Chip stocks like Nvidia (NVDA), Advanced Micro Devices (AMD), Intel (INTC) and more are in focus on July 20.

That’s not only as these three stocks work on their sixth straight daily gain, but also as earnings start to roll in and as the Chips Act -- formally the Creating Helpful Incentives for the Production of Semiconductors for America Act -- is being voted on in Congress.

Despite the selloff, earnings remain somewhat resilient. Taiwan Semi (TSM) reported a top- and bottom-line beat last week and provided upbeat guidance.

The report from Taiwan Semi — the sector’s largest company — should outweigh the commentary from ASML Holding NV (ASML), which said this morning that supply-chain disruptions and uncertainty forced it to reduce its guidance. That came, however, alongside a strong second quarter.

The semi stocks are also looking at a potential boost from Congress as well.

As reported earlier, the Chips for America, or Chips, Act cleared its first procedural hurdle by a 64-34 vote in the U.S. Senate late on Tuesday.

If it passes, Intel, Micron (MU) and others are reportedly set to benefit from the legislation.

Let’s look at the charts.

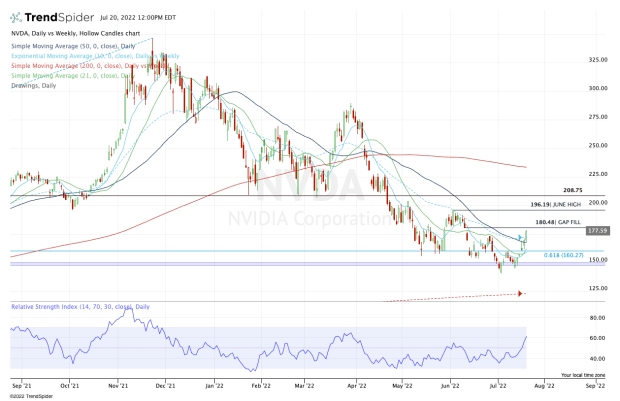

Trading Nvidia Stock

Chart courtesy of TrendSpider.com

Last week all three stocks put in higher lows, a key bullish development.

Nvidia has traded well lately, working on its 10th rally in the past 12 sessions.

On Monday Nvidia was rejected by the 50-day moving average. On Tuesday, it rallied up to, but could not push through, the 10-week moving average. With today’s action, Nvidia is pushing through both measures, with traders now focusing on the gap-fill at $180.50.

If it can push through this zone, the June high and resistance near $195 are in play. Above $200 and prior support between $208 to $210 is in play.

On the downside, the bulls want to see support from the 50-day and 10-week moving averages, but they need to see support from the 10-day and 21-day moving averages and preferably from $160.

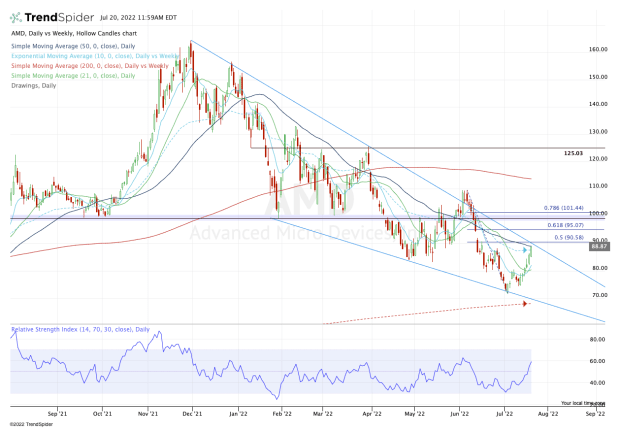

Trading AMD Stock

Chart courtesy of TrendSpider.com

Up about 25% from this month’s low, AMD stock has also traded quite well lately.

But the shares are now coming into a key area on the chart, with the 10-week and 50-day moving averages in play. It’s also trading up into wedge resistance (blue line), with the 50% retracement at $90.60.

From here, the levels are very straightforward.

On the upside, AMD stock needs to clear $90.60 to continue higher. If it can, the gap-fill level at $94.25 and the 61.8% retracement are in play up near $95. Above that puts the key $100 level in play, followed by the 78.6% retracement at $101.44.

On the downside, $80 to $81 is key. A drop below that level puts it below support, as well as the 10-day and 21-day moving averages.

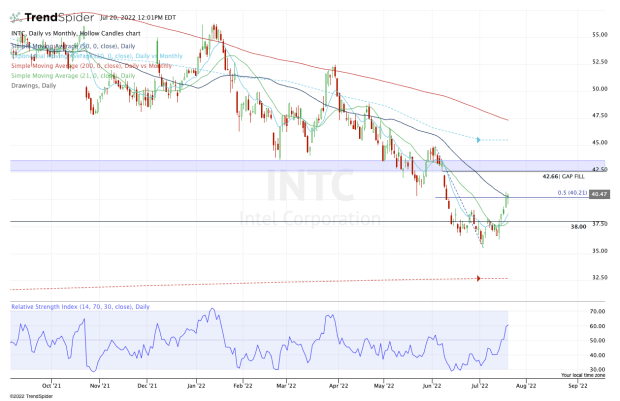

Trading Intel Stock

Chart courtesy of TrendSpider.com

Then there's Intel. This stock has not traded all that well, but it ended up holding a key support level near $38. With the recent rebound, the shares are trying to push back to a big breakdown spot.

For those interested in the “big picture setup” for Intel, the monthly setup can be found here.

Amid the current rally, Intel stock is now rallying into the 50% retracement and 50-day moving average. It’s also near the May low.

If the stock pulls back, holding the 10-day is ideal, but holding $38 and the 21-day moving average is much more vital.

On the upside, a continued rally puts the gap-fill level up near $42.60 in play. This level is the bottom of a key zone, which is highlighted on the chart between $42.50 and $44. Let’s see how Intel stock trades there -- assuming it can get there.