MARA Holdings Inc. (NASDAQ:MARA), the world’s largest publicly traded Bitcoin miner by hashrate, has cratered into oversold territory, with its Benzinga Edge’s Stock Rankings‘ momentum score plunging to the bottom 10th percentile of all stocks.

Check out MARA’s stock price here.

What Does Momentum Ranking Entail?

The metric, which tracks relative price strength and volatility across timeframes, reflects a week-over-week collapse amid Bitcoin’s sharp correction from recent highs above $126,000.

BTC was trading 30.7% lower from its all-time high on Oct. 7. During the publication of this article, the prices were 1.34% higher at $87,471.66 per coin.

See Also: Forget MSTR — These 3 BTC-Linked Stocks With Weakening Momentum Are In Focus Amid Big Bitcoin Fall

MARA Tumbles Amid BTC Correction

Shares of MARA have plummeted 42.69% over the last month and 31.81% in the last six months. Whereas it was down 34.86% and 57.57%, year-to-date and one-year, respectively. It was down 1.61% in premarket on Tuesday.

As of date, the digital asset firm holds 52,850 BTC worth roughly $4.67 billion.

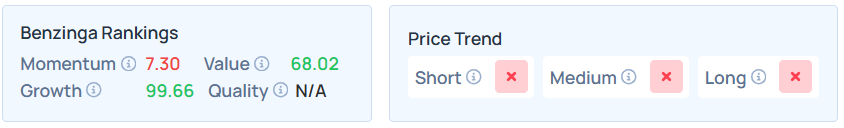

Apart from the momentum score, MARA maintained a weaker price trend over the short, medium, and long terms, with a solid growth ranking. Additional performance details, as per Benzinga Edge’s Stock Rankings, are available here.

MARA Reports Mixed Q3 Results

Despite the third quarter’s mixed results, with revenue up 92% to $252 million and net income flipping to $123 million, MARA’s treasury-heavy strategy leaves it vulnerable to crypto volatility.

Its quarterly earnings of 27 cents per share missed the consensus estimate of 44 cents by 38.22%.

The CEO highlighted the importance of electricity in BTC mining and AI during the earnings.

"We believe electrons are the new oil, and energy is becoming the defining resource of the digital economy. Just as oil fueled the industrial age, electricity now powers the digital one, and those who control abundant, low-cost energy hold the key to generating both value and intelligence. From Bitcoin mining to artificial intelligence (AI), every digital system requires energy to create economic output," Fred Thiel, CEO of MARA, said in a letter to shareholders.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock