Benzinga's options scanner has just identified more than 11 option transactions on Coinbase Glb (NASDAQ:COIN), with a cumulative value of $748,910. Concurrently, our algorithms picked up 4 puts, worth a total of 217,395.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $80.0 to $345.0 for Coinbase Glb over the last 3 months.

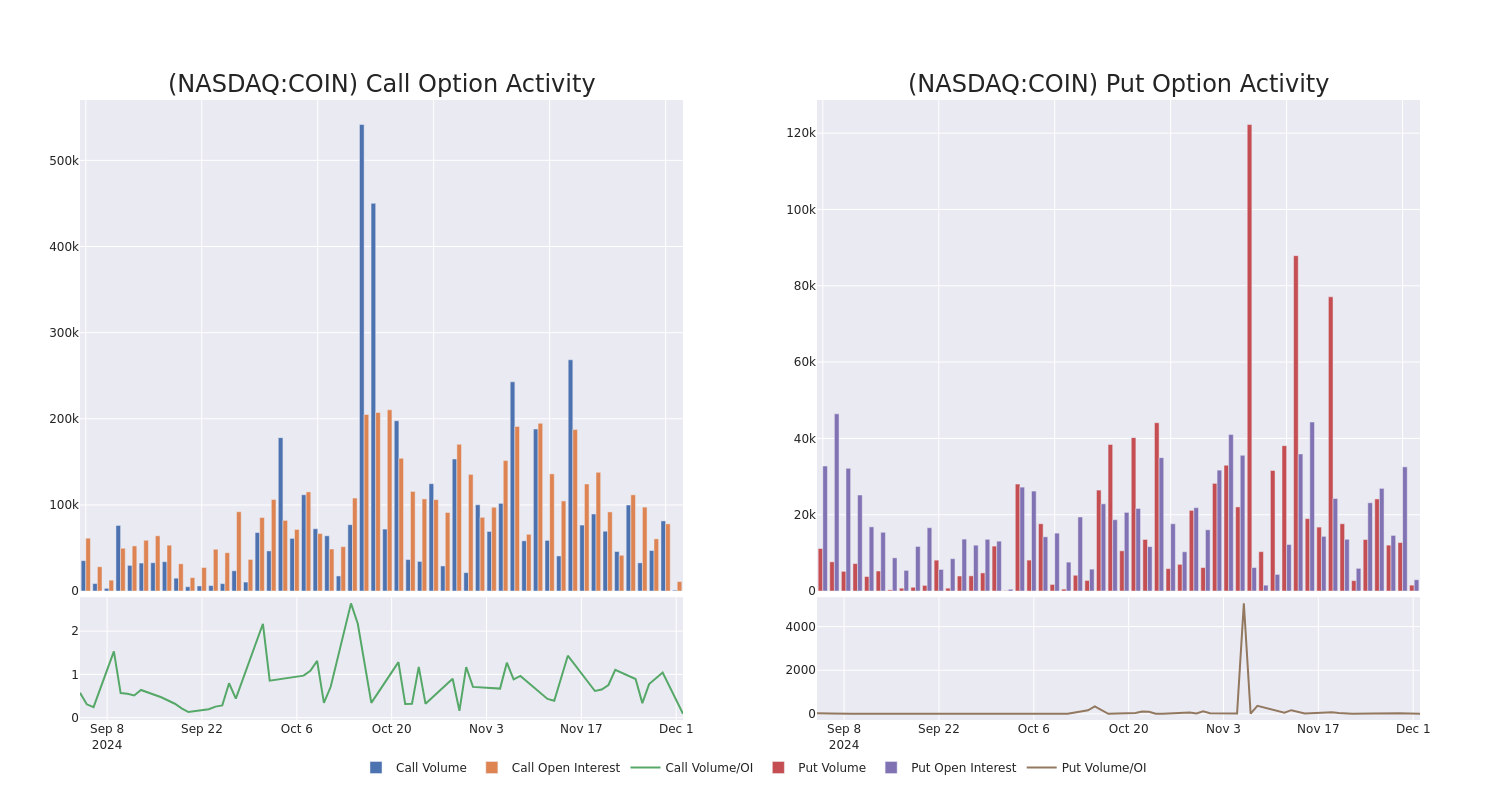

Volume & Open Interest Development

In today's trading context, the average open interest for options of Coinbase Glb stands at 1396.3, with a total volume reaching 2,511.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Coinbase Glb, situated within the strike price corridor from $80.0 to $345.0, throughout the last 30 days.

Coinbase Glb 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COIN | CALL | SWEEP | BULLISH | 12/06/24 | $14.1 | $12.55 | $13.5 | $300.00 | $202.5K | 1.6K | 153 |

| COIN | CALL | SWEEP | BULLISH | 12/13/24 | $19.85 | $19.45 | $19.45 | $305.00 | $124.4K | 284 | 384 |

| COIN | PUT | SWEEP | BULLISH | 06/20/25 | $52.15 | $50.0 | $50.55 | $280.00 | $101.1K | 569 | 0 |

| COIN | CALL | TRADE | BULLISH | 12/20/24 | $23.85 | $23.0 | $23.54 | $300.00 | $94.1K | 6.7K | 41 |

| COIN | PUT | TRADE | BULLISH | 12/06/24 | $11.2 | $10.95 | $10.95 | $300.00 | $54.7K | 2.1K | 721 |

About Coinbase Glb

Founded in 2012, Coinbase is the leading cryptocurrency exchange platform in the United States. The company intends to be the safe and regulation-compliant point of entry for retail investors and institutions into the cryptocurrency economy. Users can establish an account directly with the firm, instead of using an intermediary, and many choose to allow Coinbase to act as a custodian for their cryptocurrency, giving the company breadth beyond that of a traditional financial exchange. While the company still generates the majority of its revenue from transaction fees charged to its retail customers, Coinbase uses internal investment and acquisitions to expand into adjacent businesses, such as prime brokerage and data analytics.

Having examined the options trading patterns of Coinbase Glb, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Coinbase Glb

- Trading volume stands at 816,595, with COIN's price up by 1.56%, positioned at $300.81.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 73 days.

What The Experts Say On Coinbase Glb

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $366.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Needham has decided to maintain their Buy rating on Coinbase Glb, which currently sits at a price target of $375. * Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Coinbase Glb, targeting a price of $358.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Coinbase Glb options trades with real-time alerts from Benzinga Pro.