We have discussed in several previous articles the benefits of a pairs trade approach. A pairs trade is simply taking a bullish position on the stock you feel will do better than a similar stock that you take a bearish stance on. Buy Ford/Sell General Motors the classic example if you think Ford will outperform GM.

Instead of using simple stock to express the viewpoints, it is in many ways better to use options. Why? Limited risk, lower upfront cost along with three somewhat less known, but very important, benefits.

A quick walk-through our recent trade in the POWR Options portfolio will help shed some light on understanding these “under the radar” trade management benefits we employ.

The pairs trade we selected was a recently completed bullish call on Cheniere Energy Partners (CQP) and a bearish put on Sunoco (SUN) . Both oil related names so highly correlated stocks-meaning they move up and down together on a regular basis.

Initial trade February 27 shown below:

Action To Take

Buy to open SUN 6/16/2023 $50 put for $4.10 w/.20 discretion

Each option will cost around $410 per contract.

Action To Take

Buy to open CQP 6/16/2023 $50 call for $4.00 w/.20 discretion

Each option will cost around $400 per contract.

Reasoning on the trade was this: Cheniere Energy Partners (CQP) was an A-rated (Strong Buy) stock while Sunoco (SUN) was a C-rated (Neutral) stock. Both in the same industry-MLP Oil& Gas.

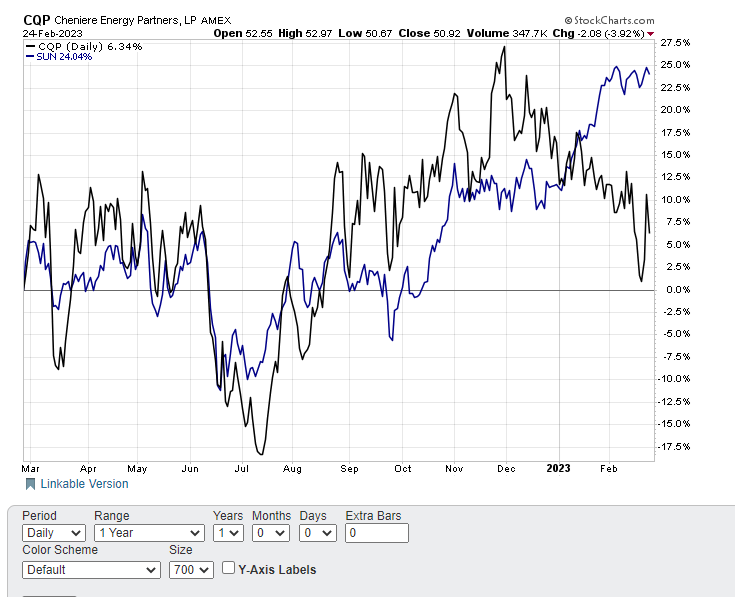

You would expect these two stocks to move in a similar fashion given they are both oil related names. Indeed, they did for pretty much all of 2022.

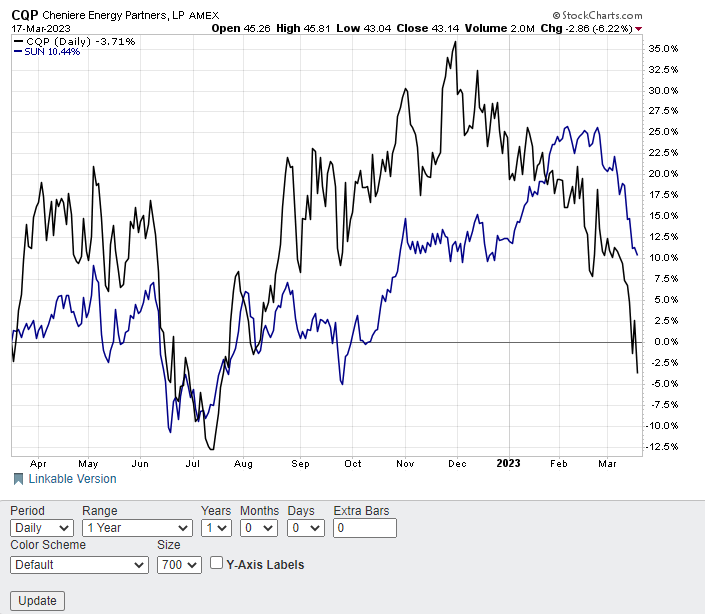

However, much-lower rated SUN had dramatically out-performed the higher rated CQP in 2023 by over 17%. The graph below shows how these two normally related stocks diverged. The pairs trade was put on with the expectation of CQP subsequently outperforming SUN over the following few weeks and for the spread to narrow. This outperformance would cause the spread to converge, leading to a profit.

