While everyone is digesting the news from the Federal Reserve, investors in Electronic Arts (EA) are weighing the possibility of M&A.

The videogame stalwart's shares were up as much as 17% in the premarket, and at last check were up about 5%, following reports that Amazon (AMZN) might be mulling an acquisition of the company.

The move in the premarket sent Electronic Arts stock up to a key resistance area, which we’ll discuss in a moment.

Perhaps helping improve sentiment around the possibility of such a deal, Microsoft (MSFT) has a pending acquisition of Activision Blizzard (ATVI).

While reports about Amazon’s interest in EA have conflicted, EA seems like a chart worth a second look.

Trading EA Stock

Chart courtesy of TrendSpider.com

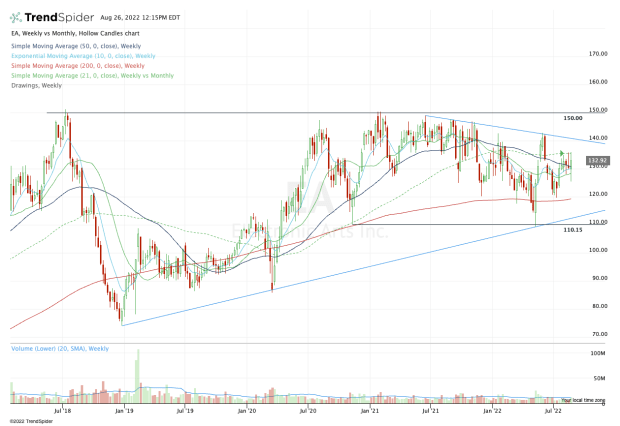

In 2018, EA stock rallied up to the $150 mark before collapsing about 50% heading into 2019. Since then, the $150 level has been very stiff resistance and again rejected the stock in 2021.

Since then, downtrend resistance has been pressuring the stock, while buyers have shown up at uptrend support and the $110 area. The $110 level was major support in 2020, was not tested in 2021 and was again strong support in 2022.

In essence, the stock is trapped in a wide range between $110 support and $150 resistance.

The stock is doing a good job holding the $125 to $130 area, but the worry becomes the binary nature of such a report. A buyout is either on the table or off, and if it’s off the table, the stock risks a move lower. If it's on the table, the stock would rocket.

In the case of "no offer," the $120 area becomes of interest on the downside. It's where we find the third-quarter low and the 200-week moving average. A break of that puts the key $110 area back in play.

On the upside, it’s not that complicated either. But a buyout price would go a long way toward EA stock pushing higher.

Specifically, I’m keeping an eye on the 21-week moving average, which has been resistance all month, while EA stock has back-to-back weekly highs of roughly $135.80.

A move above this area opens the door to downtrend resistance (blue line). That’s kept the stock in check for more than a year.

If EA stock can break out over this level — as it technically did in the premarket session — it opens the door to $150 resistance.