Happy Halloween Everyone!

I might dress up as Inverse Cramer tonight because I know everyone will give me their money.

Cambiar a la suscripción paga

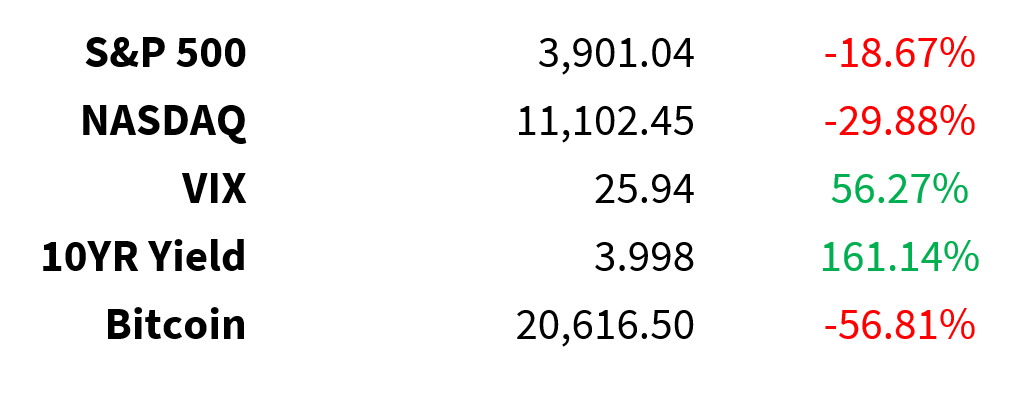

Prices as of 4 pm EST, 10/28/22; % YTD

MARKET UPDATE

Month to date

-

S&P 500 +8.8%

-

Nasdaq +5%

-

Russell 2000 +11%

-

DOW +14.4%

October 2022 ranks as the 10th best month on record for the DOW since 1915

-

DOW holdings with October performance, all 30 DOW holdings up in October

-

Caterpillar +34%

-

Chevron +25%

-

Honeywell +22%

-

JP Morgan +21%

-

Visa +18%

-

Apple +12%

-

UNH +9%

-

Walmart +9%

-

Home Depot +8%

-

Microsoft +1%

-

Why did the market go up in October?

-

Market believes the Fed will pause after 2 more hikes.

-

75-point hike in November

-

50-point hike in December

-

In September, Market assumed 75-point hike in December

-

In October, Market assumed only a 50-point hike in December

-

The revision from 75 to 50 which occurred in October was the catalyst for the majority of the October rally

-

Strong earnings from Caterpillar, Chevron, Visa, etc. also contributed

-

Investor Positioning

-

The strength also speaks to the elevated cash levels of investors and very low hedge fund leverage

-

Any small positive signal creates a large market impact

FOMC meeting is Wednesday

-

expect 75 basis point hike

-

Expect 2-year yields to go up

November 4, 2022 U.S. October jobs report

November 8, 2022 U.S. midterm elections

November 10, 2022 U.S. CPI

Europe: Inflation surged to 10.7% in October, GDP +0.2%

-

Russia pulling out of a UN deal to allow Ukraine grain exports, Wheat up 4%

-

Ukraine is one of the world’s biggest suppliers of wheat, corn and vegetable oil

-

The July agreement to open 3 ports has been vital to help alleviate a global food crisis

Crude 86.50 -1.5%

-

Crude lower after China’s Manufacturing PMI was 49.2 vs. street 49.8

-

New orders contracted for a 4th consecutive month

-

8:30 a.m. OPEC 2022 World Oil Outlook

Shanghai Disney (NYSE:DIS)

-

To close October 31 under requirement of pandemic prevention and control

Earnings

CRYPTO UPDATE

Doge

-

Dogecoin is up over 100% over the past week

-

Why? → Elon’s Twitter (NYSE:TWTR) purchase

-

Market cap >$16 billion

-

That’s roughly 3 Lyfts (NASDAQ:LYFT)

-

-

+$89 million in liquidations since Friday

-

~$650 billion in futures open interest

-

Does it make sense? → Doesn’t have to ¯\_(ツ)_/¯

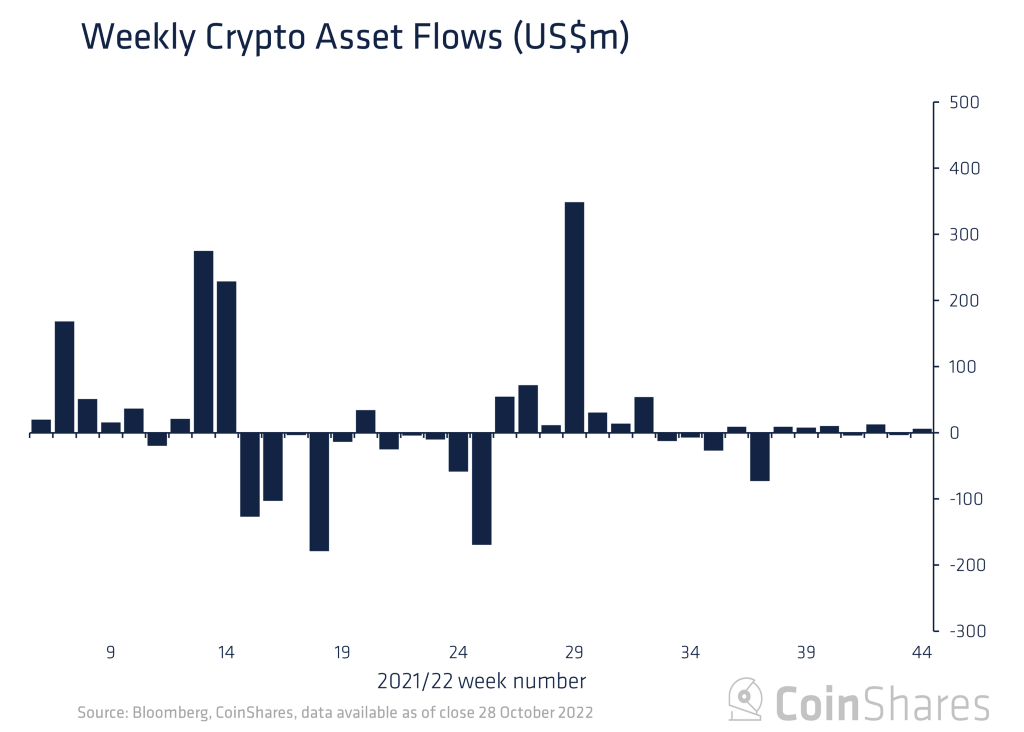

Investor flows to digital asset investment products

-

Minor ($6.1 million) inflows last week

-

7th consecutive week muted flows

-

Bitcoin inflows $14 million

-

70% of flow volumes

-

-

Ethereum outflows $2.1 million

-

7th consecutive week of outflows

-