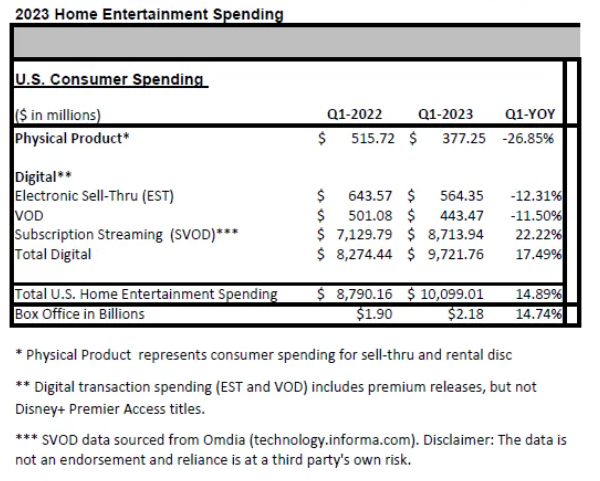

The U.S. subscription video on demand (SVOD) business grew total revenue by 22.22% to over $8.7 billion in the first quarter, the biggest rate of quarterly expansion since the go-go streaming days of the 2020 pandemic.

The data comes courtesy of Informa-owned research company Omdia, which delivers SVOD data as a third party in the Digital Entertainment Group's quarterly "Home Entertainment Spending" reports.

In the first quarter of 2022, the U.S. subscription streaming business expanded by 18%, according to Omdia.

Netflix, which is far and away the biggest SVOD company both globally and domestically, reported an uptick of 7.7% in first-quarter revenue in the U.S. and Canada, bringing in more than $3.6 billion. Netflix did this despite having fewer UCAN customers year over year -- 74.58 million in Q1 2022 vs. $74.40 million in Q1 2023. Indeed, most major U.S. subscription streaming services raised prices in 2022.

Notable in the broader report from DEG was the decline of almost all traditional "home video" channels, including the aggregate physical media business, which was down nearly 27% year over year to $377.25 million.

Meanwhile, the selling of streaming movies and TV shows, electronic sell-thru, was down 12.31% to $564.35 million in Q1. VOD was off 11.5% to $443.47 million.

DEG said the transactional numbers should improve with the revived theatrical pipeline. The firm, which gets its data from studio suppliers, attributed some of the Q1 sluggishness to the fact that the bigger rental and sale titles in the quarter, including Avatar: The Way of Water and Creed III, hit the homevid market late in the quarter.

With the rise in SVOD, total "home entertainment" spending rose to nearly $10.1 billion, up almost 15%. Of course, take SVOD away and classify it as something else -- "pay TV," maybe? -- and you'd get a very different aggregate figure for this industry.