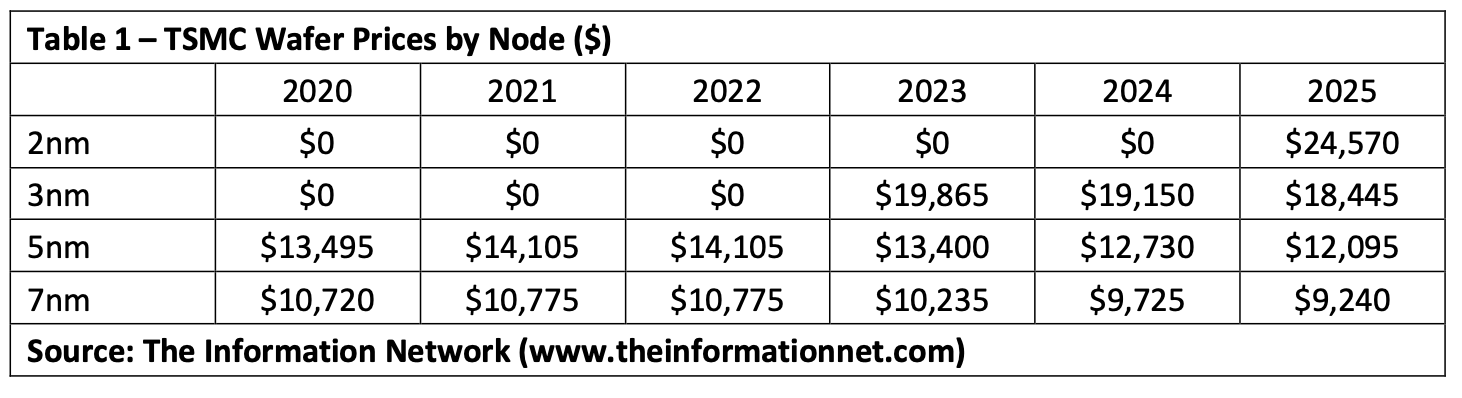

TSMC is poised to increase its quotes by almost 25% more per 300-mm wafer processed on its N2 (2nm-class) production node in 2025 compared to today's quotes for a 300-mm wafer processed on N3 (3nm-class) fabrication technology, its current flagship node, according to estimates by The Information Network published at SeekingAlpha.

The Information Network estimates that TSMC's average selling price per N3 wafer is $19,865 today, up significantly from an ASP of $13,495 per N5 wafer in 2020, when N5 was the company's leading-edge node. TSMC's N2 will bring performance, power, and transistor density improvements compared to N3, but for additional money, the analysts forecast. The Information Network believes that the contract maker of semiconductors will charge $24,570 per N2 wafer when it kicks off mass production in the second half of 2025, an almost 25% increase compared to N3.

As chips get more sophisticated, pack more transistors, and demand higher performance efficiency, they must be made using the latest process technologies. But advanced production can only be implemented using leading-edge equipment in fabs that cost tens of billions of dollars, which is why modern fabrication processes are extremely expensive, and they are poised to get even more expensive in the coming years.

TSMC's base N3 node supports up to 25 EUV layers (according to China Renaissance and SemiAnalysis), and while it is unlikely that any chip will require so many EUV layers, the number gives a sense of how complicated this technology is. One EUV litho-etch step costs $70 per wafer to perform and adds some $350 million capital cost per 100,000 wafer starts per month per fab, according to estimates by Applied Materials. Therefore, the more EUV steps a production node supports, the more expensive its usage can be.

N2 is set to be even more sophisticated, and while TSMC hasn't disclosed whether it intends to use EUV double patterning for this node, this is certainly one of the options it has on the table. In any case, N2 could be more expensive to use than N3, therefore, TSMC is more than likely to charge more for 2nm production than it does for 3nm production.

But while chip production costs are getting higher, so are chip design costs. For instance, the development cost of a reasonably complex 7nm chip was around $300 million, with approximately 40% allocated to software, based on estimates from International Business Strategies (IBS). In comparison, estimates suggest that the design cost of an advanced 5nm processor exceeds $540 million, including software expenses. Looking ahead, it is projected that developing a complex GPU at a 3nm process node will require an investment of about $1.5 billion, with software accounting for approximately 40% of the cost. These rising design and production costs will inevitably affect the prices of leading-edge CPUs, GPUs, SoCs, as well as PCs, servers, and smartphones going forward.

One thing that has to be kept in mind when dealing with alleged TSMC quotes estimates is that they reflect trends but may not accurately reflect actual numbers. TSMC prices heavily depend on multiple factors, including volumes, actual customers, and actual chip designs, just to name a few. Therefore, take these numbers with a grain of salt.