Shares of Activision Blizzard (ATVI) fell just over 4% on Friday, while Microsoft (MSFT) stock ended slightly lower.

That’s as there are questions beginning to swirl around Microsoft’s proposed $69 billion buyout of Activision.

In January, the two companies came to an agreement where Microsoft would buy Activision for $95 a share.

Despite antitrust concerns, many investors were confident the deal would close. Even Warren Buffett has expressed that confidence, as his Berkshire Hathaway (BRK.A) (BRK.B) firm has been accumulating shares of Activision this year.

Investor confidence is fading though, particularly on Friday as reports circulate that the FTC may challenge the deal.

Trading Activision Blizzard Stock

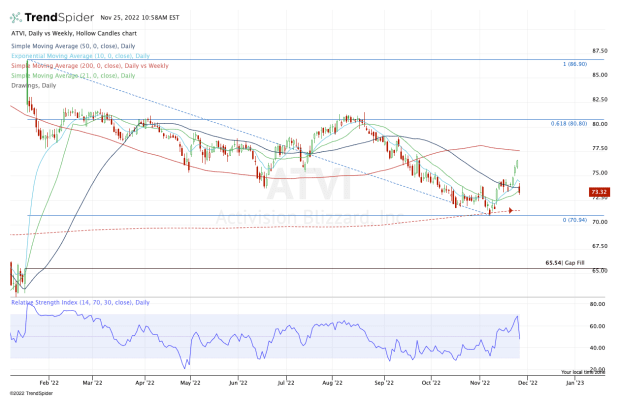

Chart courtesy of TrendSpider.com

After a strong rally into the Thanksgiving holiday, Activision Blizzard stock is now breaking lower and teetering on the 10-day, 21-day and 50-day moving averages.

If it loses these measures, it opens the door back to down to this month’s low and the 200-week moving average, which was support in early November.

That said, this whole setup is mostly binary and hinges on whether the deal goes through.

If it does, then Activision Blizzard stock will go out at $95 a share. If the deal doesn’t go through, there’s more potential downside in the stock.

How much downside though, nobody knows for sure. Activision Blizzard stock is currently 22.7% below the buyout price.

In my view, the $70 to $71 area would be support should a deal not materialize. Not only is that the lowest price the stock has traded at so far in 2022, but it’s also where the last area of support came into play.

If Activision Blizzard stock loses $70, it could go on to fill the gap down near $65.50.

Trading Microsoft Stock

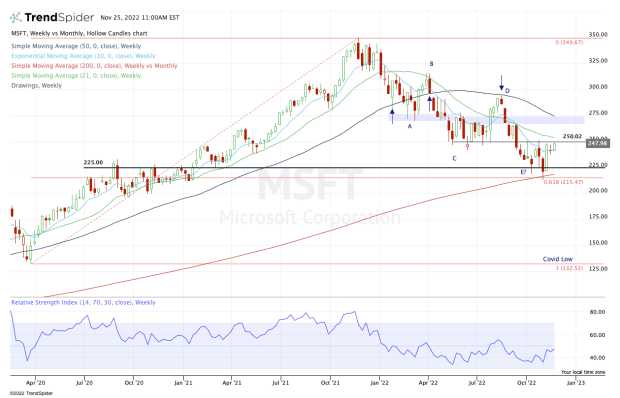

Chart courtesy of TrendSpider.com

In early November, the selloff in Microsoft stock and FAANG looked somewhat capitulatory. Investors and funds were dumping mega-cap tech and as such, Microsoft had suffered its worst peak-to-trough decline in a dozen years.

However, it also sent the stock into a key support zone, where it tagged the 200-week moving average and the 61.8% retracement from the all-time high down to the 2020 low.

While the stock has bounced nicely and reclaimed the 10-week moving average, it is now struggling with the key $250 area. That level has been stiff resistance this quarter after previously serving as support earlier in the year.

If Microsoft stock can clear this level and the 21-week moving average, it opens the door up to the $267 to $275 zone, where it finds prior resistance and the declining 50-week moving average.

On the downside, if shares trade below $237.50, it opens the door back down the 200-week moving average and the 2022 lows.