As the world starts to sober up from the onslaught of the US election, a case of the post-campaign scaries seems to be washing over America, as citizens and voters grapple with the reality of what happens now. And as easy as it is to distance another country’s political challenges from our own, there could be a lot more at stake from the incoming presidency than many may have first realised – not least in relation to the proposed Trump tariffs.

Although exact details are yet to be confirmed, the president-elect Donald Trump has already revealed certain elements of his economic agenda, which is largely based around lowering corporate taxes and raising tariffs.

But how could this actually impact Australia, you ask? That’s a a good question, so let’s start with the basics.

What Is A Tariff?

Simply put, a tariff is a tax on goods that come into, or leave, a country.

Tariffs can be applied based on country of origin/destination, or particular items.

Taxes on goods are imposed to raise money or protect local industry, but they can also be used as a political tool to apply pressure on another nation.

What Are The Proposed Trump Tariffs?

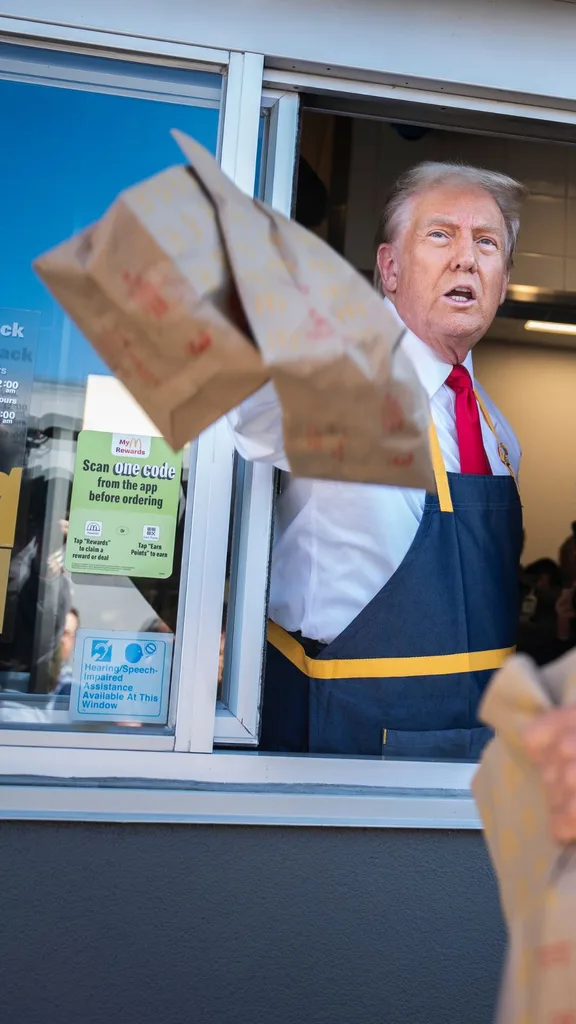

President-elect Donald Trump has been vocal about blaming the global trading system for a laundry list of local woes – including job cuts, closed off foreign markets and inflation.

The answer to all of which, according to Trump, remains closely, if not solely, linked to tariffs.

