The markets are a mess again on Monday, as investors try to find their footing amid geopolitical tensions. However, investors in Splunk (SPLK) are quite pleased on the day.

Shares of Splunk are up close to 10% on the day and are near session highs. That’s followed by reports that Cisco Systems (CSCO) reportedly offered more than $20 billion to acquire the firm.

However, given that the company’s current market cap is just shy of $20 billion at this moment, it’s no wonder no deal has come to fruition.

With its valuation hovering near six times 2023 revenue estimates and with the stock still down 45% from its high in Sept. 2020 (even after today’s rally), it’s obvious why bulls feel they deserve more.

Many investors — in Splunk and elsewhere — are likely wondering when M&A will become a catalyst for higher stock prices.

We’ve seen deals fall apart in recent weeks, like Nvidia’s (NVDA) deal to buy Arm, and we’ve seen a brutal selloff in growth stocks.

Will M&A begin to spur stocks like Splunk higher?

Trading Splunk Stock

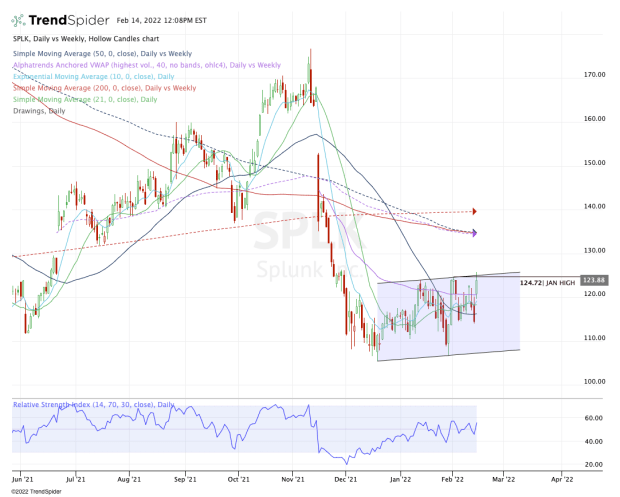

Chart courtesy of TrendSpider.com

Right now, Splunk stock is giving traders a potential breakout from its current trading range, as well as a monthly-up rotation over the January high of $124.72.

If it can remain in this state — meaning if these observations remain true — then Splunk stock could have more upside potential.

Specifically, I would look for a potential squeeze up to the $135 area. There the stock finds its 200-day and 50-week moving averages, as well as the weekly VWAP measure.

In other words, this is a significant area and should Splunk get there, it’s a reasonable area for traders to reduce their position size.

If it can continue to push higher, the 200-week moving average may next.

On the downside, things get a bit trickier if Splunk is rejected by last month’s high and channel resistance.

Below these measures and the $123.75 level could keep the $120 mark on the table, along with the 10-day and 21-day moving averages and the daily VWAP measure.

If those levels fail to support the stock, last week’s low and this month’s low could be in play, with both at $113.98.