Those “smart money” trades might be institutions with access to experienced research teams and trading algorithms, making educated guesses on where stock prices are heading next. Or they might be the result of “in-the-know” traders who have a tip on an upcoming event or breaking news.

Recently, we’ve seen another class of “smart money” traders emerge. A group that has a knack for accurately predicting significant market events — congressional traders. Let’s take a look at two recent trades made by members of congress that were incredibly well-timed.

Sick of Wall Street insiders getting the last laugh? Take back the power. Discover how we uncover the massive option trades that they want to keep secret — and how we use them to our advantage.

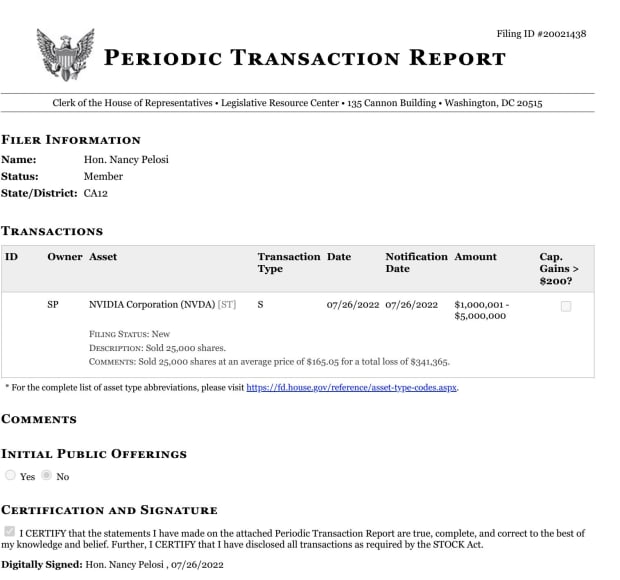

Nancy Pelosi Sells NVIDIA (NVDA) Ahead of New China Restrictions

Nancy Pelosi has received a lot of attention for her well-timed stock and option trades. Back in March 2021, Pelosi caught flack for buying 25,000 shares in Microsoft (MSFT) less than two weeks before Microsoft signed a $22B deal with the U.S. Army. (Source: SEC). Recently, Pelosi made another felicitous trade, this time on the sell-side.

On July 26th, Nancy Pelosi sold 25,000 shares of NVIDIA for $165.05 per share, realizing a -$341,365 dollar loss. At the time, it seemed like a rare miss for the experienced congressional trader.

However, one month after the sale, the U.S. enacted new restrictions that would impair NVIDIA’s ability to sell high-tech semiconductors to China. This resulted in a massive loss of future revenue for the chip company. Following the news, shares of NVIDIA plunged to a 52-week low, making Pelosi’s July sale of NVIDIA a sharp move in hindsight. Had Pelosi held onto those NVDA shares, her -$341,365 dollar loss would have become a loss of more than $1 million dollars based on NVIDIA’s current price.

Though Nancy Pelosi is likely the most famous congressional trader, she isn’t the only one who’s been known to make auspicious stock and option trades.

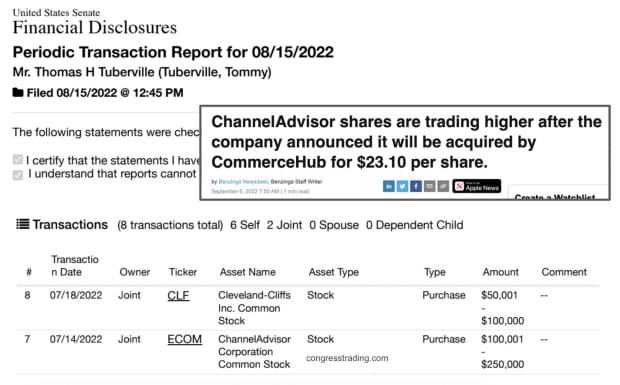

Alabama Senator Tommy Tuberville Buys ChannelAdvisor Corp (ECOM) Before Acquisition

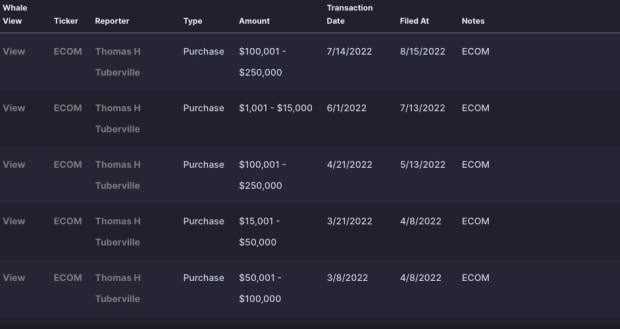

On July 14th, Alabama Senator Tommy Tuberville purchased between $100,000 to $250,000 dollars worth of shares in ChannelAdvisor Corp (ECOM) at an average cost basis of $14.15 per share. According to UnusualWhales, the Alabama senator made four other purchases in ECOM since March.

On September 6th, the news broke: ChannelAdvisor would be acquired by CommerceHub for $23.10 per share — more than 55% above Tuberville’s cost basis. This isn’t Tuberville’s first timely stock market move.

Some of Tuberville’s past trades include:

- Buying far OTM put options on the Invesco QQQ Trust Series on December 29th, with QQQ trading between $399.11 and $403.05. (Source: SEC)

- Shorting ARKK on February 17th, with ARKK trading at roughly $68.11. (Source: BusinessInsider)

- Traded wheat and corn futures whilst sitting on the Senate agricultural committee. (Source: SEC, CongressTrading.com)

The bottom line: Whether we’re examining unusual options activity trades made by hedge funds and institutions, or the moves made by congressional traders like Pelosi and Tuberville, the goal is the same — to capitalize on trades made by those who may have access to information that individual traders don’t have. This is why we follow the “smart money”.