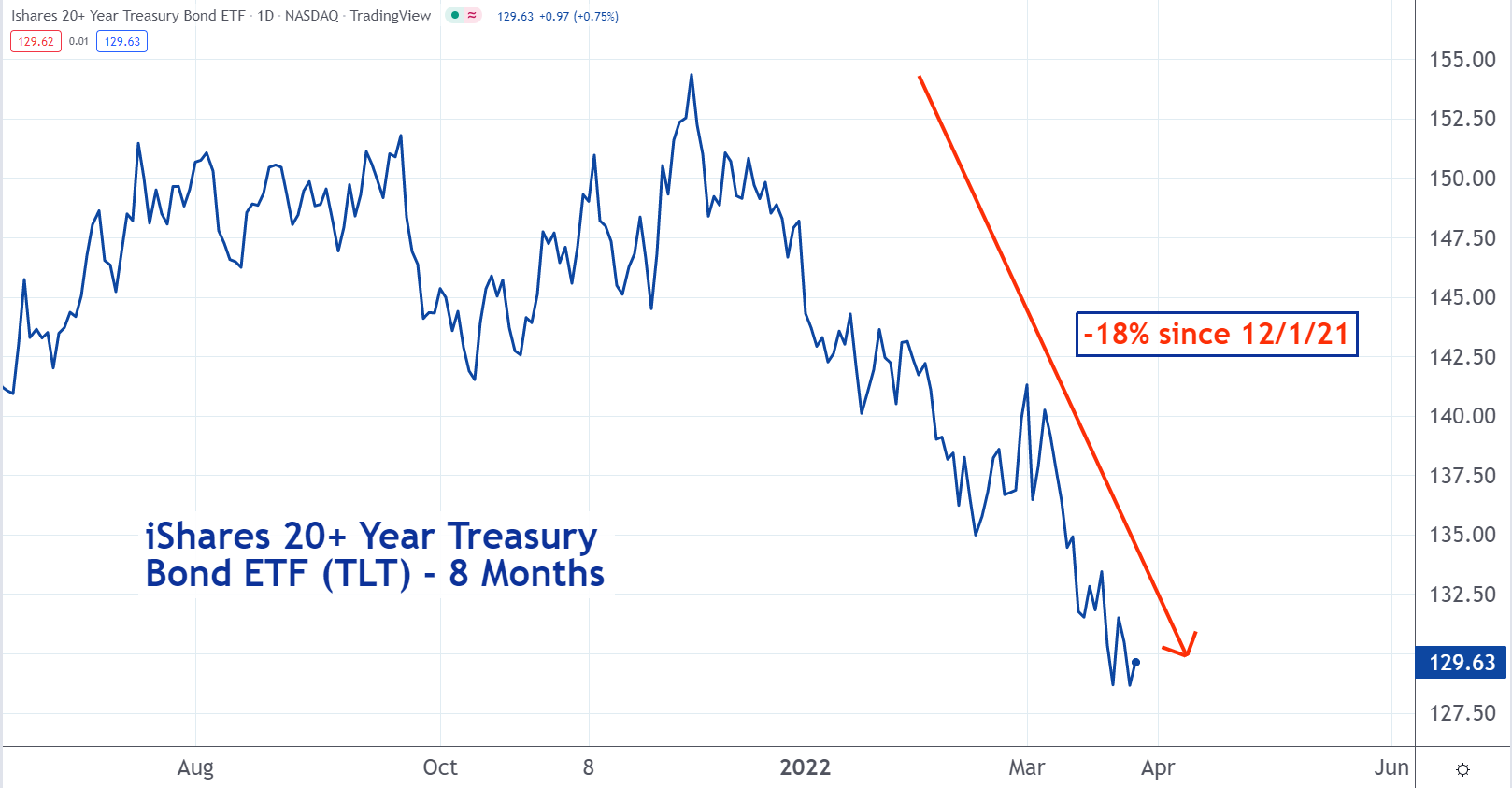

The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) is designed to track long-term U.S. Treasury bond prices. And as you can see on the following chart, the bond market has been in a steep decline.

This is a result of rising interest rates. They decrease the value of the bonds, which causes investors to sell them. This pushes the price lower.

As of now, this bearish action has been contained within the bond market. But if it continues, it could spill over into the stock market.

Many large institutions have big holdings of U.S. Treasury bonds. If they start losing money on their bond holdings, they may be forced to sell stocks to cover their losses. This will put pressure on the equity markets.

To learn more about trading and ETFs, check out the new Benzinga Trading School.