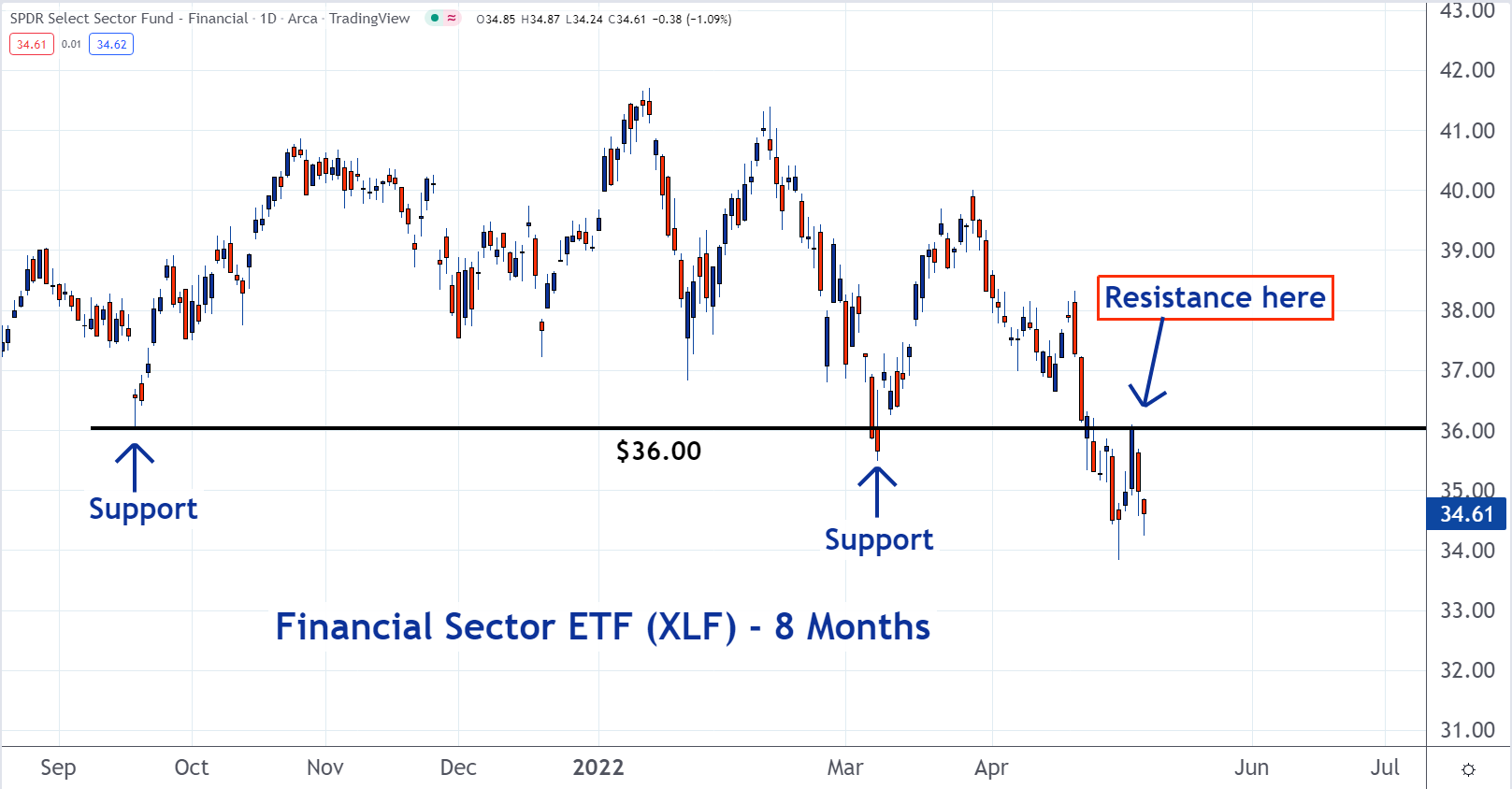

The stock market is rebounding but there may not be any follow-through. At least, that’s what the Financial Select Sector SPDR Fund (NYSE:XLF) says. This ETF tracks the important financial sector.

As you can see on the following chart, the ETF hit resistance at the important $36 level. Since then, it has been trending lower.

Resistance tends to form at former support levels and that’s what happened here. Many of the investors who bought shares at the support regret doing so after the price falls below it. A number of them decide to sell, but they don’t want to lose money so they place their sell orders at the same price they bought at.

If there is a large enough number of these sell orders, it will create resistance. This is why support can convert into resistance. This is what happened with XLF at $36. Until this resistance breaks and XLF trades higher, it could hold the market down.

To learn more about trading, check out the new Benzinga Trading School.