Planning for retirement is a multi-decade process that must include considerations regarding inflation, market fluctuations, and risk tolerance. With the cost of living skyrocketing and the fate of Social Security unclear, 401(k)s, IRAs, and 403(b)s may not be enough to sustain consumers through retirement.

The possibility of outliving retirement savings has become more prevalent, forcing Americans to adjust their investment portfolios.

💸💰 Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💸

Workplace pensions were historically a more predictable retirement plan, as employers shouldered the investment burden and employees were guaranteed lifetime income. Now, consumers must consider supplementing their savings with additional financial products.

Related: The average American faces one major 401(k) retirement dilemma

Annuities are one of the only investments that can provide a guaranteed income stream, though each type of annuity has different terms and serves a distinct purpose.

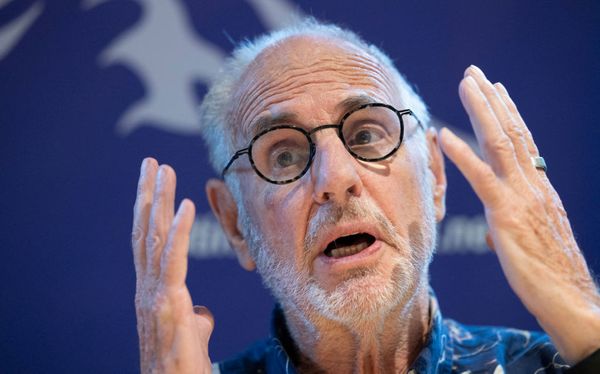

We spoke with Bryan Pinksy, President of Individual Retirement at Corebridge Financial, to discuss how annuities can help bridge the income gap between retirement savings and Social Security payments.

While each retirement plan is unique to a person’s financial situation, it’s clear that there is a universal need to protect retirement plans from inflation risk, longevity risk, and sequence of returns risk (more on this below).

Finding the right annuity for your portfolio can mitigate risk and provide a safety net during retirement

There are four main types of annuities, each with its own benefits, risks, and use cases. Fixed annuities are a more stable option for most investors, but those with a higher risk tolerance may want to accumulate more savings through a variable annuity.

- Fixed annuities: offer a set interest rate on the investment and provide guaranteed income for life or a set term. This product is tax-deferred until money is withdrawn, and its value increases over time, unaffected by market fluctuations. Most fixed annuities offer death benefits for selected beneficiaries.

- Variable annuities: allow the buyer to choose from several investment options within their contract. The portfolio performance — and therefore payout— is based on market performance. This product is riskier than a fixed annuity but can provide larger financial gains. It also grows tax-free and offers a standard death benefit.

- Immediate annuities: distributed payments from a large lump sum that can be paid out at a frequency and duration determined by the buyer. Immediate annuities can be fixed or variable, so the purchaser can choose between a guaranteed income stream or market-driven returns. Payouts from this contract can begin within one month of being issued and can be delayed up to one year, benefiting those approaching retirement.

- Deferred annuities: provide retirement income over a specified period through either a lump-sum payment or several premium payments. You can defer income payments to allow your investment time to grow, making the product more beneficial for those further away from retirement age. Purchasers can choose a fixed or variable contract to provide either guaranteed income or market-driven returns.

Pinsky explains how annuities work and that the type of annuity selected will depend on the buyer’s age, savings, and risk appetite.

“Annuities are long-term financial products specially designed for solving the challenges that are unique to retirement,” he said. “What’s probably most familiar is the protected lifetime income that many annuities offer and the tax deferral they provide, which can help Americans save more for use in retirement. They can serve as a great vehicle to build that retirement nest egg so individuals can get to retirement, and help them live through it too.”

“There are some types of annuities that can also meet the need for growth and provide some downside protection,” he continued. “The specific product characteristics will depend on which version of an annuity is utilized. There is a wide array of annuity products, and the right one for any individual is based on their needs, risk tolerance, and other sources of income.”

He highlights the value of providing extra income to supplement 401(k)s, IRAs, 403(b)s, and Social Security payments.

“Purchasing an annuity can help people build a base of protected lifetime income to complement other sources of retirement income like their 401(k)s and Social Security, especially if they need to cover essential expenses before claiming benefits,” he said.

“That extra income can make it easier to manage living expenses when you get to and then need to live through retirement. Since most annuities provide that protected lifetime income, purchasing an annuity can help allay the anxiety or fear associated with that.”

