Traders who were betting on DraftKings (DKNG) ahead of earnings will be disappointed with Friday’s near-20% decline.

The company beat consensus expectations for earnings, but guidance was not enough to conjure up a bullish reaction. That’s despite the stock already being down 70% ahead of the report.

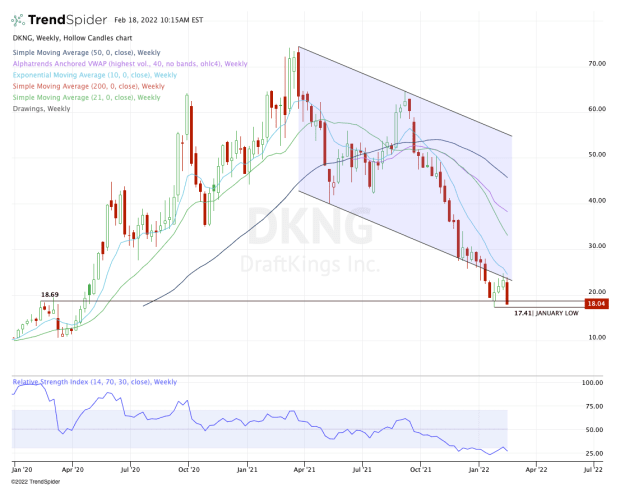

With today’s decline, shares are now down about 76% from the all-time high and are closing in on new 52-week lows. That happens if DraftKings stock takes out last month’s low at $17.41.

While other gambling stocks have been inching higher lately — stocks like Wynn Resorts (WYNN) and Caesars Entertainment (CZR) — they have another catalyst in play: A return to tourism.

We’re seeing cruise stocks, airlines, hotels and stocks like Airbnb (ABNB) find a new gust of bullish momentum.

DraftKings doesn’t have a hospitality side to its business and thus, it’s floundering with the rest of the growth stocks. Is it time to place a bet on the long side?

Trading DraftKings Stock

Chart courtesy of TrendSpider.com

As I look across the carnage in the growth space, I see tremendous long-term opportunity. However, I also see persistent risk as these stocks get completely throttled.

Is DraftKings one of the high-quality stocks that’s suddenly too cheap to pass up?

I wish I had the conviction to say one way or the other.

Down more than 75% from the highs and it’s a little too late to turn fully bearish. At the same time, others — like Roku (ROKU) and Fastly (FSLY) — have declined 80% to 86% from the highs. DraftKings could be next for all I know.

Looking at the weekly chart above, DraftKings stock sits in a precarious area, down in the $18 to $20 breakout zone from 2020.

By all accounts, it looks to be waning as support, as shares initially bounced from this zone, but failed to regain channel support.

The stock also remains trapped below all of its short-term daily and weekly moving averages. That’s fairly indicative of a major downtrend.

I am curious to see how the stock handles last month’s low at $17.41.

Does it break below this level, bottom and reclaim it? If so, that could give us a possible bullish reversal and potentially put $20-plus back in play. The declining moving averages would still be a problem, but that would make for a decent bounce.

The flip side is, the stock breaks last month’s low and can’t reclaim it. That would give us a monthly-down rotation and put even more downside on the table.

In so many words, traders who like this stock should be open-minded, but remember that the losses can continue and until the trend changes, it favors the bears. That doesn't mean there won't be trading opportunity, but a change in trend is what's really needed for bulls to get long and stay long.

Rising interest rates, inflation, and market volatility are on the horizon. You don’t want to miss out on this exclusive opportunity to unlock Action Alerts PLUS at our lowest price of the year.