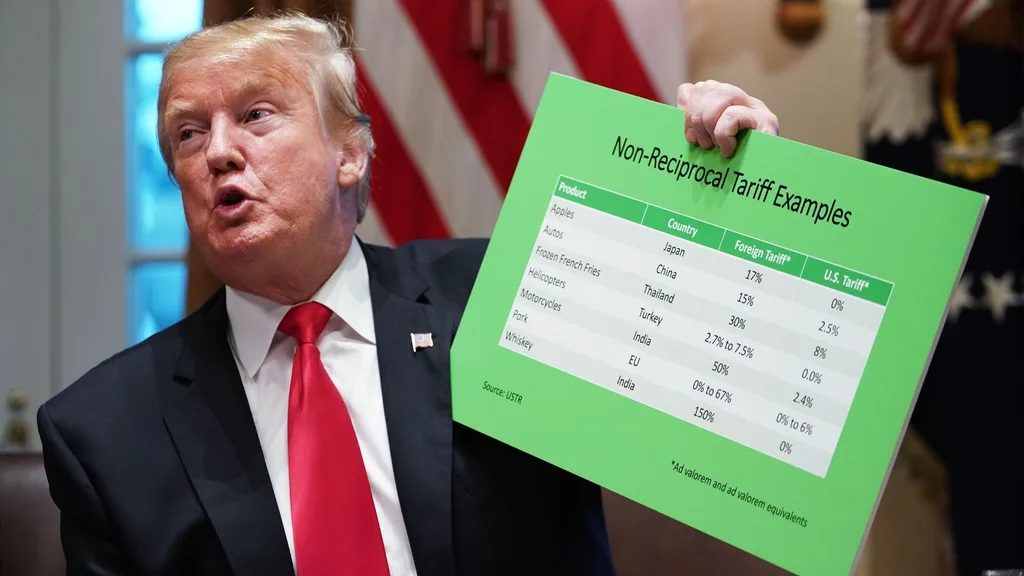

Trump’s proposal involves ‘sweeping’ or ‘across-the-board’ 10-20 per cent tariffs on all imports to the US from around the world. Plainly put, Australian exports to the US would then become 10-20 per cent more expensive on American soil.

But where Australia could really be impacted, is in Trump’s proposal for China.

Going into the election, and reiterated since, the president-elect has vowed to face his geopolitical and economic rival head on by implementing a 50-60 per cent tariff on goods imported from China.

Let’s use a hypothetical situation relating to a US-based clothing company, as an example. Say a brand imports its goods – in this case, t-shirts – from China into the US, under Trump’s proposed tariff hike, the American clothing company will now pay a 60 per cent tax on the value of that import. So, if a t-shirt costs $10 to import from China, the US company would have to pay $6 per t-shirt to the US Government.

Sounds simple right? But here’s where it gets sticky.

If companies are now having to pay 60 per cent tariffs, then its hardly going to just accept the loss. Instead, the more likely scenario will see the company increase the cost to the consumer, as a way to recoup or mitigate the significant knock to profits.

Trump’s strategy behind this is two-fold. On one hand, the proposed tariffs will be instated as a deterrent to companies importing from China therefor creating an incentive to manufacture in America. Very simplistically, more local manufacturing equates to more jobs for Americans.

But in deterring US companies from importing goods from China, the tariffs can also be seen as be a tactic to weaken the Chinese economy.

And this is where experts argue, that Australia could be hit the hardest.

So What Do Tariffs Mean For Australia?

According to Richard Holden, Professor of Economics at UNSW Business School, Australian businesses should start working on adaptive measures, and likewise the government needs to start talks about possible exemptions.

“If Trump goes ahead with across-the-board tariffs or very significant tariffs on China, that could easily usher in retaliatory tariffs and an era of deglobalisation – and that would be very bad for the US economy, for the global economy, and for Australia in particular,” says Professor Holden.

In the same respect, says Professor Holden, reactionary measures could also be expected from China.

“China might do the same thing and say, ‘Well, if the US is going to impose big tariffs on Australia, which is a military and security ally of the US, then we’ll have big tariffs on Australia.’ That would be really bad for all of our exports.”

Furthermore, University of Sydney Economics lecturer Vladimir Tyazhelnikov says the flow on effect of tariffs on China could lead to less demand for Australian goods and resources – both in China and the US.

“[Those tariffs could lead to a] decline in manufacturing, particularly in China, and they would demand less inputs that Australia exports, and that would probably be the main blow to the Australian economy.”

As outlined in modelling by Washington-based Peterson Institute for International Economics, Trump’s promised economic policy would first and foremost impact American citizens, however, it also found that Australia would be the “fourth-worst hit” in a worst-case scenario.

In a similar scenario modelled by KPMG, chief economist Brendan Rynne estimates that Australia’s economic output could drop by between 0.8 per cent and 1.5 per cent, or in dollar figures – $20 billion to $37 billion. This drop could also cause a rise in inflation due to higher import prices.

“The pathway for the RBA would become a lot harder. The RBA could have to push up the cash rate to the 5 per cent range [from the current 4.35 per cent] that we have seen in other countries,” says Dr Rynne.

Treasurer Jim Chalmers is due to address the Australian Institute of International Affairs next Monday to discuss Treasury modelling for Australia, but extracts shared by The Conversation outline the difficulties associated with such modelling.

“The timing of this, and the responses and ramifications that might follow – what economists call second-round effects – are difficult to predict.

“But we wouldn’t be immune from escalating trade tensions that might ensue.

“This is consistent with the views expressed by the Prime Minister, Treasury Secretary, Reserve Bank Governor, and CEO of the National Australia Bank.”

READ NEXT:

What Does A Trump Win Mean For Australians?

Donald Trump Is The Winner Of The US Election

What Does The Trump Win Mean For Women’s Productive Rights?

This article originally appeared on Marie Claire Australia and is republished here with permission.