More on retirement:

- The average American faces one major 401(k) retirement dilemma

- How your mortgage is key to early retirement

- A few simple tasks can help you thrive in retirement

“Every person eligible for Social Security has to consider when they should start taking payments,” he continued. “Given the age and income level parameters, payments will vary by person. So the age at which someone retires will depend on their financial situation, personal health history, and other considerations.”

Annuities with a payout over a set term of 5-10 years can help retirees defer Social Security until full retirement age to ensure they get the biggest checks possible. However, lifetime income from an annuity can also be used to enhance monthly Social Security checks throughout a person’s retirement.

“Individuals should absolutely have that conversation with an advisor,” Pinsky explained. “For those who do decide to delay their payments for whatever reason to get those higher Social Security payments in the future, an annuity can help bridge the gap between when they retire and when they start claiming Social Security benefits.”

“There are many factors you should consider before claiming Social Security benefits, and financial professionals are well-versed in helping individuals understand their circumstances. They can also work with workers to explain how Social Security fits with their overall retirement plan, including whatever savings and other income they have through their savings and an annuity.”

Fighting sequence of returns risk and longevity risk with a financial advisor

The most prominent retirement risks that consumers need to be aware of are longevity risk and sequence of returns risk.

Longevity risk—the possibility of outliving your retirement savings—is a relatively new phenomenon caused by the rising popularity of 401(k)s and the lack of guaranteed retirement income. Workers of all ages must consider longevity risk when accumulating savings and considering investment strategies, and retirees must consider this risk when developing their 401(k) withdrawals and spending plans.

Sequence of return risk—the potential for poor market performance during later working years—is a threat workers approaching retirement age need to take note of. This occurrence can derail retirement plans, as there is little time for an investment portfolio to recover before withdrawals begin.

Related: Dave Ramsey has major warning on retirement, 401(k), Social Security

“Sequence of returns risk is one of the major risks that retirees face—having some kind of market drop at just the wrong time, which can be very damaging to what they are trying to accomplish,” he said. “It can severely impact the level of income your investments would generate over retirement and can increase the possibility of eventually running out of money.”

Pinsky explains how workers and recent retirees can navigate a tumultuous market leading up to retirement and how to effectively plan how to spend your savings when you no longer have a paycheck.

“The odds are that people during their working years were used to receiving a paycheck every two weeks or at some regular cadence,” he continued. “You always knew how much you would spend on essential expenses—housing, utilities, health care, groceries. When that paycheck stops, and retirement begins, there are a lot of questions.”

“It’s essential before you get to that point that you figure out where your income is going to come from and how you will be confident that your income is going to cover the retirement income expenses specific to you,” he said. “When people retire, they need to go from a savings mindset to a spending mindset, from accumulation to decumulation. Financial advisors are very good at helping clients during the accumulation phase and navigating the decumulation of those hard-earned assets.”

Older workers — particularly those in Gen X — may benefit from relatively low-risk investments that still have the potential for market gains. Pinsky explains that Registered Index-Linked Annuities (RILAs) may be a great mix of market gains and protected income that increasingly stressed Gen X workers may want to explore in preparation for retirement.

“There is one type of annuity called a RILA, a registered index-linked annuity,” Pinsky said. RILAs tend to offer a good level of market upside while providing some downside protection with a buffer. They don’t give you complete downside protection, and they often don’t give you full upside potential, but they give you a balance of the two, he explained.

Gen X is feeling the crunch of the high cost of living, market dips, and an uncertain future for Social Security. Corebridge found that only 32% of Gen X workers are confident they can manage their retirement savings to provide income throughout their life, and two-thirds are more scared of running out of money than they are of dying.

Pinsky explains that there is still enough time for Gen X to address their retirement concerns, and RILAs that offer market upside and protection may be a great option to help meet their retirement savings goals.

“Gen X today still has, on average, 5 to 15 years before they retire. They may want an annuity that offers growth potential because they have a different risk tolerance than the boomers have right now because of where they’re at in their retirement journey,” he explained.

“So they want that growth potential for their retirement assets, but they may also want some protection. It gives them upside but some protection in case the equity markets don’t perform well.”

Pinsky notes consulting a financial advisor can help anxious workers find the right annuity to fit their investment timeline, establish a withdrawal and spending plan during retirement, and understand how Social Security fits into the equation.

Related: Veteran fund manager sees world of pain coming for stocks