A lot of turmoil surrounds Adidas (ADDYY) , as the athletic apparel maker has felt pressure to drop Ye — formerly known as Kanye West — from its line.

The company has finally done so, but not without its stock paying the price. Shares of Adidas, the ADR unit that’s traded here in the U.S., have fallen in five straight trading sessions — including Tuesday.

Currently down about 3% on the day at last check, that’s much better than the 7.6% decline it sported near today’s open.

At this morning’s low, shares of Adidas that are listed in Germany were down about 22% amid the stock’s five-day skid, while the U.S.-listed shares were down about 19%.

The company’s decision to cut ties with Ye came after “a series of media appearances in which he made anti-Semitic remarks,” as previously reported by TheStreet.

While the decision to end the partnership will result in a 250 million euro charge for Adidas, the stock is not reacting as poorly as some would have thought. Let’s look at the chart.

Trading Adidas Stock

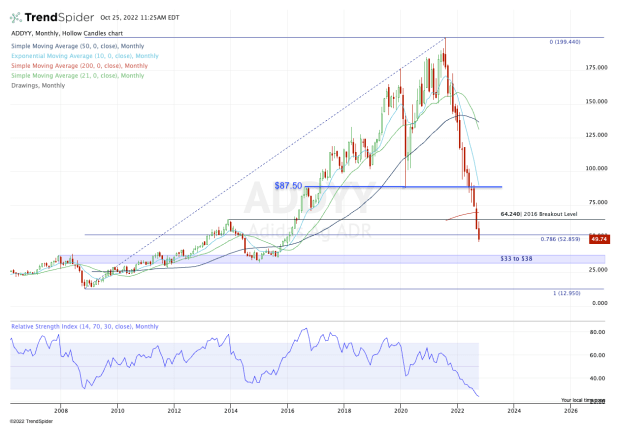

Chart courtesy of TrendSpider.com

Adidas stock has not performed well, but that’s not surprising. Nike (NKE) shares have been buried too, suffering a peak-to-trough loss of 54%.

Currency woes, supply chain problems and combating a potential global recession have impacted both stocks negatively, although Adidas stock has certainly taken a bigger blow.

At this morning’s low, shares of the U.S.-traded unit were down 67% year to date. From the all-time high in August 2021, the stock was down 76% (and has declined in 14 of the last 15 months).

Unfortunately, when we look at the chart, Adidas has broken below some pretty significant support levels amid its slide lower. They include the pivotal $87.50 level, the 200-month moving average and the 78.6% retracement from the all-time high down to the 2009 low.

From here, bulls may be getting interested in the stock, but it would be much more constructive to see Adidas stock regain $50 and the 78.6% retracement, allowing investors to use the recent low as their stop.

On the Upside

On the upside, the more levels it can reclaim, the better, but we must be aware that these levels may act as resistance too.

If Adidas stock can reclaim and stay above the $50 to $52.50 area, it could put $64 to $65 back in play, along with the 200-month moving average. Above that zone could put the mid-$80s and the declining 10-month average in play.

If shares continue lower, there’s significant support in the $33 to $38 region, but that would require a 25% decline from current levels (at a minimum).

The bottom line: With today’s reversal off the low and the news out of the way regarding Ye, let’s look at Tuesday's low — $47.45 — as a line in the sand. Aggressive bulls who like Adidas can try to be long above this level.