This did occur, but not to a large degree. The spread did converge by about 3.5%, narrowing from 17.7% to 14.15% as both stocks fell sharply.

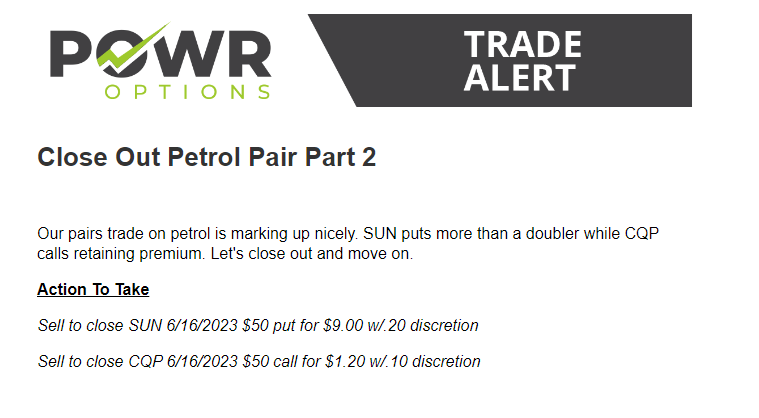

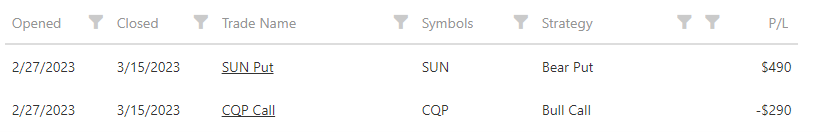

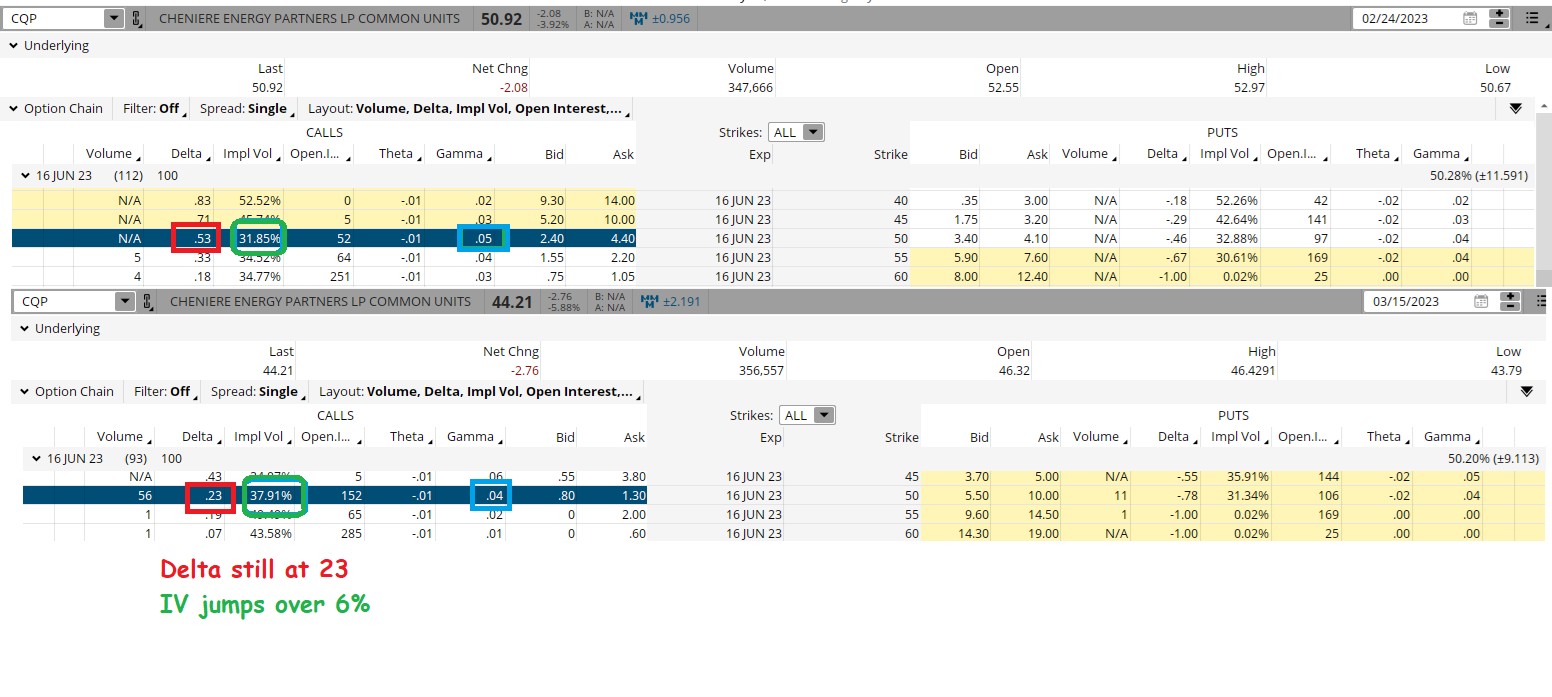

Our pairs trade, however, did quite well. Closed out on March 15 as seen below.

We gained $490 on the SUN puts and lost only $290 on the CQP calls for a net gain of $200 as shown in the table.

The initial cost on the pairs trade was $810. The net gain of $200 equates to a 24.69% return. Holding period was a little more than two weeks. Plus, we were hedged at trade inception with a bullish call and bearish put on two highly correlated stocks.

So, while the two stocks that comprised the pairs trade did start to converge as expected, that convergence certainly didn’t account for the majority of the profit.

Instead, the three things listed below-gamma, time decay management, and implied volatility analysis-are the hidden benefits to the POWR Options Pairs Trade approach.

Gamma

Options move in a curved, not linear, fashion. The bigger the favorable move in the underlying stock the more favorably the option moves in comparison. Conversely, the bigger the unfavorable move in the stock the less the options will move against you.

The initial delta at trade inception will change as the stock price changes. This rate of change in the option delta compared to the stock price is called “gamma”.

Gamma is an options metric that describes the rate of change in an option's delta per one-point move in the underlying asset's price. Delta is how much an option's premium (price) will change given a one-point move in the underlying asset's price.

Buying options puts you long gamma. This means you are more right if you are right in picking direction. It also means you are less wrong when you are wrong on direction. Sounds to good to be true? Well, it kind of is-because time decay is the bad part about buying options.

Time Decay

