As borders open and New Zealanders get back on planes, the way travel insurance companies explain their Covid-related travel disruption cover to their customers is coming under scrutiny

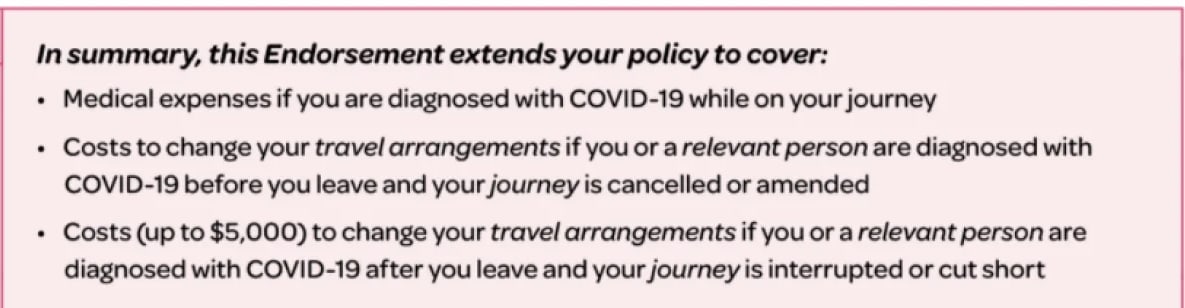

The pink box on the Southern Cross travel insurance Covid endorsement summary document seemed clear.

Effective May 27, 2021, the company was extending its policies to cover “costs to change your travel arrangements if you or a relevant person are diagnosed with Covid-19 before you leave and your journey is cancelled”, it said.

That’s what I wanted. I was travelling overseas from a busy household. Some people at home were at school, others worked in places like childcare centres and hospitality venues.

There was a chance someone in my household would test positive for Covid before I left and I would be forced to isolate and delay my flight. I wanted cover for that.

There were some caveats in the pink box summary. Cover only applied if you and a relevant person were fully vaccinated, and the summary needed to be read with the full TravelCare endorsement.

The full endorsement is five pages long, and mentions five times the importance of being fully vaccinated. It also contains lots of references to the main Southern Cross insurance policy document.

There are lots of what look like hyperlinks to the relevant parts of the policy document, but in fact the words don't appear to be hyperlinked. There are lots of references to finding information “overleaf”, which are less helpful when you are reading a document on a computer.

I search out the TravelCare policy document. It is 100 pages long. This is a $150 travel insurance policy. I wonder if buying a house would need less small print.

I search “Covid” within the document, hoping to find the relevant sections. There are no references to “Covid” in the document. However in the ‘before you travel’ section, there are plenty more look-like-hyperlinks-but-aren’t references to sections like “Things we never cover (page 80)” and “Other losses we won’t cover if you need to change your plans before you leave (page 48)”.

A pandemic is mentioned as a never-cover-under-any-circumstances situation, but I figure that’s why the pink box is there - to tell me Southern Cross has made an exception for Covid-19.

I re-read the pink box. It definitely says “Costs to change your travel arrangements if you or a relevant person are diagnosed with Covid-19 before you leave and your journey is cancelled” are covered.

Southern Cross is, from its own marketing material “an award-winning travel insurance trusted by Kiwis for nearly 40 years”.

I buy the policy.

I’m sure you know where this story is going. Someone in the household tests positive for Covid two days before I am due to leave. I have to isolate for seven days, and when I rebook my flight for the following week it is $1050 more expensive than my original ticket because I am booking so close to my new departure date.

I contact Southern Cross helpline, where someone tells me I’m not covered.

The reason is something I hadn’t even thought about. It’s because Southern Cross has a very specific definition of “relevant person” - and in this case it’s nothing to do with whether they are relevant to the reason I can’t fly.

On page 96 of its 100-page document, Southern Cross lists who it sees as a “relevant person”:

- A member of my immediate family

- My travelling companion

- A person directly related to the primary purpose of your journey

Not a household contact.

Should I have known that from my pre-purchase perusal? I return to the endorsement with the pink box. It clearly tells me the definition of “fully vaccinated” is critical but it doesn’t mention the same thing about the definition of ‘relevant person’. Or that its own definition of a “relevant person” might not be the same as a customer’s perceived definition. There’s no link to page 96 or mention that I might want to check out “relevant person” in the definitions on page 96.

