If the price of oil keeps moving higher, there’s a good chance that shares of the VanEck Oil Services ETF (NYSE:OIH) break out and move higher as well. It is designed to track the overall performance of U.S. listed companies that are involved in providing services to the upstream oil sector. They include specialties like oil equipment, oil services and drilling.

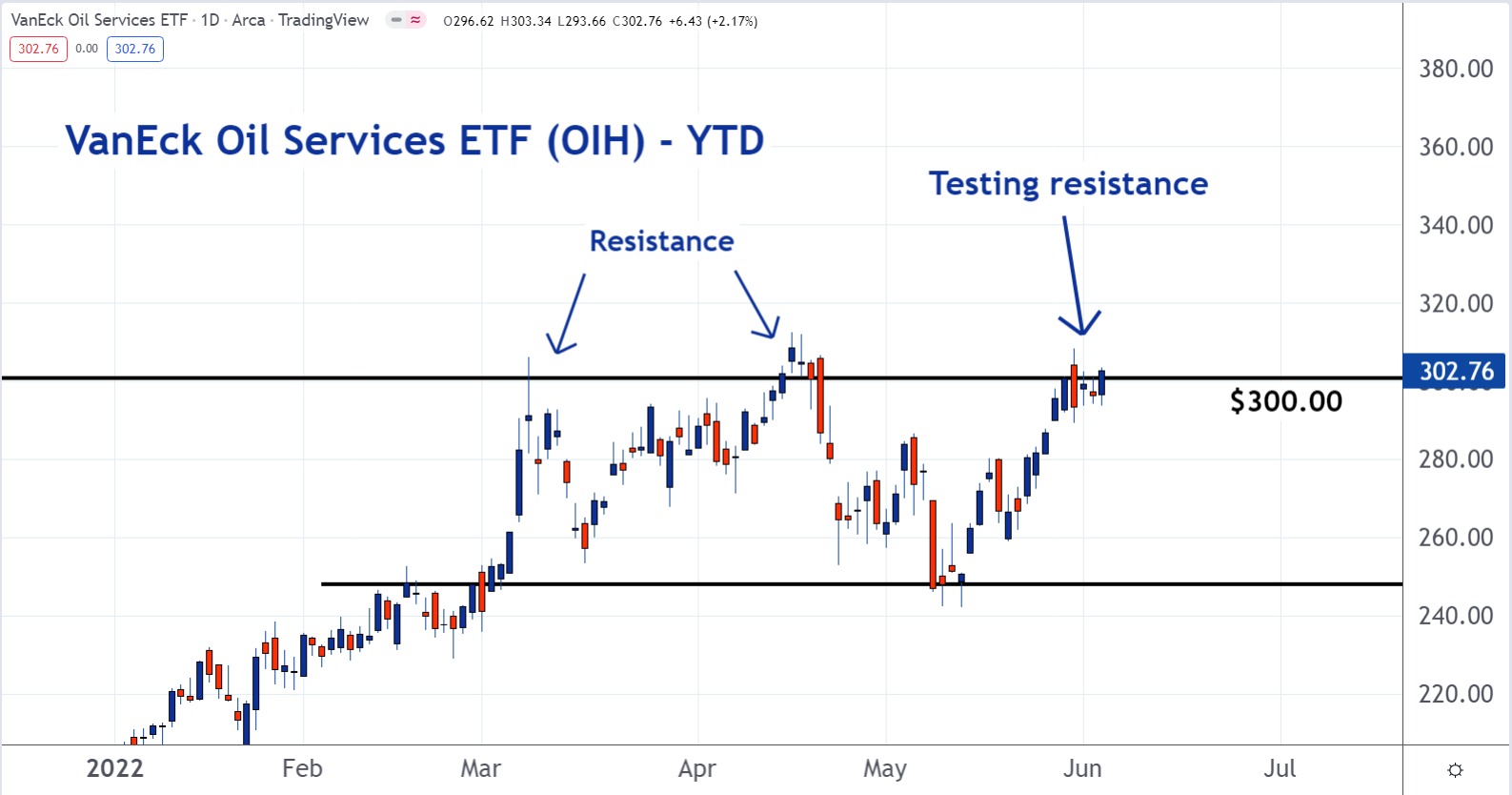

As you can see on the following chart, OIH has hit resistance around the $300 level. If it can clear and hold this level, it will show that the sellers who created the resistance have left the market. With this large amount of supply out of the way, investors will be forced to pay higher prices to acquire shares. This could force the ETF into a new uptrend.

To learn more about trading, check out the new Benzinga Trading School.