Options are a wasting asset. Each day that passes they lose a little more of their overall value. This notion is called time decay, or theta to use the Greek term. While gamma is the good side of buying options, theta is unquestionably the bad side. POWR Options is acutely aware of time decay. This is why we almost invariably elect to exit the options well before expiration (usually 30 days or so).

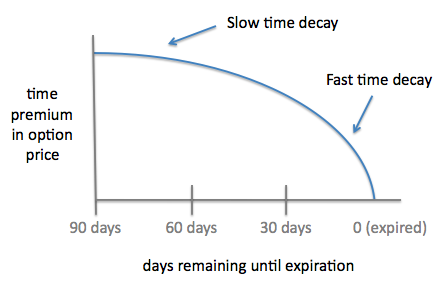

The illustration below shows how option time decay really hits up hard in the final 30 days or so before option expiration. Exiting before then and salvaging time premium, or the remaining value of the option, is crucial to long-term success.

Certainly exiting the CQP/SUN pairs trade in just a few weeks made time decay less relevant.

Having options you bought expire worthless, or for zero value, is something that needs to be avoided-at all cost. We have accomplished that so far in POWR Options.

Implied Volatility

At POWR Options, we always look very closely at implied volatility (IV) when considering trade possibilities. It is, in our opinion, one of the most crucial elements to option trading.

Implied volatility is a measure of how much the options market expects the underlying stock to move. Higher IV means bigger moves are expected and lower IV equates to smaller anticipated moves. IV is also in essence the price of the option. Higher IV makes options more expensive. Lower IV cheapens options.

Since we are always buying options, we focus on purchasing those options that have a comparatively low implied volatility. Low comparative IV means option prices are somewhat cheap-always a good thing.

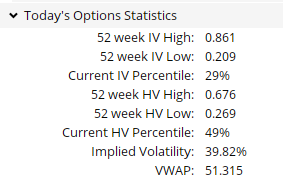

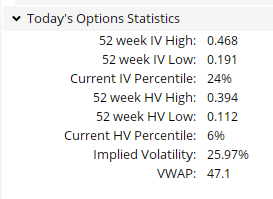

The current IV percentile ranks where the implied volatility is right now as compared to IV range over the past year. The lower the percentile the lower the IV is right now. 100% would mean IV is at the highest readings in the past year. 0% would be the lowest. 50% would be about average.

We look to buy options that are trading well below the 50% level-in other words comparatively cheap options. A look at the options on both SUN and CQP below shows that both were well under the 50% IV percentiles when we bought them on February 27.

