/Lockheed%20Martin%20Corp_%20TX%20facility-by%20JHVEPhpoto%20via%20iStock.jpg)

President Donald Trump is looking to increase the national defense budget, and that could be a boon to defense stocks like Lockheed Martin (LMT). Trump said in a Truth Social post that the Pentagon’s budget for 2027 should be $1.5 trillion, an increase from the $1 trillion originally proposed. The defense budget for 2026 is $901 billion.

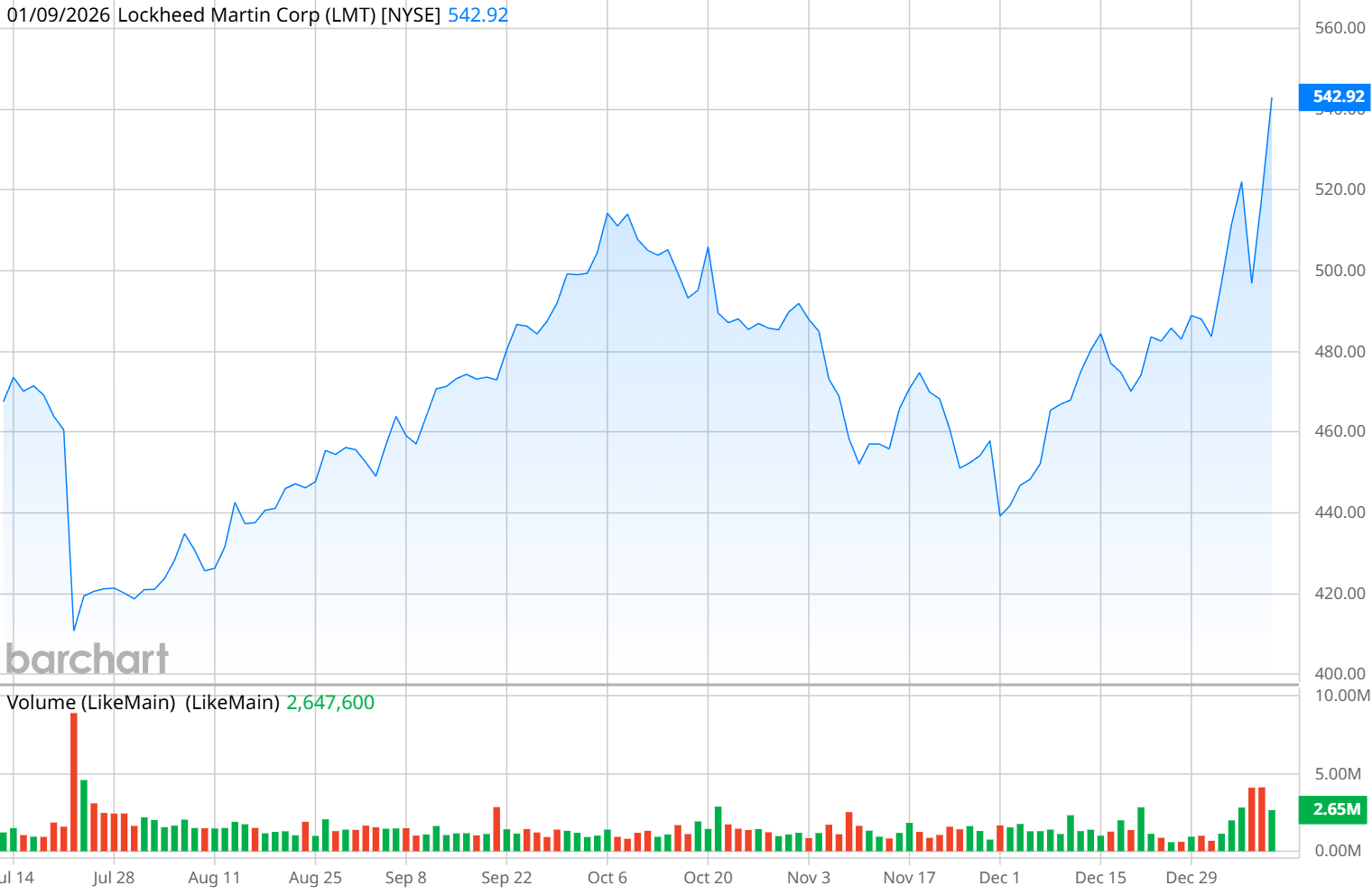

While the budget has a long way to go, including a long Congressional process, the proposal is sending names like LMT higher. LMT stock is up nearly 7% in the last five days, including a jump of 5% on Jan. 9.

Is Lockheed Martin a good buy here? Or is the stock overrunning its valuation? Let’s take a look.

About Lockheed Martin Stock

Based in Bethesda, Maryland, Lockheed Martin is the largest defense contractor in the world. It makes military aircraft such as MH-60 helicopters, the F-16 Fighting Falcon, the F-35 Lightning fighter, and the F-22 Raptor. Lockheed Martin also makes missile systems, helicopters for military and commercial customers, and operates a space systems division that works with commercial and military space systems. The company has a market capitalization of $127 billion.

With the recent run-up in LMT stock, Lockheed Martin is up almost 16% in the last year. That trails the performance of the S&P 500 ($SPX), which is up 19% in the last 12 months, as well as the performance of top defense companies like RTX (RTX) (up 65%), Northrup Grumman (NOC) (up 32%), and General Dynamics (GD) (up 38%).

Part of the problem is a bad second quarter of 2025, in which Lockheed Martin took $1.6 billion in charges, including a $950 million write-down in the Aeronautics program because of design and test challenges that required changes to the program’s processes and testing. Following that debacle, however, LMT stock recovered nicely, with shares up around 30% since August 2025.