Covid and chemotherapy

But what is for me truly astonishing is it also doesn’t mention the fact that even had the relevant person in my case been one of those select people above, Southern Cross would still not have covered my situation.

And that’s because, as the company told me in an email after I contacted them, the “relevant person” has to be:

- Dead

- In hospital or end-stage palliative care; or

- Diagnosed with a terminal condition, or a condition that requires radiotherapy or chemotherapy

Remember we are talking about a specifically Covid-19-related situation covered by a special Covid-19-related extension to a more generalised travel insurance policy.

Covid and chemotherapy?

I tell the Southern Cross helpdesk I find it hard to believe any normal customer would have realised that these conditions from section D.2.3 on page 47 were relevant to the Covid isolation situation I was trying to take out insurance to guard against.

I am not making a judgment here about Southern Cross. Someone else might well have had a different understanding and made a different decision based on the information that was available.

Conduct and culture

But what is clear as New Zealand opens up its borders with considerably more than 10,000 new cases every day in the motu, is the experience normal customers have dealing with their insurance companies around Covid coverage is truly relevant.

The Government and the regulators have talked ad infinitum over the past three years about the conduct they expect from the insurance and banking sectors. It’s simple: companies have to put the interests of the consumer above those of their shareholders. Customers over profits.

The Financial Markets Authority and Reserve Bank said it in their 2018 conduct and culture review into the retail banks. They said it again when they reviewed the life insurance sector.

And they said it specifically to the general insurance companies (including travel insurance) when they completed that review in July last year.

After talking to 42 insurance companies, the FMA/RBNZ didn’t mince words about what they found.

Only two companies - IAG and MAS - met the regulators’ expectations in full; leading insurance brands, including AA, AIG, Tower, Vero and Southern Cross, were “inadequate” or “deficient”.

“The responses showed there is a poor understanding of and commitment to good conduct and culture practice across the sector,” the report said.

Meanwhile:

- The level of conduct maturity [is] low, with some insurers demonstrating that they did not see conduct and culture as relevant to their organisation."

- Product and policy-holder review processes need to be improved.

- Many boards are yet to support the development of an organisational culture that promotes good conduct, rebalance shareholder and customer interests, and set an appropriate conduct risk appetite.

- Not enough has been done to ensure remediation activity is completed promptly and addresses the root cause of issues.

All this is despite the FMA and RBNZ having “clearly communicated these expectations over the past several years” and the fact insurers will be covered by the Government’s new conduct licensing regime set out in the Financial Markets (Conduct of Institutions) Amendment Bill (CoFI), the report said.

To be fair, the insurance industry argues the view of the industry portrayed in the 2021 FMA/RBNZ report relates to the situation in the industry in 2019, and things have improved since then.

The Government has been saying the same thing about insurance company conduct and culture.

Speaking at the beginning of the pandemic and referencing the disruption people were experiencing from Covid, then Consumer Affairs Minister Kris Faafoi told insurance companies that treating consumers “honestly and fairly” and “actively identifying and addressing poor conduct” should be a central feature of their business.

“You provide a pivotal service that should support, not undermine, consumers’ financial resilience,” Faafoi said.

