A noted short seller has taken a short position in one of the most notable SPAC deals that involves a former U.S. president.

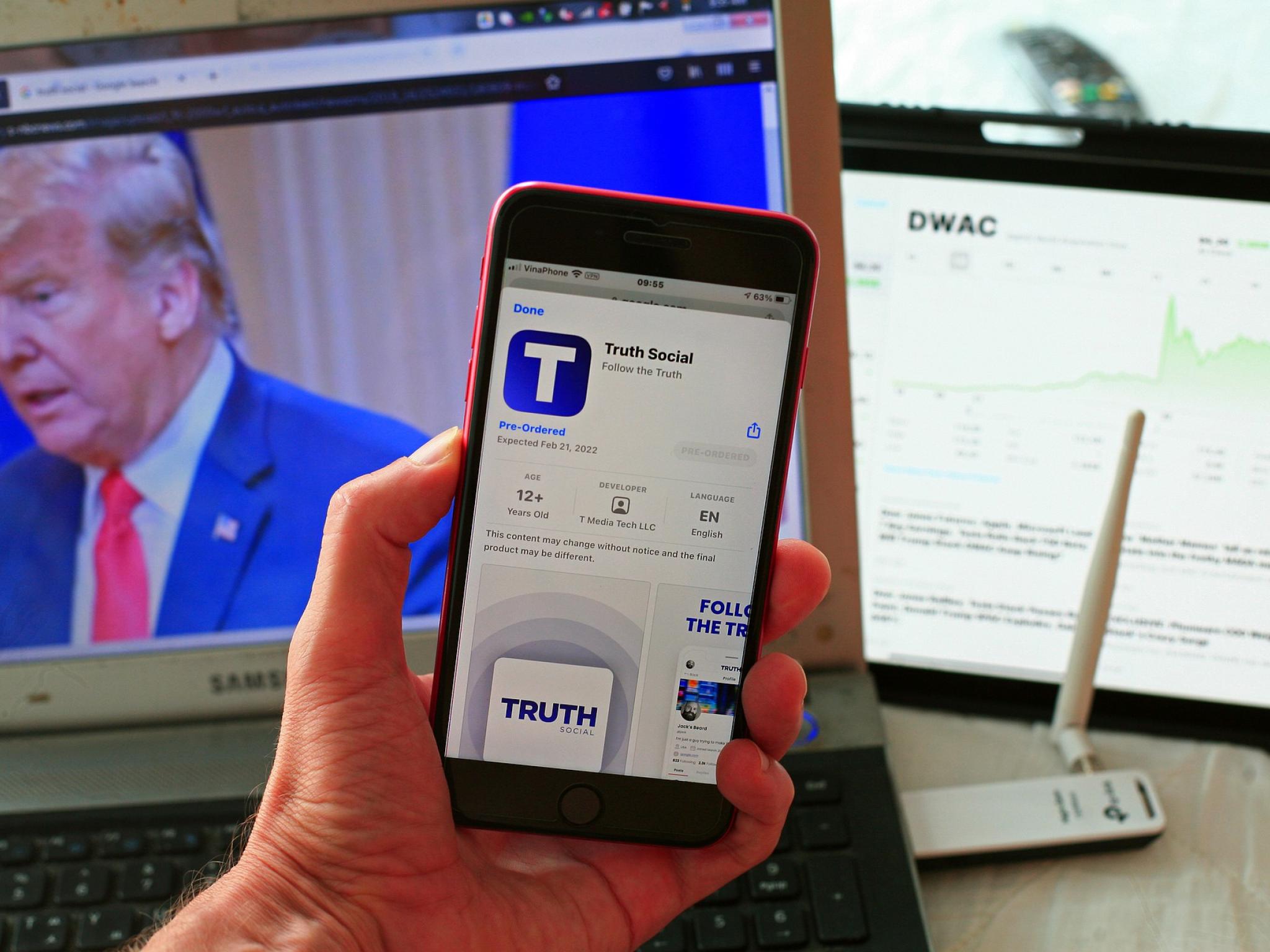

What Happened: Kerrisdale Capital issued a short report on Digital World Acquisition Corp (NASDAQ:DWAC) Wednesday. Digital World Acquisition Corp announced a SPAC merger with Trump Media & Technology Group, a company created by Donald Trump, in the fall of 2021.

The main thesis of the short report has to do more with regulatory hurdles of the SPAC and less about the involvement of Trump or the declining interest in the Truth Social social media platform.

“We believe $DWAC will never secure regulatory approval to close its proposed merger with Trump Media & Tech Group,” Kerrisdale tweeted.

The short seller points to the SEC cracking down on SPACs recently and calls Digital World Acquisition “a poster child for some of the worst abuses the investment vehicle has spawned.”

The SPAC and the target company are high-profile, which could lead to the SEC making an example. Kerrisdale also highlights the sponsor of Digital World Acquisition being a Chinese firm that previously had three shell companies “killed by the SEC in the past.”

The SPAC merger announcement has still not resulted in an effective S-4 filed and Kerrisdale highlights an active SEC investigation into the company’s S-1.

Digital World Acquisition may have also violated the terms of a SPAC by holding discussions with Trump Media & Technology Group prior to the IPO and not disclosing this.

“$DWAC is presently valued at an absurd $8bn. Our $DWAC PT is $10.”

Related Link: Is Trump's Truth Social Already Doomed? Why Elon Musk Could Put The Final Nail In The Coffin

Why It’s Important: Former hedge fund manager Whitney Tilson shared a similar take back in December in regards to the SEC signing off with its blessing of the merger.

“If the SEC acts, the reason it will cite is that there were discussions between DWAC’s CEO and representatives of Trump before DWAC’s initial public offering, which is forbidden,” Tilson said.

Tilson also highlighted the structure of the PIPE, which gave large investors shares at a discount and the ability to freely sell shares after the merger, instead of a typical SPAC lockout period.

“Mark my words, there’s no way the SEC allows this to go through.”

Along with the SEC issues, Truth Social has had a difficult launch and despite the company bragging about Trump's huge social media following, he is not actively posting on the social media platform.

Downloads of Truth Social have dropped 93% since the first week the app was available. Truth Social is also available only on Apple Inc (NASDAQ:AAPL) iOS devices and won’t be coming to Android devices from Alphabet Inc (NASDAQ:GOOG)(NASDAQ:GOOGL) anytime soon.

Shares of Digital World have risen sharply over the last year and any hint of the SPAC not being approved could lead to a sharp decline. If the merger is cancelled or the SEC fails to give its blessing, Digital World Acquisition would be left to find a new target or to liquidate. Both results would likely see shares trading closer to the $10 net asset value level of the SPAC.

Benzinga reached out to Kerrisdale Capital for comment about its short report, and the company's spokesperson responded, "Unfortunately the Company has no comment..."

DWAC Price Action: Digital World Acquisition shares are down 5.93% to $45.92 on Wednesday afternoon at publication. Shares have fallen over 11% year-to-date after being one of the best performing IPOs of 2021.