Investors with a lot of money to spend have taken a bearish stance on ON Semiconductor (NASDAQ:ON).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with ON, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for ON Semiconductor.

This isn't normal.

The overall sentiment of these big-money traders is split between 27% bullish and 72%, bearish.

Out of all of the options we uncovered, 10 are puts, for a total amount of $480,715, and there was 1 call, for a total amount of $204,000.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $70.0 for ON Semiconductor over the last 3 months.

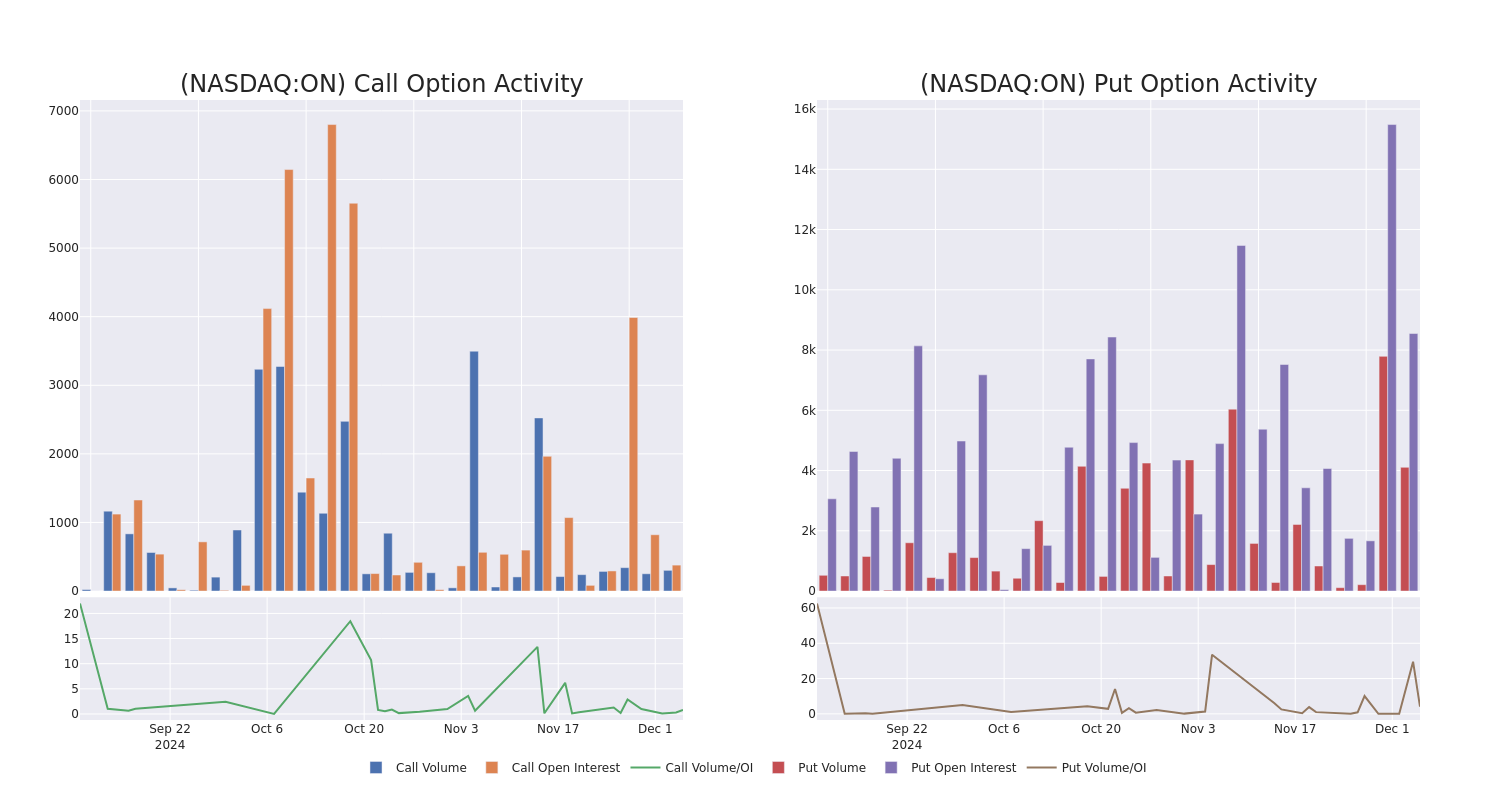

Volume & Open Interest Development

In today's trading context, the average open interest for options of ON Semiconductor stands at 1487.83, with a total volume reaching 4,409.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ON Semiconductor, situated within the strike price corridor from $60.0 to $70.0, throughout the last 30 days.

ON Semiconductor Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ON | CALL | TRADE | BEARISH | 03/21/25 | $7.05 | $6.8 | $6.8 | $65.00 | $204.0K | 378 | 302 |

| ON | PUT | TRADE | BULLISH | 03/21/25 | $5.85 | $5.7 | $5.7 | $65.00 | $113.4K | 1.4K | 291 |

| ON | PUT | SWEEP | BEARISH | 01/17/25 | $6.35 | $6.25 | $6.35 | $70.00 | $78.7K | 4.8K | 218 |

| ON | PUT | SWEEP | BEARISH | 04/17/25 | $4.15 | $3.95 | $4.1 | $60.00 | $40.9K | 525 | 301 |

| ON | PUT | TRADE | BEARISH | 04/17/25 | $4.15 | $3.95 | $4.08 | $60.00 | $40.8K | 525 | 401 |

About ON Semiconductor

Onsemi is a supplier of power semiconductors and sensors focused on the automotive and industrial markets. Onsemi is the second-largest power chipmaker in the world and the largest supplier of image sensors to the automotive market. While the firm used to be highly vertically integrated, it now pursues a hybrid manufacturing strategy for flexible capacity. Onsemi is pivoting to focus on emerging applications like electric vehicles, autonomous vehicles, industrial automation, and renewable energy.

After a thorough review of the options trading surrounding ON Semiconductor, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

ON Semiconductor's Current Market Status

- Currently trading with a volume of 935,328, the ON's price is down by -1.11%, now at $65.24.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 60 days.

Professional Analyst Ratings for ON Semiconductor

In the last month, 3 experts released ratings on this stock with an average target price of $89.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Reflecting concerns, an analyst from Loop Capital lowers its rating to Buy with a new price target of $95. * An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $87. * Reflecting concerns, an analyst from Wells Fargo lowers its rating to Overweight with a new price target of $85.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ON Semiconductor options trades with real-time alerts from Benzinga Pro.