Shares of SoFi Technology (SOFI) may not be at the session high, but the stock is still up an impressive 16% on Wednesday.

The move comes as the company received regulatory approval to officially become a bank.

SoFi, which boasts a robust growth profile, is leaping on the news.

Further, Rosenblatt analysts assigned a $30 price target in response to the news, implying more than 100% upside in the share price even after today’s rally.

Like most growth stocks though, that growth hasn’t mattered lately. Investors have been selling it lower and lower, as it recently hit new lows.

Using the Ark Innovation Fund (ARKK) as a proxy for growth stocks, this asset does a good job highlighting what it’s been like for investors lately.

Of course for SoFi stock, it doesn’t help that bank stocks have been underperforming lately after reporting earnings.

Trading SoFi Stock

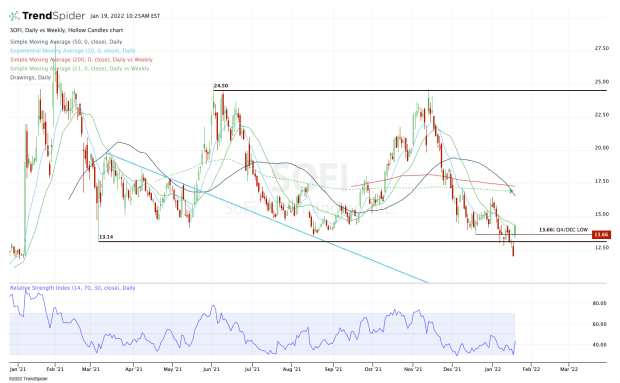

Chart courtesy of TrendSpider.com

When looking at the chart, there are two key areas that stand out to me. First, there’s the $13.14 level, which was the March 2021 low.

That level was not retested — as the $15 area had been pretty stout support — until earlier this month.

On Tuesday Jan. 18, shares really rolled over, hitting new lows. However, today’s gap-up rally has me looking at a second key level: $13.66.

That level is the December low, as well as the fourth-quarter low. If SoFi stock can stay above this mark, it will avoid a quarterly- and monthly-down rotation.

That’s important, as the stock already has a lot working against it in relation to how its peers are trading.

If it stays above this mark, it will also be above the 10-day moving average. If SoFi stock can take out the 21-day, then Wednesday’s high is in play at $13.89.

Above that and perhaps this stock can get back to $15-plus. Specifically, it will put this month’s high in play at $16.13.

On the downside, losing today’s low at $13.37 puts the gap-fill in play at $13.11 and leaves this month’s low vulnerable to a retest.