CQP IV

SUN IV

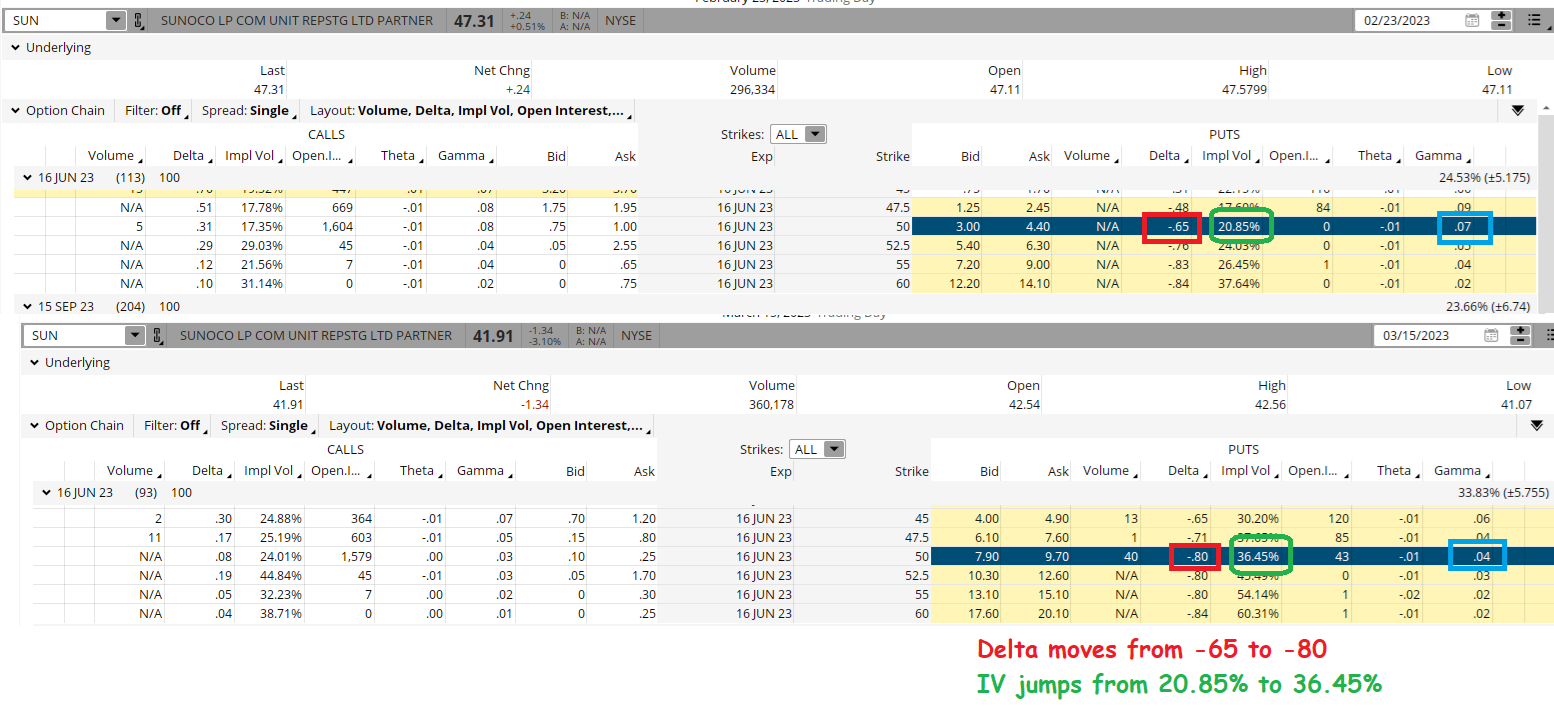

You can see below how the implied volatility (IV) jumped from 20.85% when we purchased the SUN puts to over 36% when we closed out the position. Another advantage to buying cheaply priced, or low IV, options. Also shown is how the delta on these bearish puts moved from -65 to -80, the positive effect from gamma.

The same scenario played out in the CQP calls as well.

The power of the POWR Ratings plus the expected convergence of related stocks can be a decided edge when constructing pairs trades. Understanding the somewhat hidden benefits of gamma, time decay management, and implied volatility analysis turns the pairs trades into POWR Pairs trades. Put the odds further in your favor with this approach.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

SUN shares closed at $41.60 on Friday, down $-0.32 (-0.76%). Year-to-date, SUN has declined -1.79%, versus a 1.98% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

Three Better Ways To Put Profit Probabilities In Your Favor With A POWR Pairs Approach StockNews.com