It's been a rough year for stock investors, with the S&P 500 ETF Trust (NYSE:SPY) now down 14% year-to-date.

One unconventional indicator with a 100% track record of success suggests investors should be buying the recent market dip.

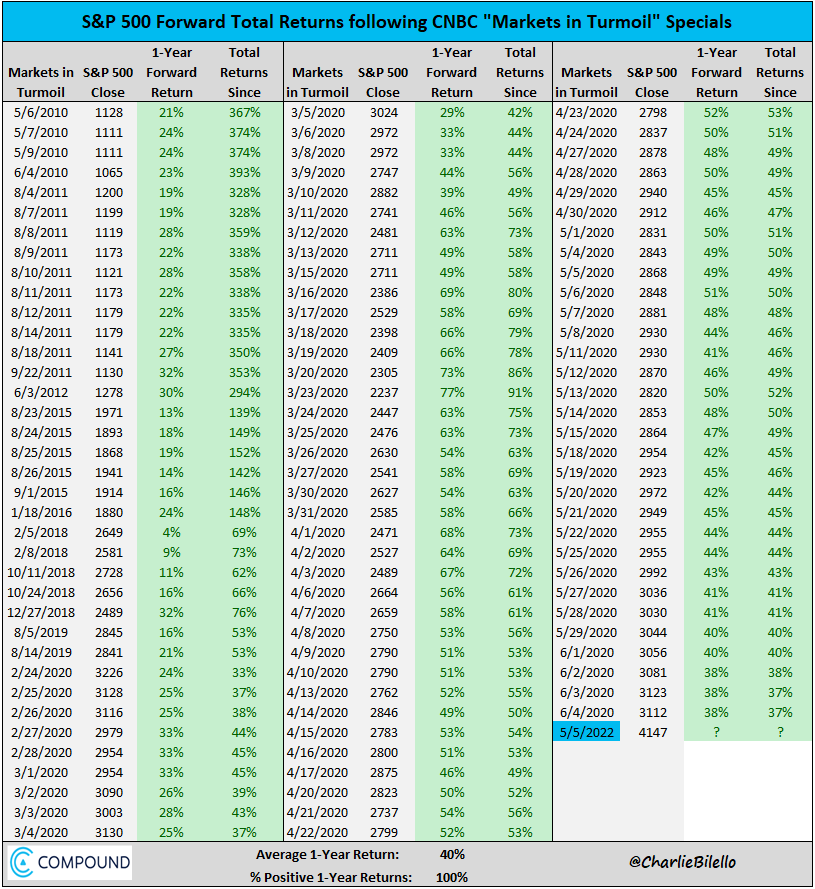

Contrarian Indicator: Charlie Bilello, founder and CEO of Compound Capital Advisors, tweeted on Friday that the S&P 500 has generated a positive one-year return each time CNBC has run a "Markets in Turmoil" special, the latest episode of which aired on Thursday.

Bilello tweeted the following chart of S&P 500 returns, which includes dozens of "Markets in Turmoil" specials going back to May 2010.

Not only have the one-year S&P 500 returns been positive 100% of the time following a "Markets in Turmoil" special, the S&P 500 has averaged an impressive 40% one-year return following the shows.

Word Of Caution: Before investors go scooping up every share of S&P 500 stock they can find, Bilello also included a warning about the limited sample size of his study.

"Important caveat: the data set of 'Markets in Turmoil' specials starts in 2010, and is therefore limited to a buy-the-dip bull run where corrections have been short lived. When the next longer-term bear market comes, there will surely be losses following these specials," he said.

Bilello suggested the results are far from a coincidence given how much of a contrarian buy signal the media can be. He noted that in general, market conditions are probably more favorable than average for buying stocks when CNBC is running "Markets in Turmoil" specials.

Benzinga's Take: Traders shouldn't be too hard on CNBC for seemingly adding fuel to market panic by running these specials. The financial media is simply reflecting the climate of fear in the market during periods of extreme volatility, and savvy investors have known to "buy when there's blood in the streets" for centuries.