Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- Morgan Stanley analyst Joseph Moore upgraded Micron Technology, Inc. (NASDAQ:MU) from Equal-Weight to Overweight and raised the price target from $160 to $220. Micron shares closed at $187.83 on Friday. See how other analysts view this stock.

- Rothschild & Co analyst Harry Bartlett upgraded Affirm Holdings, Inc. (NASDAQ:AFRM) from Neutral to Buy and boosted the price target from $74 to $101. Affirm shares closed at $74.83 on Friday. See how other analysts view this stock.

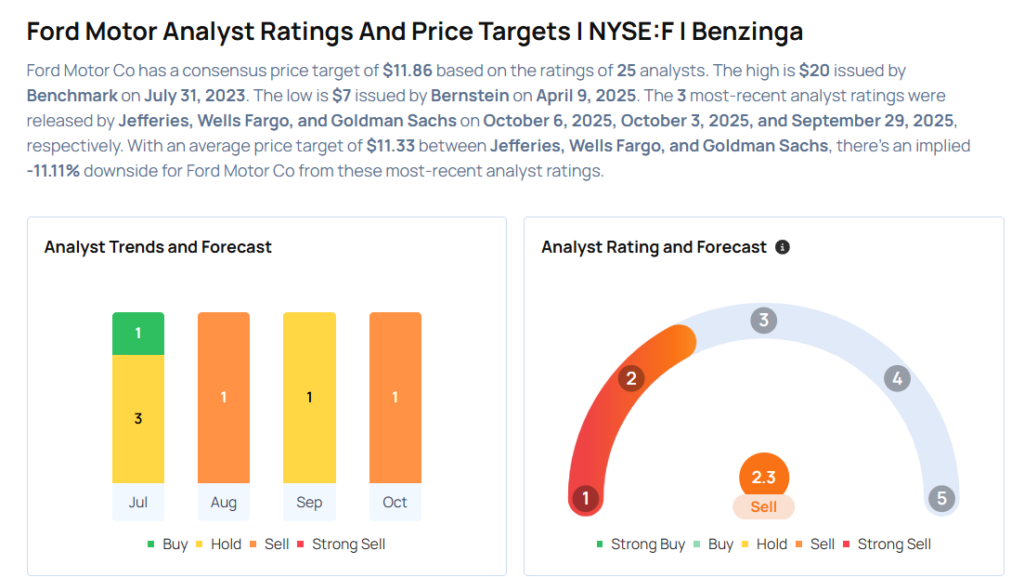

- Jefferies analyst Philippe Houchois upgraded Ford Motor Company (NYSE:F) from Underperform to Hold and raised the price target from $9 to $12. Ford shares closed at $12.67 on Friday. See how other analysts view this stock.

- B of A Securities analyst Katherine Griffin upgraded Brinker International, Inc. (NYSE:EAT) from Neutral to Buy and raised the price target from $190 to $192. Brinker shares closed at $126.59 on Friday. See how other analysts view this stock.

- Wells Fargo analyst Joseph O’Dea upgraded Lennox International Inc. (NYSE:LII) from Underweight to Equal-Weight and lowered the price target from $675 to $575. Lennox Intl shares closed at $550.63 on Friday. See how other analysts view this stock.

Considering buying F stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock