Norwegian Cruise Line (NCLH) is up about 5.5% so far on Tuesday, after the company reported earnings before the open.

The company reported a top- and bottom-line beat, while its revenue outlook for next quarter came in at $1.4 billion to $1.5 billion. That’s roughly in-line but just a little bit below consensus expectations of $1.46 billion.

That was better than the mixed report investors heard from Royal Caribbean (RCL) last week, although that stock traded quite well after an initial decline on the news.

For its part, Norwegian Cruise stock is helping give a lift to the sector. While shares are up about 5.5% on the day, the stock was up almost 10% at its high.

Carnival Cruise (CCL) and Royal Caribbean stock are each up about 3.5% in sympathy to the report.

If Norwegian Cruise stock can push just a little bit higher, it could really open the door to higher prices.

Trading Norwegian Cruise Stock on Earnings

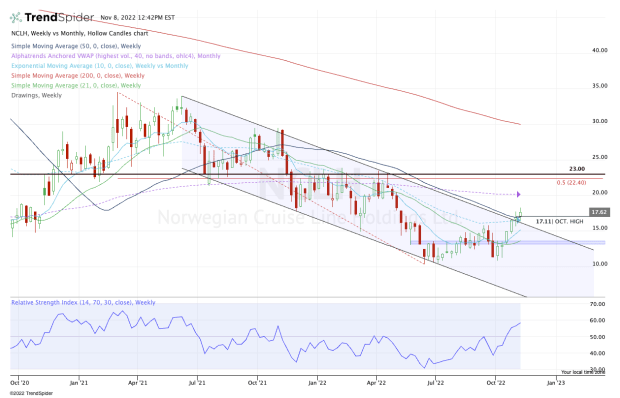

Chart courtesy of TrendSpider.com

Norwegian Cruise stock enjoyed a nice rally off the 2020 low, but in mid-2021, the stock fell into a long downward channel. That was marked by a series of lower highs and lower lows and can be seen on the weekly chart above.

Shares are quietly up in five straight weeks and are working on a sixth. Last week’s close was important, as the stock finally ended the week above the 10-month moving average and above downtrend resistance.

With this week’s push, the stock is also clearing the 50-week moving average and the October high of $17.11 — giving us a monthly-up rotation.

From here, the charts are looking much better. I previously mentioned that higher prices could be in store with just a “little bit” more of an upside push. That’s if shares can clear last week’s high of $17.75 and close above that level.

That opens the door to the monthly VWAP up near $20, then the $22.50 to $23 zone. Near the former level, shares would face the 50% retracement. The latter level marks a key pivot for the stock.

On the downside, a break back below this week’s low of $16.32 is a concern.

That would put shares back below the 50-week moving average and threaten a move back below the 10-month moving average and downtrend resistance. In that case, bulls would need to see support come into play near $15.50.