What's more, because of that, Lockheed Martin stock is attractively valued right now, with a forward price-to-earnings (P/E) ratio of 18.4, which is better than the P/E ratios of its competitors. Notably, Lockheed Martin also pays a generous quarterly dividend, with a yield currently at 2.54%. For shareholders, that means you’re getting about $250 annually in dividends alone from a $10,000 investment.

Lockheed Martin Beats on Earnings

Lockheed Martin put the second quarter in the rearview mirror quickly and generated a solid Q3. Revenue of $18.6 billion was up from $17.1 billion a year ago, and net earnings came in at $1.6 billion, or $6.95 per share. That handily beat analyst estimates for $6.33 per share.

The company reported a massive backlog of $179 billion, even after delivering a company record 143 F-35 Lightning II jets in the third quarter. “Based on the effectiveness and reliability of our products and systems, strong demand from Lockheed Martin’s customers […] continues. As a result of this unprecedented demand, we are increasing production capacity significantly across a wide range of our lines of business,” said CEO Jim Taiclet.

Lockheed also announced that it had $3.3 billion in free cash flow, compared to $2.1 billion in Q3 2024. Management expanded its stock repurchasing program by $2 billion to reach $9.1 billion, and raised the dividend by 5%. Interestingly, Trump issued an executive order this month seeking to halt stock buybacks by defense contractors, but it’s unclear how such a measure would be enforced.

Lockheed Martin updated its full-year guidance, raising its revenue projections to a range of $74.25 billion to $74.75 billion from a previous range of $73.75 billion to $74.75 billion. It also expects full-year EPS in a range of $22.15 to $22.35, up from a previous range of $21.70 to $22. The company has scheduled its Q4 earnings report for Jan. 29.

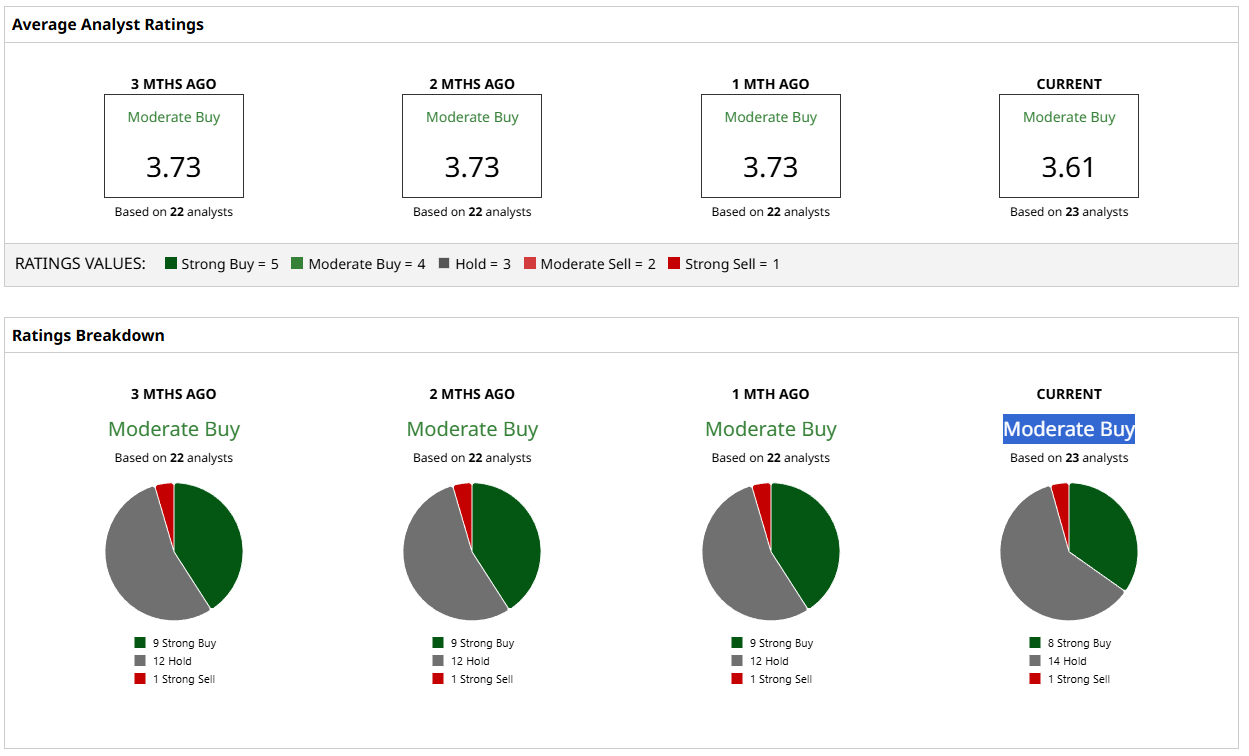

What Do Analysts Expect for LMT Stock?

Based on 23 analysts with coverage, LMT stock has a consensus “Moderate Buy” rating. Eight analysts have a “Strong Buy” rating, 14 analysts have a “Hold," and only one suggests a “Strong Sell” rating. However, I'm expecting that calculus to begin shifting in light of Trump’s bid to increase defense spending in 2027. Analysts at Truist have already upgraded LMT stock from a “Hold” to a “Buy,” raising their price target from $500 to $605.

If you’re looking to take a position in defense stocks right now based on Trump’s aggressive spending plans, then Lockheed Martin is an appealing choice. However, the government’s push to reduce stock buybacks for companies that it believes are underperforming is a potential concern. That could weigh on LMT stock moving forward.