Earnings reports began earlier this month and are about to dial up seriously over the next several days.

We have a mix of defensive stocks like Coca-Cola (KO) and McDonald’s (MCD) reporting earnings — a group that continues to dominate — and of course, a healthy dose of earnings from Big Tech.

Most notably, Microsoft (MSFT), Alphabet (GOOG) (GOOGL), Meta (META) and Amazon (AMZN) all report this week, (here’s TheStreet's Martin Baccardax with a preview for that group).

In fact, more than one-third of the S&P 500 will deliver its quarterly results over this five-day stretch.

With the S&P 500 and Nasdaq locked in a tight trading range for weeks now, many traders hope that the earnings reports will break the market out of its range.

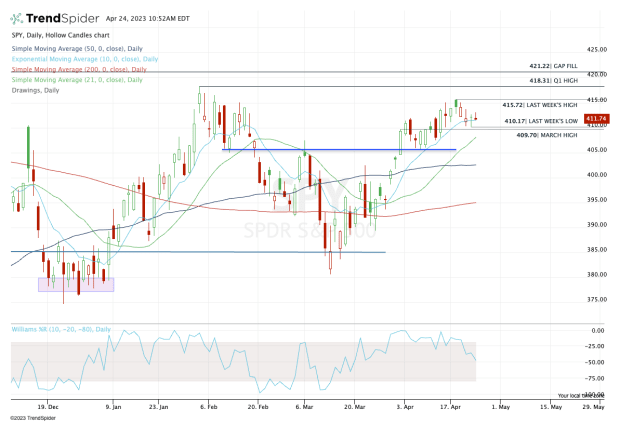

Trading the S&P 500 ETF (SPY)

Chart courtesy of TrendSpider.com

On the daily chart above, you can see how the SPDR S&P 500 ETF Trust (SPY) topped out around $418, then suffered a controlled 9% correction in the span of about six weeks.

But the SPY also made a strong break back to the upside, ultimately pushing through the $405 area and riding the 10-day moving average higher. Currently, it continues to struggle with the $415 to $416 area but holds up over the March high.

Don't Miss: Procter & Gamble: Bulls Enjoy the Breakout; Now What?

In the short term, active traders need to keep an eye on the $409.70 to $410.20 zone. This area marks the March high and last week’s low, so a break below this area that’s not quickly reclaimed could create more selling pressure.

In that scenario, it could put the 21-day moving average in play currently near $408. Below that brings $405 back into play, followed by the 50-day moving average near $402.50.

I don’t know when it will be filled, but the bulls should keep the gap-fill level near $396.50 in their back of their minds.

On the upside, the bulls ultimately need a push up to and ideally through last week’s high at $415.72. That would open the door to the first-quarter high at $418.31, then put the gap-fill from August in play at $421.22.

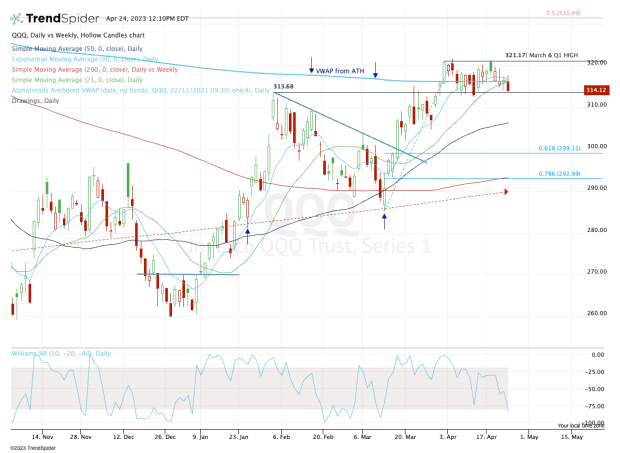

Trading the QQQ ETF

Chart courtesy of TrendSpider.com

Like the SPY, the Invesco QQQ Trust Series 1 (QQQ) climbed into the $313 area and suffered a similar 9% correction over about six weeks.

But the QQQ was quick to bounce off the 200-week moving average and regain $300, before getting above $313 and holding this level as support.

That was quite the bullish development, although the ETF has traded in an impressively tight range all month.

The shares have been trapped in a $9 range for the month of April. And the QQQ setup is a bit easier because of this tight range, as it’s essentially trapped between $313 on the downside and $321 on the upside.

Big Tech is going to be the driver for the QQQ, as Microsoft, Meta, Amazon and Alphabet make up more than 30% of the fund’s weighting.

Don't Miss: Can Amazon Stock Break Out Ahead of Its Earnings Report?

If we get an upside breakout over $321, it opens the door to the $327 to $327.50 area, followed by the $334 level.

On the downside, a break below $313 opens the door down to the $303.50 to $305 area, followed by $300. If the selling pressure really ramps up, the $293 zone could be in play.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.