October has been volatile for stocks, but mostly toward the upside as the S&P 500, Nasdaq and other US stock indices have burst higher. However, it’s been a very mixed bag for EV stocks.

Tesla (TSLA) has been all over the map this month. Its third-quarter delivery results were a new record, but they were short of analysts’ expectations and the stock fell hard as a result.

Then Tesla stock was rallying as other automakers, like Ford (F) and Rivian (RIVN), powered higher on solid results. Then it tanked on the reports of Elon Musk’s acquisition of Twitter (TWTR) is back on.

Now the volatility is spreading from Tesla to other EV stocks, particularly China-based EV producers.

Nio (NIO) stock is down 7.5% on the day, while Li Auto (LI) is down 12%. Xpeng (XPEV) is the best performer of the three, down about 3.5% on the day.

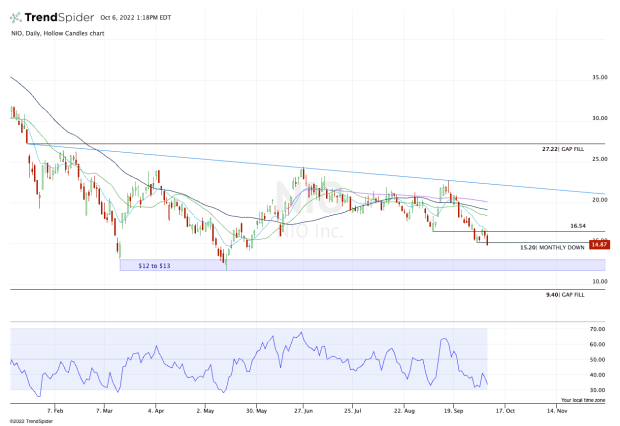

Trading Nio Stock

Chart courtesy of TrendSpider.com

Coming into October, Nio stock was in a painful skid. That wasn’t uncommon though, as the S&P 500 was also hitting new lows into the end of the month.

Nio shares fell more than 20% in the last two weeks of September, but are now rolling over again after a short-lived rally.

The stock failed to regain and hold the $16.50 area, while active resistance via the 10-day moving average continues to squeeze it lower. Now trading back below the September low of $15.20, Nio stock is in the midst of a monthly-down rotation.

If it can’t regain $15.20, we could be looking at a scenario where the stock falls back down to the $12 to $13 range. This zone was significant support in the first and second quarter of this year.

Should the stock regain $15.20, bulls really need to see Nio reclaim $16.50 and the 10-day moving average. That could open the door to the $18 to $19 range.

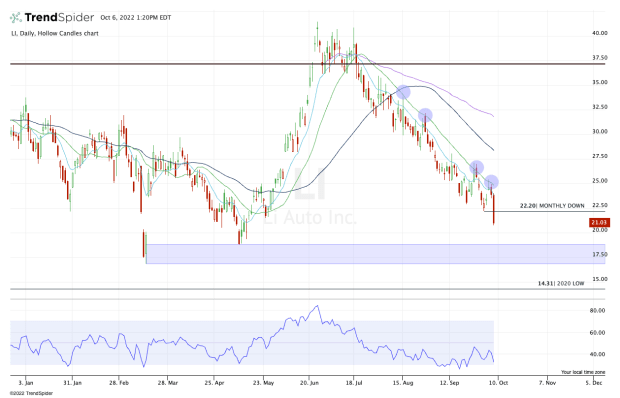

Trading Li Auto Stock

Chart courtesy of TrendSpider.com

Li Auto is another name where the trend has been highly unfavorable for the bulls. Just look at the daily chart above and you’ll notice that each rally has been an opportunity to sell the stock.

The 21-day moving average has been active resistance, while today’s double-digit plunge below $22.20 also puts the stock in a monthly-down rotation.

If it can reclaim this level, look for a possible rally back to the 21-day, which has been the make-or-break measure since mid-July. Above that and the $27.50 to $28 zone could be in play, but it’s very clear at the moment that the 21-day is resistance until proven otherwise.

On the downside, Li Auto stock needs to find support at or above $20, otherwise it risks a decline down to the $17 to $18 zone, which was notable support in the first and second quarter of this year.