TJX, the parent company behind big box discount chains T.J. Maxx, Marshalls and HomeGoods, reported earnings early Wednesday. TJX stock is nearing a buy point.

Analysts noted traffic trends at discount stores improved in April as inflation pressures weigh on customer wallets. They forecast that trend would continue as cautious consumers prioritize off-price options and affordability during the year.

And there's a hole to fill in the market after Bed Bath & Beyond filed for bankruptcy on April 23. Bed Bath & Beyond closures present an opportunity for Burlington, Ross Stores and TJX in terms of real estate, inventory and market share, Bank of America noted on May 2. Bed Bath closed 400 locations last year, and there's a chance to snap up additional vacancies and closeout merchandise, according to BofA.

TJX operated 4,835 stores in nine countries as of year-end.

Meanwhile, TJX is best positioned for clothing, bedding and soft-line products, Jefferies analyst Corey Tarlowe wrote in a May 9 research note. TJX is also outperforming competitor Burlington in the discount apparel space, Tarlowe says, based on foot traffic data.

In addition, TD Cowen raised its price target on TJX stock on May 12, noting improving traffic trends in April as customers sought affordable options. TJX looked stronger than Ross and Burlington based on those trends, according to the firm. TD Cowen inched up its price target to 89 from 88 per share and maintained its outperform rating.

On March 28, TJX boosted its quarterly dividend 13% to 33.25 cents per share after matching Q4 earnings estimates and announcing a $2 billion to $2.5 billion stock buyback plan.

Earnings

TJX earnings rose to 76 cents per share, leaping 55% from its diluted earnings of 49 cents last year and up 12% from its adjusted earnings of 68 cents per share, respectively. Total revenue rose 3.3% to $11.78 billion.

Analysts polled by FactSet expected first-quarter TJX earnings to rise to 72 cents per share on 3.6% revenue growth to $11.82 billion.

Total comparable sales for TJX rose 3% from last year, led by a 5% increase at its Marmaxx stores — the name of the combined Marshalls and T.J. Maxx locations. TJX noted "very strong" sales for its apparel and accessories product categories. HomeGoods comparable sales retreated 7% for the quarter.

For Q2 of its 2024 fiscal year, TJX sees overall comparable sales increasing 2% to 3% with earnings ranging from 72 cents to 75 cents per share. FactSet analysts forecasts earnings of 79 cents per share.

TJX projects comparable sales up 2% to 3% for the year and earnings between $3.49 and $3.58 per share. The earnings forecast includes a 10 cent per share benefit from an extra week in TJX's fiscal calendar. FactSet projects earnings of $3.53 per share for the year, improving from $3.11 per share last year.

TJX earnings accelerated the past two quarters, posting 14% growth to 89 cents per share in Q4. Sales grew 5% for the fourth quarter, matching a combined 5% decline from the previous two periods.

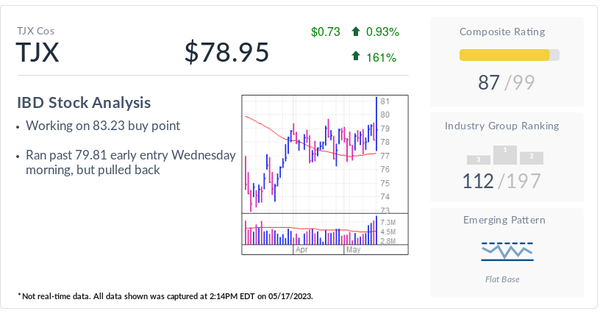

TJX Stock

Shares are nearing the 83.23 buy point for its 19-week flat base. Aggressive investors could find an early entry at 79.81, just above its weeks of tight action and close to its 21-day exponential moving average and 50-day line.

TJX ranks second in the Retail-Apparel/Shoes/Accessories Group, according to the IBD Stock Checkup. It only trails Lululemon Athletica. Shares have an 88 Composite Rating, which combines various technical indicators into one easy-to-read score. TJX's relative strength line is off highs from early January and it has an 89 RS Rating.

TJX stock rose about 1% to 78.95 Wednesday following results after briefly edging lower during trading. Shares slid 1.3% Tuesday leading up to the report and are down 0.8% this year.

You can follow Harrison Miller for more stock news and updates on Twitter @IBD_Harrison.