A variety of offerings

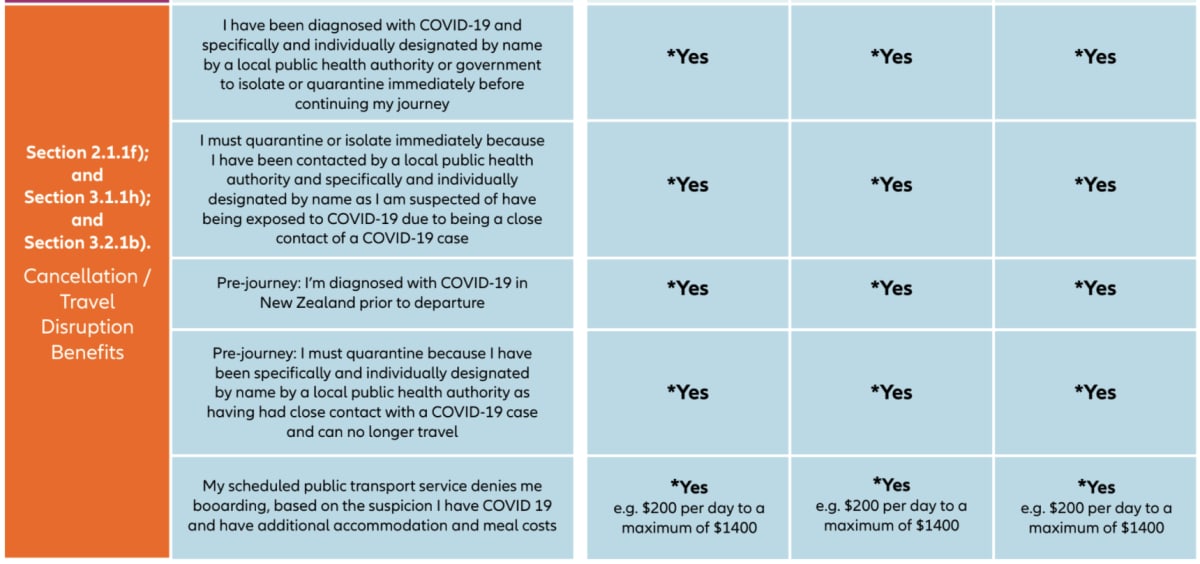

There are other companies providing Covid-related travel insurance. Travel agency House of Travel, for example, offers an Allianz product which comes with a three-page Covid-specific FAQ explainer under the heading "The reopening of our borders."

“I have been identified as a close contact and need to isolate immediately. This has affected my travel arrangements. Does my selected cover* for epidemic and pandemic diseases apply?”

The answer appears clear: “Cover is in place providing that you are specifically, and individually designated by name in an order or directive to be placed in mandatory quarantine or isolation, by the New Zealand Government or any other government or local authority, based on their suspicion that you have been exposed to an epidemic or pandemic disease. If you have not received official notification to enter mandatory quarantine or isolation then this aspect of the cover does not apply.”

That’s me.

House of Travel provides a single-sheet tick-box leaflet for its customers.

Although the proof of the pudding is in the eating - or in this case the claiming - the Allianz FAQ makes me wonder why I hadn't done a bit more homework on different company offerings.

The perils of Covid add-ons

Rebecca Styles is watchdog Consumer NZ’s investigative writer and she’s in the middle of updating the organisation’s travel insurance buyers guide - something members are crying out for as they think about heading overseas again, she says.

Covid coverage is particularly tricky because it’s mostly tacked onto policies which point-blank exclude covering travel disruption due to pandemics, epidemics, or Government-imposed restrictions, like closing borders.

It’s like an exemption to an exemption to insurance cover.

"You shouldn’t need a law degree to read an insurance policy, and you shouldn’t have to read 96 pages of documentation to see if someone is going to be covered.”

– Rebecca Styles, Consumer NZ

That’s why for more than a year after Covid-19 arrived, there were basically no travel insurance policies covering it.

That’s changing, Styles says, as people start moving around again. There are now a few companies offering what are basically Covid add-ons.

Some are easier to understand than others, and customers should always go for a policy written in plain English and where exclusions are made clear, she says.

“Some policies are like a door stop. You shouldn’t need a law degree to read an insurance policy, and you shouldn’t have to read 96 pages of documentation to see if someone is going to be covered.”

Styles says while some of the bigger travel insurance companies are offering some Covid coverage, some smaller or cheaper players aren't. She hasn't checked the insurance offered by some credit card companies when you buy an airline ticket that way, but she says customers might want to be careful.

Same with airline travel insurance. Earlier this year customers got burnt when they realised the Air New Zealand's insurance they'd bought with their tickets didn't get them a credit or a refund when the Government suddenly put the country into the red traffic light setting.

The airline's insurance wasn't valid with Covid-related travel disruption.

“We’re very clear”: Southern Cross

Southern Cross Travel Insurance chief executive Jo McCauley defends the way the company informs its customers about its Covid cover.

“The ‘relevant person’ description of who is covered under the Covid endorsement aligns to our usual position on our policies, which is why, for consistency of language, we have kept this definition in our Covid endorsement,” she says.

“We believe we’re very clear in how we promote our Covid cover. We do outline that our cover has limitations, and this is something we explain in the FAQs on our website.”

I hadn’t seen the FAQs, but after McCauley mentioned them, I see they are flagged in a pink box at the top of the home page.

The main set of Covid questions come after you click “load more” three times, although there is also a search function, where finding the crucial question for me - “Is there cover if my travel is affected if I am a close contact and need to isolate?” - requires only one “load more”.

The answer is clear enough. “No, for Covid-19 cover to apply you must be diagnosed with Covid-19. We do not provide cover if you need to self-isolate or quarantine due to being a close contact."

McCauley says it's a question of price. “Offering cover to people who are ‘close’ or ‘household contacts’ and who no longer want to travel or can’t, would make the cost of our policies substantially higher and give fewer customers access to cover for Covid.

“So we’re striking a balance here with the level of cover we offer and the affordability of the policy.”

Southern Cross travel policies are written in plain language, McCauley says.

“The policy you are referring to has the WriteMark endorsement – which is a quality mark awarded to documents or websites that achieve a high standard of plain language. Writing our policies in plain language is a sustained and continued focus for us, not just a one-off.

“It’s part of our duty of care that’s always been at the heart of our customer service.”

Significant improvements

Karen Stevens has been Insurance and Financial Services Ombudsman for more than 20 years. She says insurance documents are considerably simpler to understand than they used to be, with the focus on the consumer from regulators and Government pushing improvements.

“When I first started there was a lack of clarity and a lot of small print and terms being used which people couldn’t understand.” Karen Stevens, Insurance and Financial Services Ombudsman

Plain English policy documents are also a requirement under the Fair Insurance Code, which applies to all members of the Insurance Council of New Zealand.

Newsroom understands Southern Cross is not a member of the Insurance Council but Allianz is.

“When I first started there was a lack of clarity and a lot of small print and terms being used which people couldn’t understand,” Stevens says.

Still, there’s also the issue of whether people buying insurance actually read their policies before they sign up, even when they are clearly written.

“There are a lot of indications people have no idea what they are covered for. Assumptions are made and sometimes those assumptions are wrong.”

“Talk to your insurer”

Insurance Council chief executive Tim Grafton says any Covid-related policy documents should be clear and easy to understand - they are newly-minted, after all. And while in a competitive market different insurance companies will cover different people in different situations, customers should be able to tell easily which policies work for them.

“If you were using a term like ‘relevant person’ the policy should define it as clearly as possible and close to where they are using the term. It might be a hyperlink.”

In the end, however, it’s up to customers to do their homework.

“I’d encourage any person taking out travel insurance to talk to their insurer to see exactly what they are covered for. There is an obligation on insurers to answer questions.”

Financial Services Complaints Ltd (FSCL) is another organisation which hears complaints about the insurance industry. Chief executive Susan Taylor says while there were a lot of cases following the March 2020 lockdown, when everyone’s travel plans got turned upside down, it’s too early to see whether there are similar issues between insurers and customers over Covid coverage now New Zealand’s borders have opened up again.

People are only now starting to book travel and take out insurance for those trips. If problems arise, there are internal insurance company processes to try and work out solutions. It’s only if these break down that a disputes resolution service gets involved.

As well as potential issues with new Covid-related clauses, Taylor foresees problems if another wave or variant causes more disruptions. Customers often don’t realise insurance companies don’t cover travel to a country with a ‘do not travel’’ advisory. “And that can change week to week, month to month depending on outbreaks”.

She says she’s seeing improvements with policies written in plain English, “but there’s still some work to do”.

The FSCL tends to find in favour of complainants in situation where there’s an ambiguity in the way a policy is worded,” Taylor says - the organisation applies the ‘contra proferentem’ rule, where an ambiguous clause is interpreted against the interests of the party that created that clause.

But if a policy is just overly complicated, Taylor is more likely to suggest an insurer rewrite a particular section.

“Sometimes we find the wording doesn’t cross the line to ambiguity but it could have been clearer and that would likely have prevented the complaint in the first place.”

The lesson is - as always - buyer beware.

“Proceed with caution, read your policy carefully and ask your insurer questions.”